Gold Leasing Explained

Commodities / Gold and Silver 2016 May 06, 2016 - 03:16 PM GMTBy: Arkadiusz_Sieron

According to popular opinion, gold does not bear interest. Although that is true for retail investors, gold lending is an integral part of the gold wholesale market. What is gold leasing and how does it affect gold prices?

According to popular opinion, gold does not bear interest. Although that is true for retail investors, gold lending is an integral part of the gold wholesale market. What is gold leasing and how does it affect gold prices?

A lease is a contract where an asset is rent to someone else. As odd as it sounds, gold is also leased. Why? Well, on the one hand, some entities own gold they need to put to work, e.g. the bullion banks that hold a metal as a debt to their customers, so they can lease it out to earn money. On the other hand, there are companies in the gold industry who, for some reasons, prefer to borrow the metal instead of buying it outright. For example, there might be a gold mining company which expects to have one thousand ounces of gold from its production. However, the metal will be ready to sell in the market not earlier than before one month, since it must be refined etc.

The company, however, still needs to pay its employees and cover other expenses on an ongoing basis. Therefore, it might borrow gold for one month from the bullion bank, sell it for cash and pay its bills, and then give the produced and refined gold back to the bank. Since the gold lease rate (GLR), i.e. the interest rate for borrowing gold, is usually lower than the U.S. dollar interest rates, it makes sense to borrow gold rather than greenbacks (at least for companies who can easily sell gold or use it in their production processes).

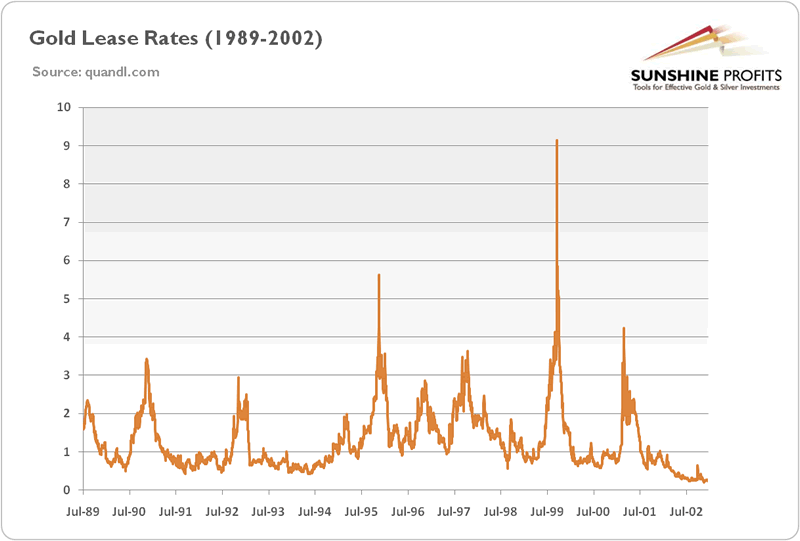

There is a lot of misunderstanding about the gold leasing. For example, in past decades the most prominent gold lenders have been central banks (however, these leases have recently been unwound to a great extent), so some analysts argue that central banks leased their bullion to manipulate the gold prices. However, the cause and effect actually work the other way around. When the price of gold declines, the demand for borrowing gold increases. When gold is in a bear market, traders can borrow it, sell at the moment, invest the cash elsewhere, and then repay the lease with much cheaper gold in the future (however, there is some are some negative consequences, as gold hedging exerts additional downward pressure on gold prices). Therefore, it should not surprise us that in the 1980s and 1990s, when gold was in that long-term bear market and many investors believed that this trend would persist indefinitely, the gold leasing market was active, and the gold lease rates were relatively high (indicating a more intense borrowing demand), as one can see in the chart below.

Chart 1: The 3-months gold lease rate (orange line, in %) from July 1989 to 2002.

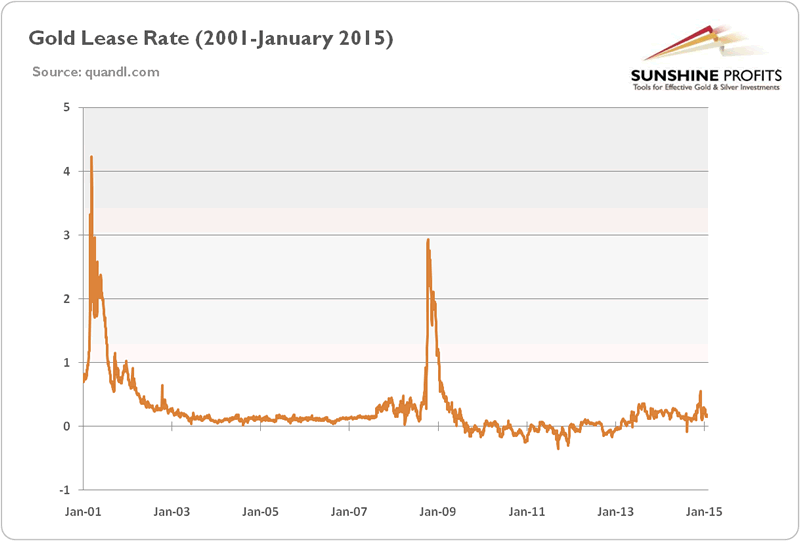

It is true that the 'gold carry trade' (i.e., the strategy of borrowing gold and investing in other assets at a higher rate) was possible thanks to central banks willing to lend large amounts of gold at low interest rates. However, gold cannot be lent unless there are willing borrowers. In the 1990s, when the gold prices were decreasing, the borrowing of gold or shorting gold (hedging forward production) worked beautifully. However, when the bull market in gold began, borrowing gold became unprofitable. In the 2000s, the global mining hedge book fell dramatically as miners looked to increase their exposure to rising gold prices, and reduced their hedging. As the chart below shows, that de-hedging reduced the demand for gold borrowing, and, consequently, the lease rates fell close to zero (increasing for a short time only after the Lehman Brother's bankruptcy).

Chart 2: The 3-months gold lease rate (in %) from 2002 to January 2015.

This chart shows two more interesting things. First, in the current environment of zero interest rates and a more bullish gold market, the gold lease rates (GLR) are likely to remain low. Second, the GLR were negative most of the time in 2009-2012, which seems absurd, since it would mean that bullion banks were paying to lease gold to somebody. The truth behind the negative GLR is the fact that back then LIBOR was a terrible indicator of market interest rates (in reality, investors borrowing gold and selling it in the spot market could reinvest the proceeds at higher rates than LIBOR). Investors should be aware that the GLR is derived as a difference between the LIBOR and the Gold Forward Offered Rate (more on that later in the report), and not the actual rate that is paid to borrow gold.

To sum up, gold may be leased, or lent and borrowed, just like any other currency. Some analysts argue that gold leasing artificially suppresses the gold prices. However, in fact the changes in the price of gold drive the gold leasing market, not the other way around. In the 1990s, the gold carry trade was very profitable, as the gold prices were decreasing (only then borrowers could repay the loan with gold that had dropped in price). And the gold mining industry expected the ever-falling prices, so it was shorting gold heavily. However, as the price of gold started to rise (partially due to the decline in the U.S. real interest rates) in the 2000s, borrowing gold seemed an absurd strategy, leaving central banks with no one to lend to. Therefore, leasing gold (including central banks' operations) does not drive the gold prices, the opposite is true.

Thank you.

If you enjoyed the above analysis and would you like to know more about the structure of the gold market, we invite you to read the March Market Overview report. If you’re interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you’re not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.