Stocks Bear Market Decline Over?

Stock-Markets / Global Stock Markets Jul 20, 2008 - 03:47 PM GMT Richard Russell (Dow Theory Letters): Is the decline over?

Richard Russell (Dow Theory Letters): Is the decline over?

“So is the decline over? Anything is possible, but we still have not seen the kind of action that has ended almost every bear market of the last 75 years, according to the Lowry's studies. These previous declines have been characterized by a series of 90% down-days, with the last 90% down-day quickly followed by a 90% up-day.

“Since the May peak, we have seen only two 90% down days – June 6 and June 26. As I said, the ‘normal' situation at the final bottom of a true bear market is a 90% down-day quickly followed by a 90% up-day. So far, this has not occurred.

“Will this decline (or bear market, if that's what you want to call it) end in a different way? I've said that I can't see the market hitting bottom until at least the financials stop declining. Did the financials make the crucial turn to the upside yesterday? We should know shortly.”

Source: Richard Russell, Dow Theory Letters , July 17, 2008.

David Fuller (Fullermoney): Crude oil is key to stock markets

“I maintain that crude oil is currently the key influence on most stock markets. Given weaker oil prices, which we have seen so far this week, stock markets will surprise on the upside. Conversely, if oil were to resume its uptrend anytime soon, I believe this would weigh on most share indices.

“Barring another event-triggered spike to the upside, which would probably be temporary, I look for weaker oil prices following Tuesday's big downward dynamic, yesterday's lower low, and today's break of the June reaction lows. Now watch for a lower high, before a medium-term correction is confirmed on a move beneath $120. The remaining question in my mind is whether or not crude oil thrashes around near current levels for a little while longer before heading lower.”

Source: David Fuller, Fullermoney , July 17, 2008.

Jeffrey Saut (Raymond James): Strategy – “Rollover”

“Friday felt like Bear Stearns II, since the news about the GSEs broke on Friday just like with Bear Stearns. Hopefully, this week will be a déjà vu dance of the week following the Bear Stearns' news with the financials leading the way to the upside. Yet as Michael Steinhardt recently said, ‘There is rarely a moment such as this where as a contrarian, one sees so many reasons technically, [and] stock market-wise, to be bullish. I can't imagine a circumstance where a market is more available, more ripe, for a rally than this one. Still, this time it's different.”

Source: Jeffrey Saut, Raymond James , July 14, 2008.

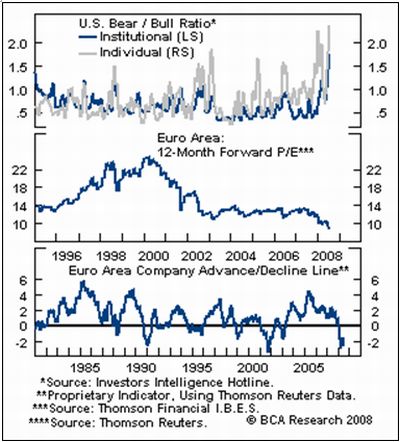

BCA Research: European equities – Near-term bounce?

“European equity investors should stay on the sidelines for now, but short-sellers are at risk of a bear squeeze.

“We would not be surprised to see the near-term bounce in European stocks continue. Bearishness has hit extremes: individual investors have been withdrawing holdings from equity mutual funds and institutions have become more pessimistic than at any time during the last thirteen years (even when the March low and the 1998 and 2002 bottoms are included).

“A record number of asset allocators are overweight cash and underweight equities, according to the most recent Merrill Lynch Portfolio Manager (MLPM) survey. Europe is also the most underweight region and a net 85% of European investors expect the domestic economy to slow (regional MLPM survey).

“In addition, the selloff has left valuations cheap across the board: P/E multiples are low even if one assumes that earnings decline by 20% (clearly a worst-case scenario) and relative to bond yields, earnings yields are at their lowest level since the secular bull market started in the early 1980s. Finally, although the broad indices are not at technical extremes, breadth has become deeply oversold. In this environment, there is no doubt that some value exists. Consequently, investors should become more discriminating. Hedge funds may wish to begin covering shorts in securities that have massively underperformed and have depressed earnings expectations.”

Source: BCA Research , July 18, 2008.

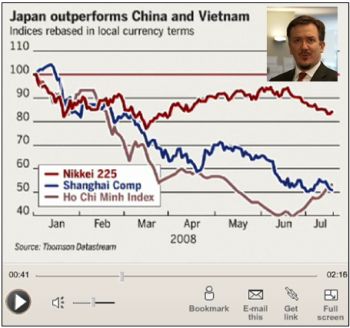

John Authers (Financial Times): Reversal of fortune in Asia

“John Authers examines Asian stock markets where Japan has outperformed both Chinese and Vietnamese stock markets so far this year.”

Click here for the full article.

Source: John Authers, Financial Times , July 16, 2008.

Kenneth Liew (UBS): Are equities a suitable inflation hedge?

“Kenneth Liew, strategist at UBS, assessed how equities performed during the high inflation period of the 1970s and early 1980s and found evidence that earnings and dividend growth rates keep pace with – if not exceed – inflation over the medium-term.

“This is not confined to energy or commodity sectors, but is evident across a large majority of sectors, he adds.

“‘However, price/earnings multiples tend to de-rate significantly when inflation rises, even in the energy and commodity sectors. As a result, share prices fall in real as well as nominal terms. P/E compression is likely due to ‘fair value' perceptions changing as higher interest rates and risk premiums accompany elevated inflation.'

“Mr Liew points out that despite stable earnings that seem ‘recession-proof', sectors such as healthcare and consumer staples underperformed during the inflationary 1970s.

“‘The reason is that their P/E multiples suffered the worst de-rating, likely due to adverse sensitivity of their premium P/E valuations to higher interest rates and risk premiums.'

