Global Gold Investment Demand Surges Record 122% In Q1, 2016

Commodities / Gold and Silver 2016 May 12, 2016 - 04:32 PM GMTBy: GoldCore

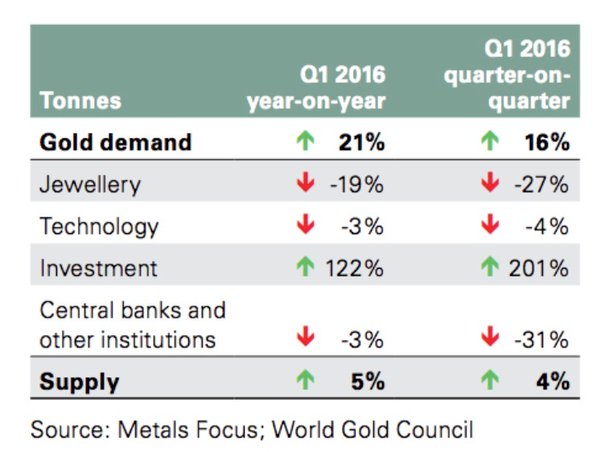

Global gold demand surged a record 21% and gold investment demand a record 122% in Q1, 2016 according to the World Gold Council who released their ‘Gold Demand Trends Q1 2016’ report today.

Global gold demand surged a record 21% and gold investment demand a record 122% in Q1, 2016 according to the World Gold Council who released their ‘Gold Demand Trends Q1 2016’ report today.

The report is a leading industry resource for data and opinion on global gold demand. The quarterly publication examines demand trends by sector as well as geography.

Key findings re global gold demand in Q1 are

– Gold was a top-performing asset in Q1 – up 17% in USD terms

– Gold demand surged to the second-highest level ever – highest since Q4, 2012

– Overall demand for Q1 2016 increased by 21% to 1,290t, up from 1,070t in Q1 2015.

– Global investment demand was 618t, up 122% from 278t in the same period last year.

– UK gold investment demand surges 61% – low base to 3.2 tonnes

– EU gold demand very robust at 58.4t and Germany remains largest buyer in EU

– Central bank demand dipped slightly to 109t in Q1 2016, compared to 112t in the same period last year.

– Total consumer demand (primarily jewellery) was 736t down 13% compared to 849t in Q1 2015.

– Global jewellery demand fell 19% to 482t versus 597t in the first quarter of 2015

– Demand in the technology sector fell 3% to 81t in Q1 2016.

– Total supply was up 5% to 1,135t in Q1 2016, from 1,081t in the first quarter of 2015. Mine supply was up 8% to 774t.

Also of note from the report:

Gold demand reached 1,290 tonnes Q1 2016, a 21% increase year-on-year, making it the second largest quarter on record. This increase was driven by huge inflows into exchange traded funds (ETFs) – 364t – fuelled by concerns around the shifting global economic and financial landscape. Higher prices and industrial action in India pushed global demand for jewellery down (-19%), while total bar and coin demand was marginally higher (+1%). Central banks remained strong buyers, purchasing 109t in the quarter. Total supply increased 5% to 1,135t. Hedging by producers (40t) supported an increase of 56t in mine supply, although countered by a marginal decline in recycling.

Investment demand ignites price rally

During the first quarter, the US$ gold price appreciated by 17% on the strength of investor conviction. This was matched by local price gains in markets across the globe.

The enthusiasm with which investors renewed their appetite for gold ETFs in Q1 was palpable – the gold price surged by 17% in response to such large-scale inflows. This was the best performance in almost three decades and gold ranked as one of the best performing assets globally during the quarter. The effect was also felt in the price of gold measured in other currencies, with double digit gains in the euro (+11%), British pound (+20%), Chinese renminbi (+16%), Indian rupee (+17%) and Turkish lira (+13%) (Chart 2).

The investment response in the ETF market was echoed in surging physical demand for gold bars and coins in a handful of markets. US investors in particular were keen to add to their holdings, wanting the security of gold amid economic uncertainty. Demand jumped by 55% to 18.3t, albeit that this was being compared with a particularly weak Q1 2015. Bar and coin demand in the UK grew by a similar magnitude (+61%) although absolute volumes remained low (3.2t). And, powered by a strong German market, European demand remains resolute – at 58.4t it <Germany> remains one of the largest markets for gold investment.

Read the full report here

Gold and Silver Prices and News

Gold futures settle higher as high flying dollar stalls (Marketwatch)

Goldman raises gold price forecasts on weaker greenback (CNBC)

Gold moves off two-week low as dollar slips, shares retreat (Reuters)

Gold Climbs on Investment Demand as Goldman Increases Forecasts (Bloomberg)

20 percent slide in sterling if Britain leaves EU (Reuters)

Experts Weigh In on How to Detect Counterfeit Gold Coins (Investment University)

Gold “Good As Portfolio Insurance” – Says Gambles (CNBC)

Comex Gold Open Interest – Craig Hemke (24H Gold)

Macy’s Crushed By Amazon, Italian Banks Crushed By Euro (Dollar Collapse)

Eurozone Recovery Wilts As Sugar Rush Fades, Deflation Lurks (Telegraph)

Read More Here

This update can be found on the GoldCore blog here.

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.