Three Overlooked, Undervalued Picks for Today's Energy Market

Commodities / Oil Companies May 12, 2016 - 06:35 PM GMT The energy sector is a tricky place to invest right now, with a fine line separating the next bankruptcy candidate from a tenbagger. Chen Lin of the popular newsletter What Is Chen Buying?, What Is Chen Selling? helps investors navigate this minefield with three companies he believes will come out on top.

The energy sector is a tricky place to invest right now, with a fine line separating the next bankruptcy candidate from a tenbagger. Chen Lin of the popular newsletter What Is Chen Buying?, What Is Chen Selling? helps investors navigate this minefield with three companies he believes will come out on top.

The recent news of Pacific Exploration and Exploration Corp. (PRE:TSX) offers fresh reminder to energy investors how dangerous the investment field of energy stocks can be. When a company goes to bankruptcy, in most cases shareholders get wiped out. Your shares, no matter how low the cost basis is, are worth zero! Recently, the day traders have been chasing "trash" stocks, stocks that are heavily in debt and close to bankruptcy. Every long-term investor needs to double and triple check reality before putting his/her hard-earned money into these names. You need to make sure your companies can "make it" first.

The problem I see is that many heavily indebted energy companies really depend on the market, or a higher oil price, in order to survive bankruptcy. If you invest in a few of these companies, you will need to check the oil price every day and night. That's why I have been advocating that investors put money in companies with strong balance sheets and strong free cash flows. These types of companies not only offer great upside with minimum risks, they can also take advantage of the downturn and come out as winners.

"When Talisman starts drilling at Pan Orient Energy Corp.'s East Jabung, it will be one of the most followed events in the energy space."

Pan Orient Energy Corp. (POE:TSX.V) is at the top of my list. At the current share price of CA$1.10, if you can hold on to the stock for at least one year, I believe there is almost no downside. Let me explain why. The company is in the process of selling off assets and returning cash to its shareholders. It just distributed CA$0.40 back to the shareholders this year. Not long ago it distributed another CA$0.75 to shareholders.

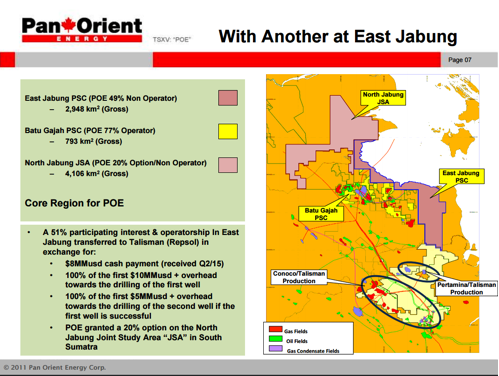

Right now Pan Orient has about CA$0.80–CA$0.90/share in cash and no debt. It has been in the process of selling all of its assets in Canada, Thailand and Indonesia, except for the one that Talisman Energy Inc. (now part of Repsol Oil & Gas) will pay for and drill in Q4/16. With the rebound of oil, the interest in buying oil assets worldwide has been on the rise. If Pan Orient can successfully sell the assets during 2016, I can see its cash balance increase to around CA$2/share by the end of 2016.

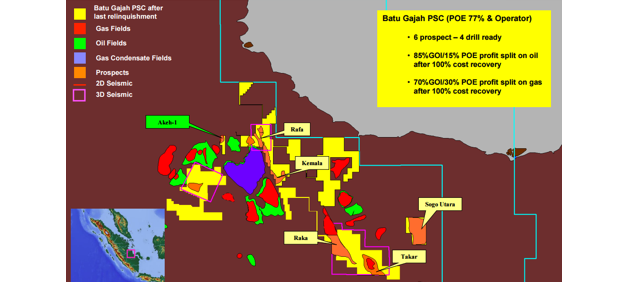

POE oil sand assets in Canada. Source: Company Presentation.

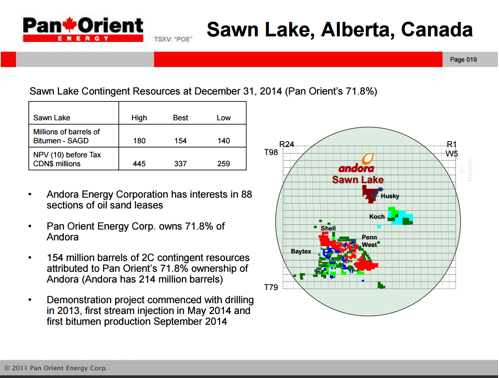

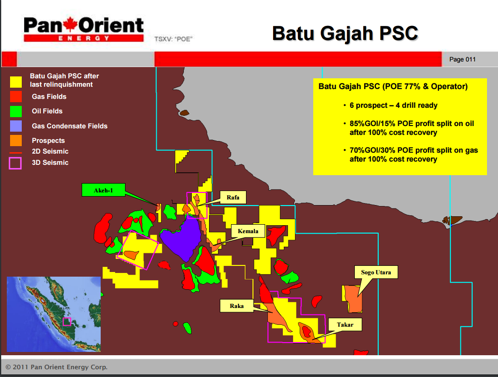

POE Batu Gajah assets in Indonesia currently under divestment. Source: Company Presentation.

