Gold Sector Checkup After the ‘Inflation Trade’ Bounce

Commodities / Gold and Silver 2016 May 07, 2016 - 07:08 PM GMTBy: Gary_Tanashian

There has been a lot of talk about how gold is not a good inflation hedge. Indeed, with the recent bounce in inflation expectations, this was shown to be true over a short timeframe, at least in relation to silver and other commodities. Gold sagged while the more inflation-sensitive commodities bounced.

There has been a lot of talk about how gold is not a good inflation hedge. Indeed, with the recent bounce in inflation expectations, this was shown to be true over a short timeframe, at least in relation to silver and other commodities. Gold sagged while the more inflation-sensitive commodities bounced.

If you are following the gold stock sector, please put aside analysis focusing an undue amount of attention on inflation. The proper fundamental backdrop for improving gold mining operational efficiency is one where economies and stock markets are weak and liquidity is constrained. That is when gold (risk ‘off’ liquidity) rises relative to those things that are positively correlated to economies.

This story is nothing new, but it bears repeating when the sector gets a spotlight shone upon it as brightly as it is now. For reference on what happens to a gold stock index when it rises amid a big ‘inflation trade’ see the chart from a 2007 post at my old blog noting the potential HUI “Crown of Thorns” H&S top that we ID’d back then to illustrate the risk to gold stocks. The H&S was the technical risk (which didn’t turn out to be the ultimate H&S, but amazingly, a much larger H&S’s left shoulder). The fundamental risk was much greater at that time and it was due to the gold stock sector having had its fundamentals eroded by years of inflationary effects as cost inputs outpaced the price of gold.

Today’s backdrop could not be more different as we are in the process of confirming a new bull market and with gold now trending up vs. most other assets the fundamental backdrop is setting up nicely (ref. Wednesday’s post Fear Not Gold Bugs). It is not complete, as the 10yr-2yr yield curve has not turned up. But a significant majority of fundametals are in the gold sector’s favor. Feel free to review the Macrocosm posts that colorfully prioritized what would be needed for a bullish gold sector environment beginning last July and then updated along the way to today’s bullish environment: Macrocosm, Macrocosm Revisited, The Planets Align and Macrocosm Updated.

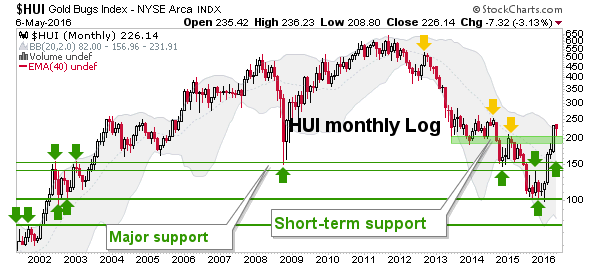

In early 2016 HUI plunged to make the final shakeout. I’d love to report that I was calling all hands on deck to buy buy buy! That was not the case because at the time gold’s ratios to stock markets were not yet trending up (a macro fundamental consideration) and being at least in part a technician, I had to respect the loss of major support. It was a breakdown that quickly turned into a whipsaw to blow up the shorts. You will recall there were a lot of bears in December and January. Now? Not so much.

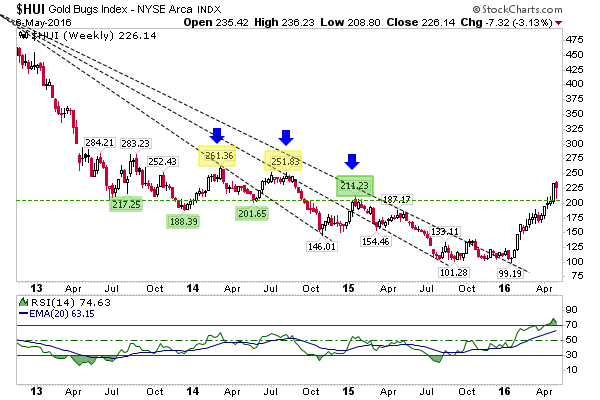

Long story short, not only have the sector’s prices risen in the meantime, so too have its fundamentals as indicators firm and/or go bullish. On the technical front, our most recent HUI target was 211, which caused Huey to hesitate for 2 weeks before it was blown through like it didn’t even exist. That is now support and it was tested harshly this week.

HUI is over bought but it’s a bull market and it is a ‘launch phase‘ of a bull market at that, so it can stay over bought for long stretches. As noted in the linked post, corrections will come but in a launch they are buying opportunities, unlike in a terminal blow off phase. This week it appears, was the most recent opportunity as April Payrolls kicked yet another negative economic surprise into gear and boosted further the ‘economic contraction’ fundamental for the sector.

The monthly log chart was used to gauge HUI’s progress at our long standing downside target around 100 (it was a target folks, not a ‘call’). You can see a firm breakout above the 211 area lateral resistance (now support). The next technical objective per the chart above is 250+.

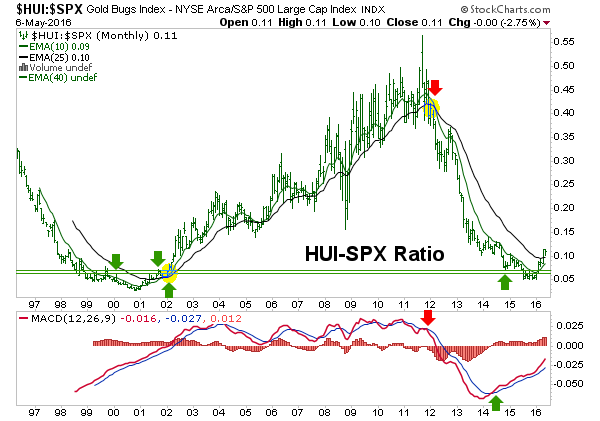

Finally, a look at gold stocks vs. the S&P 500. We have noted gold’s constructive status vs. SPX and HUI is even more so. While the moving average ‘bull signal’ has not yet triggered, barring a cataclysm, it looks like a good probability. What is needed after all, is time, not so much continued upside price action.

The bottom line is that the sector is running on momentum and is over bought. But this is bull ‘launch’ momentum and that is a powerful thing. There are issues to cause concern like the bearish Commitments of Traders (report just out) but as we were the first to note (that I am aware of), the sector is running on bull market rules with a similarity to the launch of the bull market that began about 15 years ago.

There will always be things to worry about and indeed a correction is coming at some point. But here is the thing, in a bull market a correction is an opportunity, especially when that opportunity comes in a bull market running on proper fundamentals (unlike 2007, for example). Volatility will increase but there is a confidence that people using technicals combined with the right fundamentals have when the going gets tough. Oh and for crying out loud, tune out the headlines about inflation and gold.

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com.

By Gary Tanashian

© 2016 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.