Gold Stocks Correction or Final Push Higher?

Commodities / Gold and Silver Stocks 2016 May 13, 2016 - 12:55 PM GMTBy: Jordan_Roy_Byrne

Despite maintaining an overbought condition and despite the recent bearish posture of many sector pundits, the gold stocks have yet to correct more than 11%. Since the end of January the gold stocks have held above their 50-day moving averages, which is often support during a strong trend. If the gold stocks break their lows of the past two weeks then it should usher in a 20% correction and correct the current overbought condition. However, if gold stocks do not break initial support they could begin a melt-up that would lead to a more serious correction in the summer.

Despite maintaining an overbought condition and despite the recent bearish posture of many sector pundits, the gold stocks have yet to correct more than 11%. Since the end of January the gold stocks have held above their 50-day moving averages, which is often support during a strong trend. If the gold stocks break their lows of the past two weeks then it should usher in a 20% correction and correct the current overbought condition. However, if gold stocks do not break initial support they could begin a melt-up that would lead to a more serious correction in the summer.

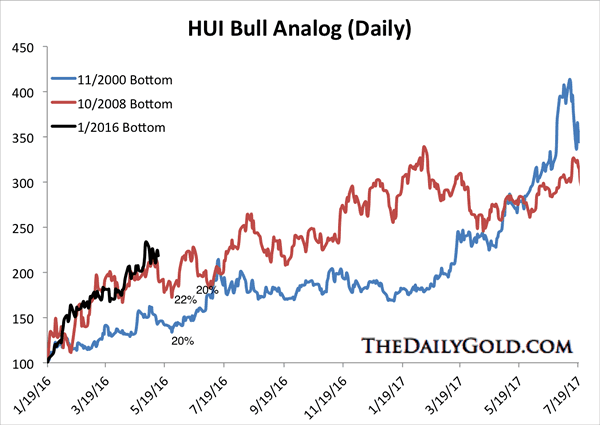

The chart below plots the three major rebounds in the HUI from the three most significant lows. The time and price scale begins from where the current rebound started. At this juncture, the two other rebounds corrected at least 20%. The current rebound has tracked the 2008 rebound very closely. That bull endured two 20% corrections over the next few months which proved to be good buying opportunities.

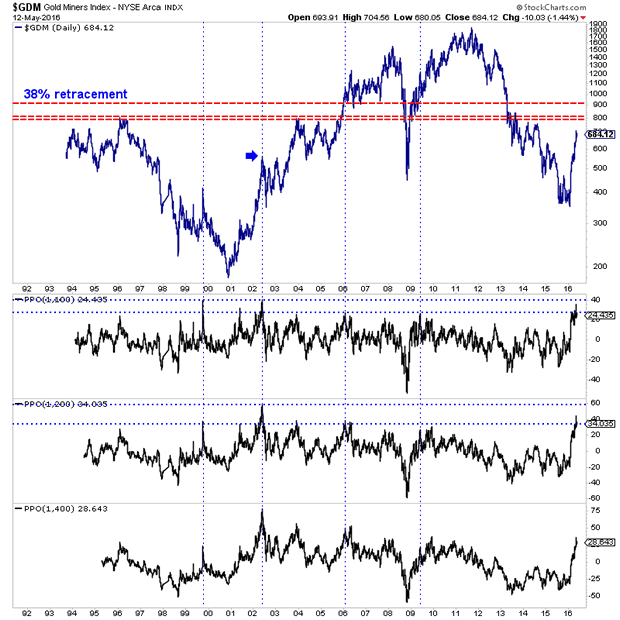

If the gold stocks do not break initial support and correct more, they would be at risk of a deeper correction following another push higher. The following chart is GDM, the parent index for GDX. Unlike GDX, GDM has a history that dates back to 1993. GDM closed Thursday at 684. It has a major resistance target at 800-810. A move to 800 is 17% upside while a move to 810 equates to GDX 29.

Also note the three oscillators at the bottom of the chart which plot GDM's distance from its 100-day, 200-day and 400-day exponential moving averages. The gold stocks are not as overbought as they were in 2002 but they are more overbought than at any other time in the past 23 years. That is a good sign considering we are early in a new bull market but it does warn of a probable sharp correction.

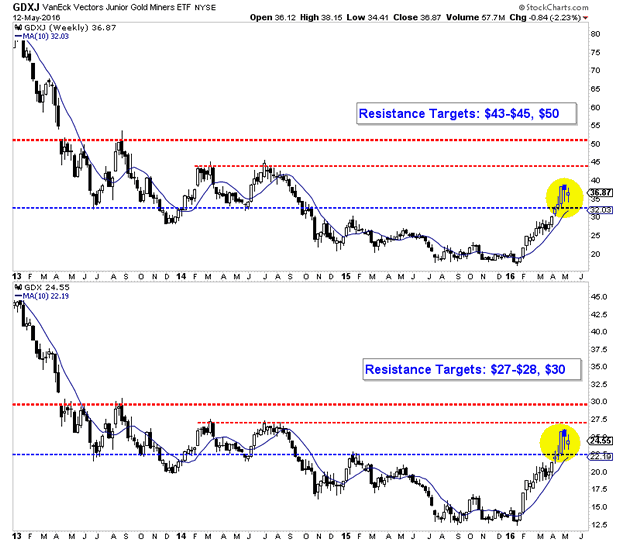

The support and resistance for GDX and GDXJ continue to be clear. GDXJ has support at $32-$33 with upside targets at $43-$45 and $50. Meanwhile, GDX has support around $22 with upside targets at $27-$28 and $30. A final push higher (before a correction) could take GDX to $29-$30 and GDXJ to $45.

The past few months has been an amazing ride in the gold stocks but all good things come to an end. Unless the gold stocks break initial support and correct by 20% (from recent peaks) then the risk of a final push higher or melt-up type move increases. That is great for us bulls but the problem is it would likely lead to a 30% correction and a potential multi-month consolidation during the second half of 2016.

Consider learning more about our premium service including our favorite junior miners which we expect to outperform in 2016.

Good Luck!

Bio: Jordan Roy-Byrne, CMT is a Chartered Market Technician, a member of the Market Technicians Association and from 2010-2014 an official contributor to the CME Group, the largest futures exchange in the world. He is the publisher and editor of TheDailyGold Premium, a publication which emphaszies market timing and stock selection for the sophisticated investor. Jordan's work has been featured in CNBC, Barrons, Financial Times Alphaville, and his editorials are regularly published in 321gold, Gold-Eagle, FinancialSense, GoldSeek, Kitco and Yahoo Finance. He is quoted regularly in Barrons. Jordan was a speaker at PDAC 2012, the largest mining conference in the world.

Jordan Roy-Byrne Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.