POE Thailand assets under divestment. Source: Company Presentation.

POE East Jabung assets optioned by Talisman. Drilling scheduled for Q4/16. Source: Company Presentation.

Here comes the exciting part. What's the upside of the East Jabung drilling by Talisman in Q4/16? Here are some simple calculations based on the recent oil price and the 51-101 report:

"Mean estimated ultimate recoverable (EUR) oil prospective resources of 44 million, 28 million and 51 million barrels net to Pan Orient's 49% working interest in three respective potential reservoir horizons at the Anggun prospect." Total 123 million barrels, or US$1.23 billion worth close to CA$30/share assuming $10/barrel! How about the high case? At least three times larger. I can tell you when Talisman starts drilling, likely in Q4/16, it will be one of the most followed events in the energy space.

Here is my calculation: if Talisman successfully makes a major discovery, the share price will obviously explode. If Talisman fails, the chance is very high Pan Orient will have around CA$2/share in cash in the next 12 months. Then the company can choose to pay another dividend, or do other things to reward the shareholders. That's why I see very little downside to the stock. The insiders were agreeing with me as we saw a big purchase of 220,000 shares from the open market by Gerald Macey, chairman of the board, in the past month.

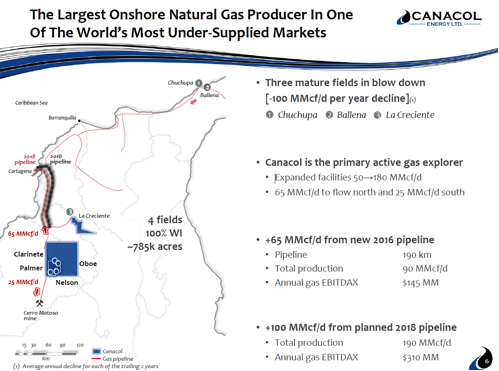

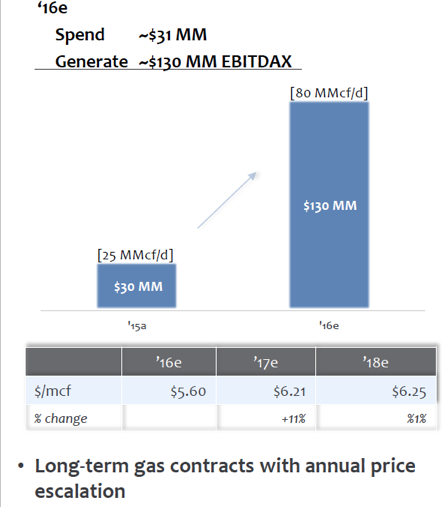

If Pan Orient is on the extreme conservative side, Canacol Energy Ltd. (CNE:TSX; CNNEF:OTCQX)is at the opposite end of the spectrum. It has some debt, net US$209 million, according to the company. The company just started to flow natural gas at 90 million cubic feet/day (90 MMcf/day). At this rate, the company has over an 80% operating margin and will generate EBITDAX at around US$150million/year. Using the current pipeline, I was told it can easily achieve 100–110 MMcf/day with no upgrade and that will further increase the cash flow. Canacol's plan is to double production again in 2018 with a new pipeline.

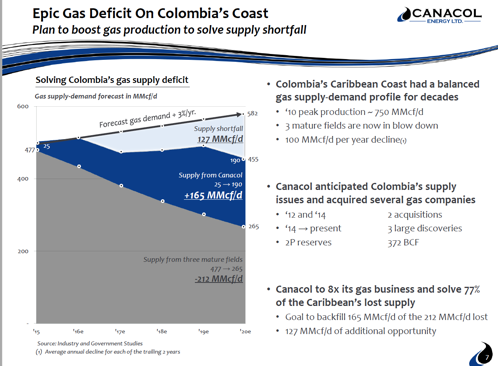

The thesis of Canacol Energy is very simple. It takes advantage of the long-term natural gas shortage in Colombia and becomes probably the most profitable energy company on earth at the current oil price. Its natural gas costs about US$1/million Btu to produce and it sells for over US$5. The profit margin is estimated to be 84%! It is probably one of the energy companies with the highest profit margin at the current oil price.

