Stocks Extended Their Short-Term Downtrend But Will They Continue Lower?

Stock-Markets / Stock Markets 2016 May 05, 2016 - 11:49 AM GMTBy: Paul_Rejczak

Briefly: In our opinion, no speculative positions are justified.

Briefly: In our opinion, no speculative positions are justified.

Our intraday outlook is neutral, and our short-term outlook is neutral. Our medium-term outlook remains bearish, as the S&P 500 index extends its lower highs, lower lows sequence:

Intraday outlook (next 24 hours): neutral

Short-term outlook (next 1-2 weeks): neutral

Medium-term outlook (next 1-3 months): bearish

Long-term outlook (next year): neutral

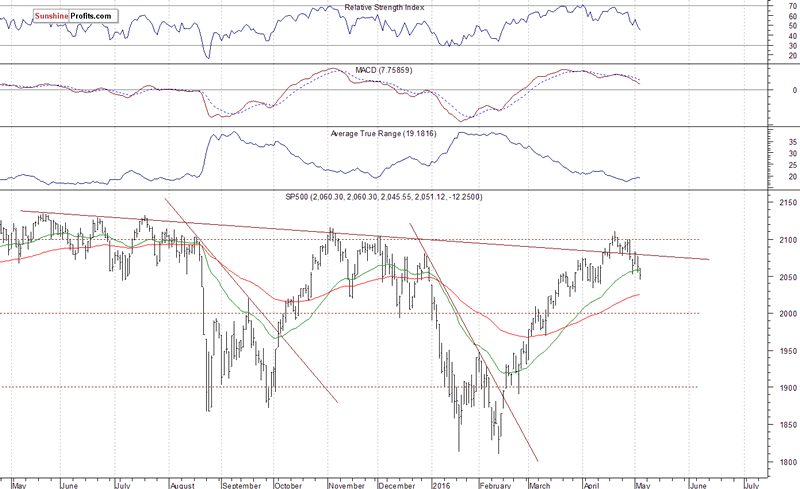

The U.S. stock market indexes lost 0.6-0.7% on Wednesday, extending their short-term downtrend, as investors reacted to economic data releases, among others. The S&P 500 index remains close to its support level of 2,050. The next important level of support is at around 2,030-2,035, marked by some previous local lows. On the other hand, resistance level is at 2,070-2,075, marked by the recent consolidation. The next level of resistance remains at 2,100-2,115, marked by medium-term local highs. Is this the end of two-month long uptrend? Or is this just correction before another leg up reaching last year's all-time high? Last year's highs along the level of 2,100 continue to act as medium-term resistance level, as we can see on the daily chart:

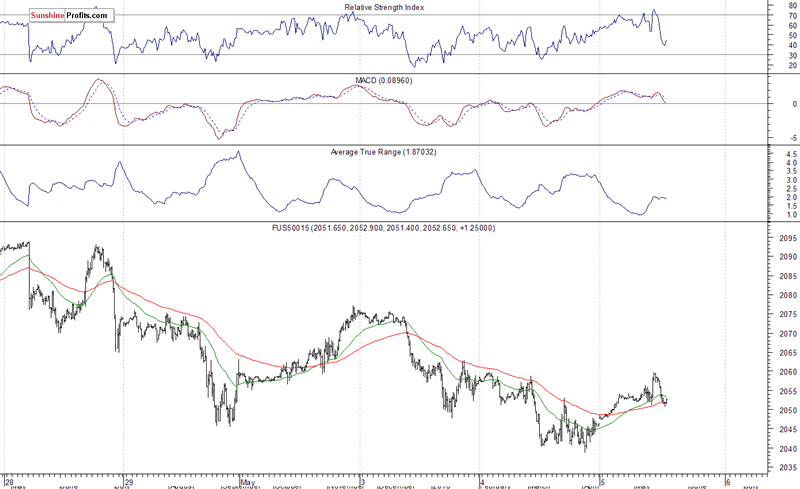

Expectations before the opening of today's trading session are positive, with index futures currently up 0.2-0.3%. The European stock market indexes have been mixed so far. Investors will now wait for the Initial Claims data release at 8:30 a.m., along with tomorrow's Monthly Nonfarm Payrolls number announcement. The S&P 500 futures contract trades within an intraday consolidation, following a rebound off yesterday's low at around 2,040. The nearest important level of resistance is at 2,060, marked by local highs, and support level is at 2,040. The market extends its slightly descending short-term trading channel, as we can see on the 15-minute chart:

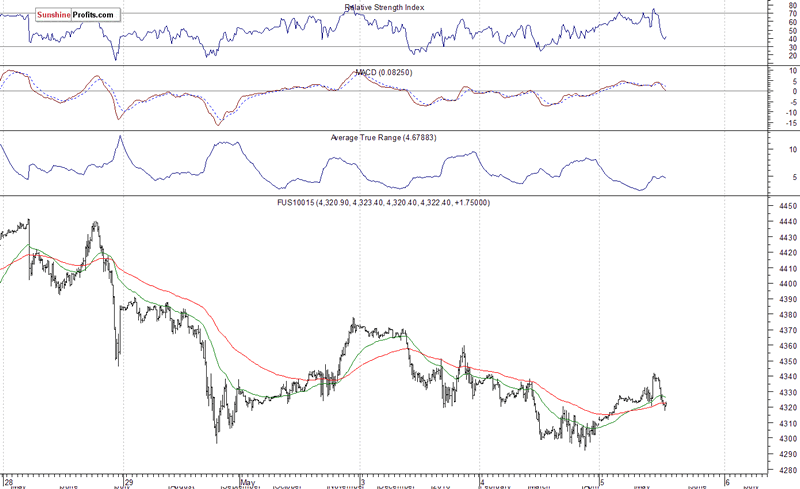

The technology Nasdaq 100 futures contract follows a similar path, as it currently trades above the level of 4,300. The nearest important level of resistance is at 4,340-4,350, marked by recent local highs. The nearest important support level is at 4,290-4,300, as the 15-minute chart shows:

Concluding, the broad stock market slightly extended its short-term downtrend on Wednesday. Is this just a downward correction following over two-month long rally or new medium-term downtrend? The S&P 500 index continues to trade above its late March - early April local lows. For now, it looks like a downward correction, so we prefer to be out of the market, avoiding low risk/reward ratio trades. We will let you know when we think it is safe to get back in the market.

Thank you.

Paul Rejczak

Stock Trading Strategist

Stock Trading Alerts

SunshineProfits.com

Stock market strategist, who has been known for quality of his technical and fundamental analysis since the late nineties. He is interested in forecasting market behavior based on both traditional and innovative methods of technical analysis. Paul has made his name by developing mechanical trading systems. Paul is the author of Sunshine Profits’ premium service for stock traders: Stock Trading Alerts.

* * * * *

Disclaimer

All essays, research and information found above represent analyses and opinions of Paul Rejczak and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Paul Rejczak and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Rejczak is not a Registered Securities Advisor. By reading Paul Rejczak’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Paul Rejczak, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Paul Rejczak Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.