Here's Why the Gold and Silver Futures Market Is Like a Rigged Casino...

Commodities / Gold and Silver 2016 May 16, 2016 - 04:58 PM GMTBy: MoneyMetals

Clint Siegner writes: A respectable number of Americans hold investments in gold and silver in one form or another. Some hold physical bullion, while others opt for indirect ownership via ETFs or other instruments. A very small minority speculate via the futures markets. But we frequently report on the futures markets – why exactly is that?

Clint Siegner writes: A respectable number of Americans hold investments in gold and silver in one form or another. Some hold physical bullion, while others opt for indirect ownership via ETFs or other instruments. A very small minority speculate via the futures markets. But we frequently report on the futures markets – why exactly is that?

Because that is where prices are set. The mint certificates, the ETFs, and the coins in an investor’s safe – all of them – are valued, at least in large part, based on the most recent trade in the nearest delivery month on a futures exchange such as the COMEX. These “spot” prices are the ones scrolling across the bottom of your CNBC screen.

That makes the futures markets a tiny tail wagging a much larger dog.

Too bad. A more corruptible and lopsided mechanism for price discovery has never been devised. The price reported on TV has less to do with physical supply and demand fundamentals and more to do with lining the pockets of the bullion banks, including JPMorgan Chase.

Craig Hemke of TFMetalsReport.com explained in a recent post how the bullion banks fleece futures traders. He contrasted buying a futures contract with something more investors will be more familiar with – buying a stock. The number of shares is limited. When an investor buys shares in Coca-Cola company, they must be paired with another investor who owns actual shares and wants to sell at the prevailing price. That’s straight forward price discovery.

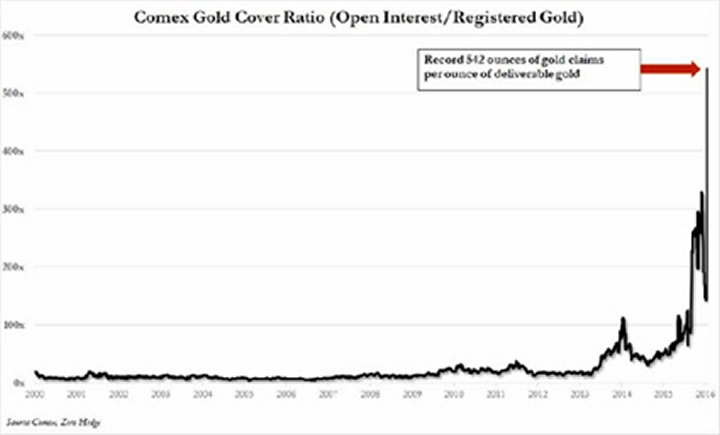

Not so in a futures market such as the COMEX. If an investor buys contracts for gold, they won’t be paired with anyone delivering the actual gold. They are paired with someone who wants to sell contracts, regardless of whether he has any physical gold. These paper contracts are tethered to physical gold in a bullion bank’s vault by the thinnest of threads. Recently the coverage ratio – the number of ounces represented on paper contracts relative to the actual stock of registered gold bars – rose above 500 to 1.

The party selling that paper might be another trader with an existing contract. Or, as has been happening more of late, it might be the bullion bank itself. They might just print up a brand new contract for you. Yes, they can actually do that! And as many as they like. All without putting a single additional ounce of actual metal aside to deliver.

Gold and silver are considered precious metals because they are scarce and beautiful. But those features are barely a factor in setting the COMEX “spot” price. In that market, and other futures exchanges, derivatives are traded instead. They neither glisten nor shine and their supply is virtually unlimited. Quite simply, that’s a problem.

But it gets worse. As said above, if you bet on the price of gold by either buying or selling a futures contract, the bookie might just be a bullion banker. He’s now betting against you with an institutional advantage; he completely controls the supply of your contract.

It’s remarkable so many traders are still willing to gamble despite all of the recent evidence that the fix is in. Open interest in silver futures just hit a new all-time record, and gold is not far behind. This despite a barrage of news about bankers rigging markets and cheating clients.

Someday we’ll have more honest price discovery in metals. It will happen when people figure out the game and either abandon the rigged casino altogether or insist on limited and reasonable coverage ratios. The new Shanghai Gold Exchange which deals in the physical metal itself may be a step in that direction. In the meantime, stick with physical bullion and understand “spot” prices for what they are.

By Clint Siegner

Clint Siegner is a Director at Money Metals Exchange, perhaps the nation's fastest-growing dealer of low-premium precious metals coins, rounds, and bars. Siegner, a graduate of Linfield College in Oregon, puts his experience in business management along with his passion for personal liberty, limited government, and honest money into the development of Money Metals' brand and reach. This includes writing extensively on the bullion markets and their intersection with policy and world affairs.

© 2016 Clint Siegner - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.