Who are Gold Traders?

Commodities / Gold and Silver 2016 Apr 22, 2016 - 06:18 PM GMTBy: Arkadiusz_Sieron

The Commitments of Traders Report is one of the most important publications on the gold market. It is usually published every Friday at 15:30 Eastern time by the Commodity Futures Trading Commission (CFTC) to provide market participants "a breakdown of each Tuesday's open interest for markets in which 20 or more traders hold positions equal to or above the reporting levels established by the CFTC". Unfortunately the readers don't get a full picture because of a three day lag between a report and the actual positioning of traders (though the report is issued on Friday, it contains Tuesday's data). The open interest, analyzed in the report, is the total number of futures contracts not yet liquidated by an offsetting transaction or fulfilled by delivery.

The Commitments of Traders Report is one of the most important publications on the gold market. It is usually published every Friday at 15:30 Eastern time by the Commodity Futures Trading Commission (CFTC) to provide market participants "a breakdown of each Tuesday's open interest for markets in which 20 or more traders hold positions equal to or above the reporting levels established by the CFTC". Unfortunately the readers don't get a full picture because of a three day lag between a report and the actual positioning of traders (though the report is issued on Friday, it contains Tuesday's data). The open interest, analyzed in the report, is the total number of futures contracts not yet liquidated by an offsetting transaction or fulfilled by delivery.

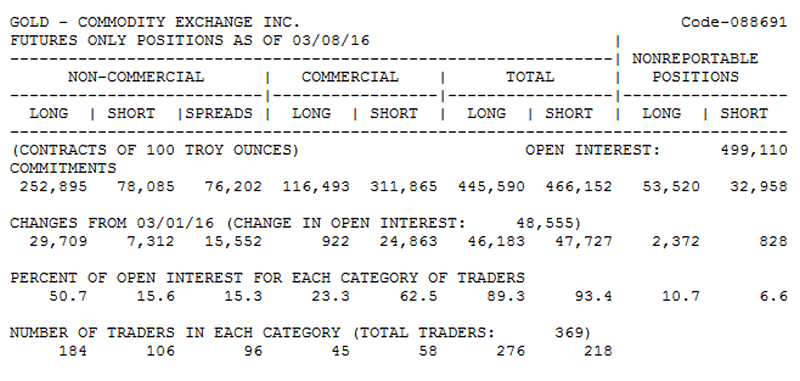

What the CoT report does is it breaks down the open interest number into categories of traders, showing the trade positions of market participant groups in the U.S. futures market, including the gold market. What are these groups? Initially, the CoT report has distinguished between commercials, non-commercials (large speculators) and non-reportables (small speculators), but in 2009 it decided to introduce the new take and a new distinction. Let's look at the first version:

Commercial Traders represent entities involved in the production, processing or merchandising of gold. These companies use the futures market to offset risk in the cash or spot market, e.g. a gold mining company may short gold futures contracts to ensure that it can sell the yellow metal at a fixed price. A gold refiner, on the contrary, may add long gold futures to ensure that it can purchase the bullion at a set price. Since commercials are industry experts, they are considered "smart-money", so it is worth analyzing their positions. However, investors should remember that they generally use futures contracts not to speculate on price direction, but rather to hedge their exposure to gold. Since gold producers are important commercial traders, the group as a whole is usually net short.

Non-Commercial Traders (large speculators) include large investors (i.e., who hold a position that equals or exceeds the exchange or CFTC-specified reporting level) who are usually not involved (at least not directly) in the production, processing or merchandising of gold. These are primarily institutional investors and hedge funds that speculate on gold prices to profit from their movements. For example, a hedge fund may sell gold futures to benefit from the impact of a strong U.S. dollar on the gold prices without intending to take physical delivery. This group also speculates on price direction, so investors should have their eyes peeled for their positions. Usually, non-commercials follow trends in gold. The commercials are usually net short, hence non-commercials take the opposite side of the trade and are usually net long in gold.

Non-Reportables (small speculators) represent small investors who hold positions in futures that are below the reporting level specified by the CFTC. Since this catch-all category consists of individual speculators, it does not affect the gold market significantly (it controls a relatively small part of open interest). Moreover, small investors are often inexperienced and make wrong predictions. This is why many analysts ignore this category; however, analyzing it can be sometimes helpful in gauging retail sentiment (or in contrarian investing).

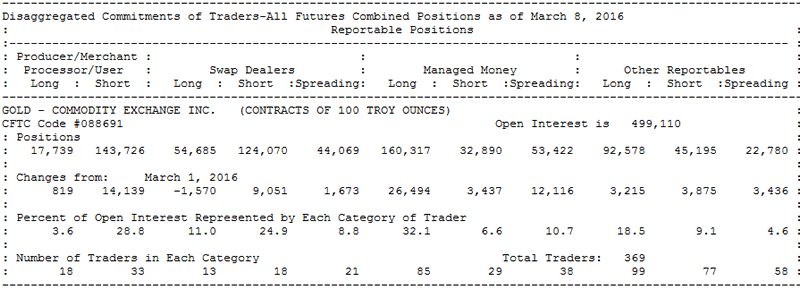

The above-mentioned classification constitutes the so-called legacy version of the COT, which is still in use. However, in 2009 the CFTC started publishing the new version. The so-called disaggregated COT report was introduced to increase transparency and it is coming out side by side with the initial version of the report. Both versions as of March 8, 2016, are presented below.

Figure 1: Gold COT report (legacy version), as of March 8, 2016 (source: www.cftc.gov)

Figure 2: Gold COT report (disaggregated version), as of March 8, 2016 (source: www.cftc.gov).

The disaggregated CoT report distinguishes four groups of traders: producer/merchant/processor/user, swap dealers, managed money, and other reportables. Producers/Merchants/Processors/Users are companies and institutions that engage in the production, processing, packing or handling of a physical commodity and use the futures markets to manage or hedge risks associated with those activities. As one can see, that group is very similar to commercials. The only distinction is that the swap dealers, before included into commercials, now have their own category.

Swap dealers are entities that deal primarily in swaps for a commodity and use the futures markets to manage or hedge the risk associated with those swaps transactions. Swap Dealers include financial institutions issuing shares of gold ETFs, which hedge the sale of those shares in the futures market. When one adds all positions of producers and swap dealers, he gets the same number as the category of commercials does in the legacy version.

Money managers - the registered commodity trading advisors (CTA), registered commodity pool operators (CPO), or unregistered funds identified by CFTC who engage in managing and conducting organized futures trading on behalf of clients. They usually follow trends in the gold market.

Other reportable are reportable traders that do not fit into any other category. Usually these are larger traders that trade for their own accounts. The money managers and other reportables replaced the non-commercials from the legacy version. In the new version of the report, the CFTC does not distinguish non-reportables, given their minimal impact on the gold market.

The key takeaway is that although the CoT report is released with a small delay, it is still a great tool for traders, since it allows investors to see what large Comex traders are doing and position themselves accordingly. It gives important data on trading positioning that drive trends in the gold market. There are also other ways to get this information, so while analyzing CoT reports might be helpful, it is not required to make profitable trades in the gold market. Nonetheless, the CoT report, depending on the classification, offers insight on three or four distinct trading groups in the gold market. The changes in positions of commercials and non-commercials (or producers and money managers) are the most closely watched. The latter usually follow the trend in gold prices, while the commercial activity often behaves in the opposite direction of the market trends.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.