Gold “Chart of The Decade” – Maths Suggest $10,000 Per Ounce Says Rickards

Commodities / Gold and Silver 2016 Apr 29, 2016 - 11:17 AM GMTBy: GoldCore

James Rickards, economic and monetary expert, joined Bloomberg’s Francine Lacqua on Tuesday to discuss the gold “chart of the decade”, his new book “The New Case for Gold,” why gold is money and why gold is going to $10,000/oz in the coming years.

James Rickards, economic and monetary expert, joined Bloomberg’s Francine Lacqua on Tuesday to discuss the gold “chart of the decade”, his new book “The New Case for Gold,” why gold is money and why gold is going to $10,000/oz in the coming years.

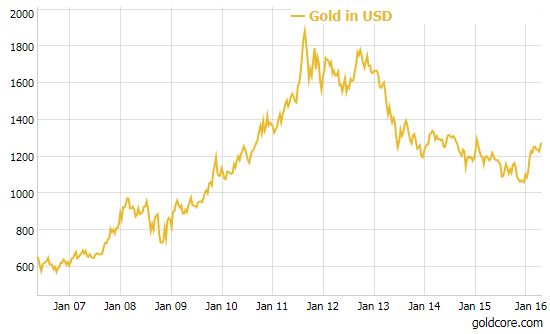

Gold in USD – 10 Years (GoldCore)

Francine generously acknowledged how Rickards was “bullish on gold for quiet some time and actually you have been proven right … it is the chart of the decade”. She said that this “has to do with inflation expectations, it has to do with currency but it is really at the end of the day just a haven so people pile into it – as much as they do yen …”

GOLD IS MONEY

Jim responded that

“Gold is a form of money and not an investment. As money it competes with other kinds of money — the dollar, euro, yen etc.. They’re like horses going around a racetrack – place your bets but you have a subjective preference for money.

As investors are losing confidence in central banks … that’s what’s been going on and been clearly revealed. Central bankers have told me that they don’t know what they’re doing and they sort of make it up as they go along. They experiment.

President Evans of the Chicago Fed has said this and others have said it privately.

I spoke to Ben Bernanke and he described that everything he’s done was an experiment — meaning you don’t know what the outcome is.

So in that world where investors are losing confidence in central banks, gold does well.

Right now there are tens of trillions of dollars of sovereign debt with negative yields to maturity – bunds and JGBs..

Gold has zero yield.

Zero is higher than a negative 50 bps so gold is now the high yield asset in this environment.”

STOCKS HIGHER ON “FULL DOVE”

Regarding stocks, Rickards had this to say:

“Both gold and stocks are going up, and the reason stocks are going up is because Janet Yellen is going “full dove”. There’s nothing the stock market doesn’t like about free money. Plus negative interest rates might be on the table for next year.

That’s sort of bullish for stocks but it’s also bullish for gold.

Sometimes gold and stocks go up together and sometimes they don’t. There’s no long term correlation, but right now in a world of easy money and negative yields it’s good for both stocks and gold.”

GOLD AT $10K/oz

When asked for his price target for gold, Rickards says

“I have a technical level for gold, it is $10,000 U.S. per ounce. That amount gets bigger over time because it’s a ratio of physical gold to printed money. The amount of physical gold doesn’t go up very much, but printed money goes up a lot, so the dollar target goes up more over time because of all the money printing.

$10,000 U.S. per ounce is the implied non-deflationary price for gold. If you have to go back to a gold standard, or anything like it to restore confidence, that is the number you must have to avoid deflation.

So $10,000 per ounce is mathematically derived and is not a guess.”

INTEREST RATES and US ECONOMY

Rickards is asked what happens if Yellen tries to normalise rates and says

“If Janet Yellen begins to normalize then it would probably throw the U.S. into a recession. A 25 basis points hike in December threw the U.S. stock market into a 10% correction in the next two months.

The U.S. is hanging by a thread. It looks like first quarter GDP is going to come in at well below 1% according to the Atlanta Fed Tracker.

What’s the difference between -1% and 1%? Technically not much. One may be a technical recession and one is not, but growth is extremely weak. You don’t raise interest rates in a recession. You’re supposed to ease in a recession.

International spill over as well as the U.S. economy being fundamentally weak is the reason to not raise rates.

The time to raise rates was 2011 and that’s long gone. But two wrongs don’t make a right.”

SHANGHAI ACCORD and ‘SUPER MARIO’

“The Phillips Curve seems to have broken down — if it ever existed. The bigger play is the “Shanghai Accord” which came out of the G20 meeting in Shanghai, China in February 2016.

It’s like a secret Plaza Accord between the U.S. Fed, the Bank of England, the Peoples Bank of China, the European Central Bank and the Bank of Japan.

The evidence for a new secretive plaza accord is overwhelming. See here is the deal – China needs to ease. But the last two times China eased, August 2015 and December/January 2016, the U.S. stock market fell out of bed.

So how do you ease China without destroying the U.S. stock market?

So the answer is keep the dollar/yuan cross rate unchanged. Then ease in the U.S. dollar so that China goes along for the ride. At the same time tighten Japan and Europe, so you get a stronger yen and a stronger euro.

China is a larger trading partner for Japan and Europe than the U.S. is, so it’s a backdoor easing for China. Cross rates unchanged but China gets to ease.”

Lacqua wonders if Mario Draghi in the ECB would agree to that and Rickards concludes by saying that ‘Super Mario’ “is his favourite central banker”.

Watch the full interview here

This update can be found on the GoldCore blog here.

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.