Canacol also has a huge inventory of oil reserves and targets. Oil majors, including ExxonMobil Corp. (XOM:NYSE), Royal Dutch Shell Plc (RDS.A:NYSE; RDS.B:NYSE), ConocoPhillips (COP:NYSE) and others, are carrying out drilling to earn their interests. Once the oil price recovers, these properties will provide more upside to the company. In particular, ConocoPhillips is going to drill important fracking wells in Colombia in Q2/16 and Canacol gets free carry. This will set the stage for significant oil discovery there. Right now you can consider it as a "free option."

Here is the bottom line: Canacol is in a high margin, high free cash flow gas business with huge exploration and growth potential. No wonder insiders were busy accumulating shares before the big rise. Three executives exercised 315,000, 233,500 and 100,000, a total of about 650,000 shares at CA$2–3.38. They wrote a check for about CA$1.5 million to the company without selling a single share to "cover their cost"; selling shares is common in this kind of situation. This indicates their bullish view toward the company.

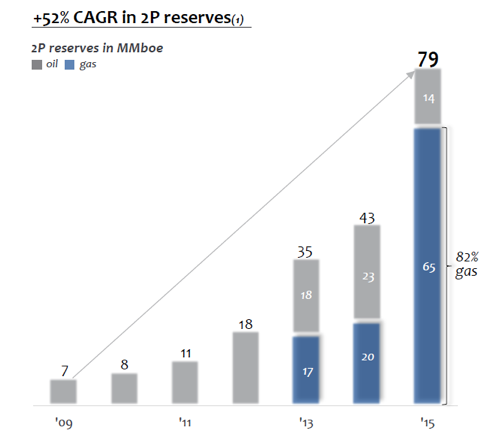

Canacol 2P reserves. Source: Company Presentation.

Plan of growth. Source: Company Presentation.

Colombia gas shortage. Source: Company Presentation.

Big jump in free cash flow. Source: Company Presentation.

The third and final stock has an even simpler thesis. It is Cub Energy Inc. (KUB:TSX.V), a company that has been almost completely forgotten by the investment community. It is a natural gas driller in Ukraine. As we know, the natural gas price in Ukraine is very high thanks to Russian domination. Natural gas prices varied from $6–9/thousand cubic feet ($6–9/mcf) last year versus $2/mcf in the U.S.

When the war broke out in eastern Ukraine, the country imposed extra taxes to support the war. As a result, the natural gas royalty almost doubled. Now with the war ended, the royalty has gone back to the original level. The company is quite nimble, and has used the downturn to increase its interests from 30% to 35% with an option to increase to 40%. In addition, it also increased its acreage by 50%. Basically all the conditions went back to prewar or better, except the stock price is still ~70% below the prewar level. That creates a good opportunity for investors who can tolerate Ukraine's geopolitics. Attached is the three-year chart of the company. In the past three years, the company didn't issue any shares; it kept its head down and continued to develop its business. Currently its 2P reserve has an NPV of $0.20, five times the current stock price.

The company's CEO is the largest shareholder of the company and has been taking good care of the business. Now that the war has ended, drilling has started, interests have increased and the royalty has been reduced; Cub Energy should start to show strong cash flow and growth soon.

Chen Lin manages a family fund and writes about it in the popular stock newsletter What Is Chen Buying? What Is Chen Selling?, published and distributed by Taylor Hard Money Advisors, Inc. While a doctoral candidate in aeronautical engineering at Princeton, Lin found his investment strategies were so profitable that he put his Ph.D. on the back burner. He employs a value-oriented approach and often demonstrates excellent market timing due to his exceptional technical analysis.

Want to read more Energy Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) The following company mentioned in the article is a sponsor of Streetwise Reports: Pan Orient Energy Corp. The following company mentioned in the article is a billboard advertiser of Streetwise Reports: Cub Energy Inc. The companies mentioned in this article were not involved in any aspect of the interview preparation or post-interview editing so the expert could speak independently about the sector. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

2) Chen Lin: I own, or my family owns, shares of the following companies mentioned in this article: Pan Orient Energy, Cub Energy and Canacol. I personally am, or my family is, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. I was not paid by Streetwise Reports for participating in this article. Comments and opinions expressed are my own comments and opinions. I determined and had final say over which companies would be included in the article based on my research, understanding of the sector and interview theme. I had the opportunity to review the article for accuracy as of the date of the article and am responsible for the content of the article.

3) Articles may be edited for clarity. Streetwise Reports does not make editorial comments or change experts' statements without their consent.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

All charts and images provided by Chen Lin.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.