Did The Big Silver And Gold Market Event Arrive?

Commodities / Gold and Silver 2016 May 02, 2016 - 12:06 PM GMTBy: Hubert_Moolman

In a previous article (September 2015), I presented the following analysis (in italics) to show how we are close to a point were a significant event could happen in the bond market and/or gold & silver markets:

In a previous article (September 2015), I presented the following analysis (in italics) to show how we are close to a point were a significant event could happen in the bond market and/or gold & silver markets:

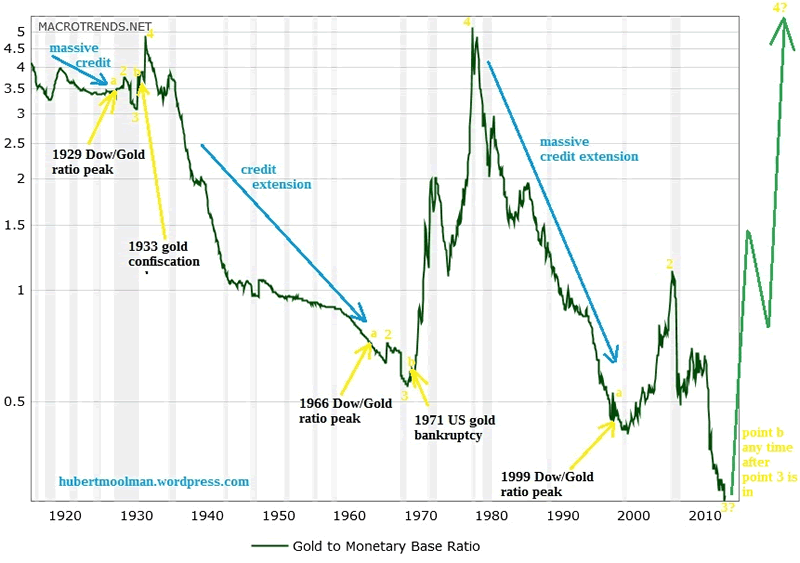

Above, is a chart (from macrotrends.com) that shows the ratio of the gold price to the St. Louis Adjusted Monetary Base back to 1918. That is the gold price in US dollars divided by the St. Louis Adjusted Monetary Base in billions of US dollars. So, for example, currently the ratio is at 0.28 [$1 125 (current gold price)/ $4 019 (which represents 4 019 billions of US dollars)].

On the chart, I have indicated the three yellow points (a) where the Dow/Gold ratio peaked. These all came after a period of credit extension, which effectively put downward pressure on the gold price. Points 2 were placed just to show the similarities of the three patterns.

After the peak in the Dow/Gold ratio and point 2, the Gold/Monetary Base chart made a bottom at point 3 on each pattern. It is at these points that the monetary base could not expand relatively faster than the gold price increased. Today, this could mean that the point at which the game is up for those who are short gold and silver(in other words, the forces that keep silver and gold suppressed have been exhausted).

I do not know if point 3 is in on the current pattern; however, given the fact that the bullion banks are under pressure as indicated in the spike in the gold coverage ratio at the COMEX, it might well be. (Note that this point 3 is now almost certainly in since the ratio made a double bottom in November 2015)

In 1933, after point 3 was in, the gold confiscation order was passed (point b). This came about due to the pressure to fulfill gold obligations. This was confirmed later by Roosevelt when he justified Gold Reserve Act 1934 by saying that, "Since there was not enough gold to pay all holders of gold obligations, . . . the federal government should expropriate and keep all of the gold"

Again in 1971, after the relevant point 3, due to being unable to cover all the foreign holdings of US dollars with the related amount of gold, the US suspended (really ended) the convertibility of the US dollar into gold, on 13 August 1971 (point b).

So, after point 3 is officially in on the current pattern, we could possibly expect a point b at which a major event in the gold or/and bond market could happen. When this event happens, it might be too late to add to your gold or silver position. It will also prove that gold, and silver is still relevant as monetary assets.

Based on the above analysis, and the following chart, I believe we have arrived at the first possible point where such an event could happen or has, in fact, already started. This might even be the reason for the recent emergency meetings between Obama and Yellen.

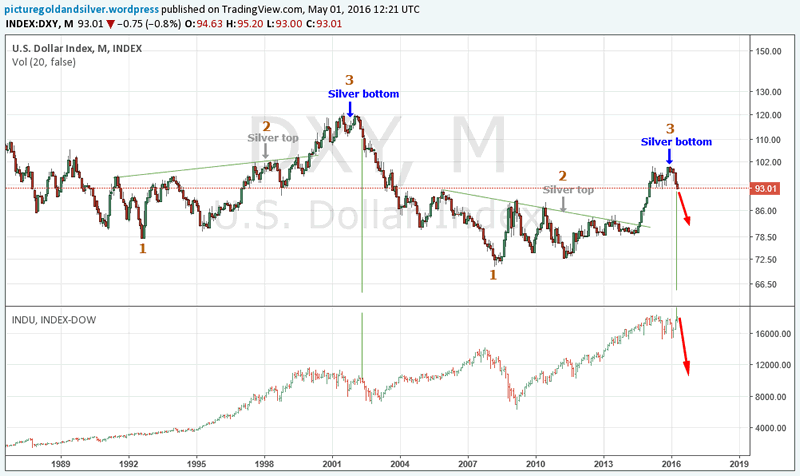

Below, I have done fractal analysis of the US Dollar index chart, and aligned it with the Dow:

(all charts are from tradingview.com)

On the US Dollar index chart, I have marked the two fractals (1 to 3). I have also indicated the relevant silver tops and bottoms to show how the patterns exist in similar conditions. Furthermore, if you look on the Dow chart, you will see that the Dow peaked just before point 3 on both patterns.

If this comparison is justified, then we will see a big drop in the Dow and the US dollar index soon. This is consistent with my long-term analysis of the Dow and the US Dollar index. While this is happening silver, and gold will rise to phenomenal highs (which has already started).

Warm regards,

For more of this kind of analysis on silver and gold, you are welcome to subscribe to my premium service. I have also recently completed a Long-term Silver Fractal Analysis Report .

Warm regards

Hubert

“And it shall come to pass, that whosoever shall call on the name of the Lord shall be saved”

http://hubertmoolman.wordpress.com/

You can email any comments to hubert@hgmandassociates.co.za

© 2016 Copyright Hubert Moolman - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.