George Soros Buying Gold ETF And Gold Shares In Q1

Commodities / Gold and Silver 2016 May 18, 2016 - 09:41 AM GMTBy: GoldCore

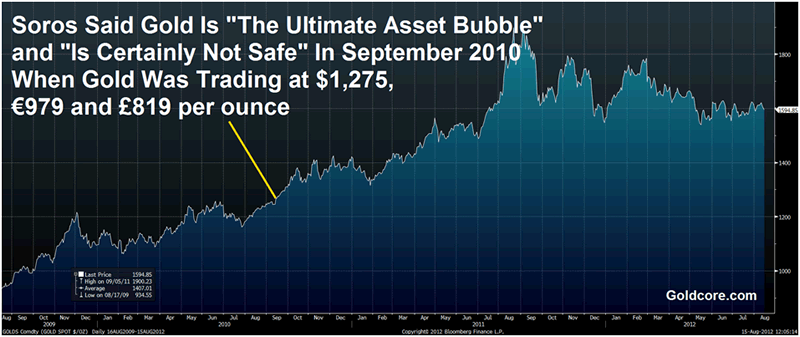

George Soros, who once called gold “the ultimate bubble,” has resumed buying the gold ETF and shares after a three-year hiatus.

George Soros, who once called gold “the ultimate bubble,” has resumed buying the gold ETF and shares after a three-year hiatus.

Soros Gets Gold Badly Wrong In 2010 – Gold in USD (2009 to 2012)

The billionaire investor yesterday disclosed that in the first quarter he bought 1.05 million shares in SPDR Gold Trust, the world’s biggest gold exchanged-traded fund, valued at about $123.5 million.

Soros cut his firm’s investments in U.S. stocks by more than a third in the first quarter and bought a $264 million stake in the world’s biggest bullion producer Barrick Gold Corp.

Soros allocation to the Gold ETF and nearly a quarter of a billion to just one gold mining share – Barrick – shows he is clearly now bullish on gold and no longer views gold as the “ultimate bubble.”

This seems likely as he has warned that there is a real risk of a euro break up and is on record regarding having deep concerns regarding the US fiscal situation – both of which are of course bullish for gold. He had also publicly declared concerns about a collapse of the Chinese economy and issued very vocal warnings a year ago in May 2015, that we are on the “threshold of a Third World War”.

Not surprisingly, he is bearish on stocks. Soros Fund Management doubled its bet against the S&P 500 stock index according to its filing to the Securities and Exchange Commission yesterday.

Soros is the man who nearly “broke the Bank of England” when the self-styled philosopher-economist and political activist manipulated the price of the pound pushing it sharply lower on international markets and badly impacting the UK economy. Five years later, he exacerbated the Asian economic crisis by betting against Thai and Malaysian currencies which almost led to a global financial crisis.

This is yet another positive development for the gold market and Soros follows in the footsteps of other many other leading hedge funds managers and billionaire investors such as Singer, Dalio and Druckenmiller and indeed institutions such as Blackrock and Munich Re.

Most hedge and institutional funds were buyers of gold in Q1. A notable exception was gold bull John Paulson who further reduced his allocation to the gold ETF by 17 percent to 4.8 million shares. It was Paulson’s third cut to his SPDR stake in a year and saw him drop to the third largest investor in the fund from second, behind BlackRock and First Eagle Investment Management. Some speculated that Paulson may have been taking profits. There is also the possibility that he quietly diversifying into physical gold in allocated accounts.

Given Soros’ awareness of financial, geo-political and indeed systemic risk, it is likely that he also owns physical gold bars in allocated accounts and not just ‘paper gold assets’ in the form of the more visible, publicly filed and high risk mining shares and gold SPDR trust.

This update can be found on the GoldCore blog here.

Mark O'Byrne

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.