“In conclusion, Mr Liew says that high dividend yields and pay-out ratios are beneficial to inflation hedging. ‘They ensure investors have adequate access to equity earnings, provided they at least rise in line with inflation,' he says.”

Source: Kenneth Liew, UBS (via Financial Times ), July 15, 2008.

Mike Lenhoff (Brewin Dolphin): Value in UK stocks

“There are signs that value is returning to the UK equity market, argues Mike Lenhoff, chief strategist at Brewin Dolphin Securities.

“He notes that the forward price/earnings ratio for the FTSE 100 has dropped to around 9.5, similar to levels seen at the end of 1990, at the time of the last major UK recession.

“But he says that with corporate earnings heading downward and estimates being cut, there is distrust in the p/e ratios.

“‘Better then to trust the dividend yield,' Mr Lenhoff says. ‘Dividends are vulnerable to cuts too but they are far less volatile than earnings.'

“Having fluctuated less than earnings in the bad times as well as in the good times, dividend growth has been half as volatile as earnings growth, he says.

“‘The prospective dividend yield for the FTSE 100 is higher now than the yield on 10-year conventional gilts, suggesting value is returning to the UK equity market. The dividend yield you see may not be quite the dividend yield you get, but it is still likely to be a good guide to value.'

“However, Mr Lenhoff points out that value is seldom a good guide to market timing.

“‘There may be better buying opportunities. But buying opportunities only look like buying opportunities well after the event. What matters is whether an investment in the UK equity market at dividend yields available today will prove rewarding eventually. We think it will.'”

Source: Mike Lenhoff, Brewin Dolphin (via Financial Times ), July 16, 2008.

YouTube: Ron Paul on the Financial Services Hearing, US dollar

“Congressman Ron Paul talks about his confrontation with Treasury Henry Paulson and Fed Chairman Ben Bernanke at the Financial Services Hearing.”

Source: YouTube , July 10, 2008.

David Fuller (Fullermoney): US dollar losing credibility

“The US dollar has now almost certainly fallen beneath the threshold of credibility as the world's reserve currency … There will be periodic rallies, of course, but I question whether there is any way for the US dollar to regain its post WW2 credibility, without a revolution in US fiscal policy and much improved standards of corporate governance. This would certainly be desirable but there is little evidence of change while Ron Paul remains a lone political voice.

“Meanwhile, there is a risk that we will see further evidence of dollar revulsion. If so, I think the main fault line, in addition to the currency, would be US Treasury yields. Recently, these have appeared to be on deflation watch.

“Among fiat currencies, the US dollar's increasing loss of credibility elevated the euro's status as a reserve unit for creditor nations, not least due to liquidity and a more widely trusted central bank. Many private institutions and investors have understandably favoured high-yielding currencies, mainly among the resources exporters. My long-term view is that the Chinese renminbi will eventually become the main global reserve currency, but obviously not until some time after it becomes fully convertible.”

Source: David Fuller, Fullermoney , July 16, 2008.

Richard Russell (Dow Theory Letters): Dollar is Achilles Heel of US economy

“I said it three years ago, I said it two years ago, I said it a year ago, I said it six months ago, and I'll say it again today. The Achilles Heel of the United States is the dollar. The reserve status of the US dollar is absolutely critical to the health of the US. If the dollar begins to lose it's reserve status, the US economy will be in shambles.

“Gold is now on the move. It's taking more and more dollars to buy an ounce of real money – gold. This is the market's way of saying that it trusts the value of the dollar less and less. You may like gold as I do, but the rising trend of gold is a red flag for the health of the United States. The rising dollar price of gold is telling us that both the US economy and the dollar are in trouble.

“The US is the only nation in the world that can print the currency that its own debt is denominated in. That's an unbelievable ‘gift'. But the US has been doing too damn much printing and too much debt creating. The world recognizes this, and it's systematically moving away from dollars. Nations are now creating Sovereign Wealth Funds that buy tangibles while at the same time they're getting rid of unwanted dollars.

“Right now almost everything from stocks to the Dow to homes to food is losing value relative to gold. I tell you it's ominous. And it's all the more ominous because 95% of analysts and economists don't recognize or understand what's going on. They're ignorant of the message that rising gold is sending us, and worse – their ignorant of the very meaning of gold.”

Source: Richard Russell, Dow Theory Letters , July 15, 2008.

Financial Times: Sovereign funds cut exposure to weak dollar

“Some of the world's largest sovereign wealth funds are seeking to scale back their exposure to the US dollar in a sign of global concern about the currency.

“One big sovereign fund in the Gulf has cut its dollar-denominated holdings from more than 80% a year ago to less than 60%, while China's State Administration of Foreign Exchange (SAFE) has been looking to strike deals with private equity firms in Europe as a part of a strategy to reduce its dollar holdings.

“Sovereign wealth funds have played a leading role in helping to recapitalize faltering US banks, but have lost money so far on such investments. Continuing market turbulence has further shaken their faith in US policy and policymakers.

“Kenneth Shen, head of the strategic and private equity group at Qatar Investment Authority, another Middle Eastern fund looking to do more deals in Europe than the US, aired such concerns publicly at a conference in Hong Kong. ‘The outlook for the US dollar is a significant issue for investors contemplating US-related investments,' Mr Shen said.

“‘The shift at China's SAFE is significant because it holds the majority of the country's $1,600 billion in foreign currency reserves in dollar instruments and has lagged behind other governments, such as Singapore, in diversifying its currency exposure. SAFE has been holding talks with Europe-based private equity firms about putting billions of dollars into their latest funds, precisely because these funds are not dollar-denominated, say people familiar with the matter.

“By allocating money to Europe-based private equity firms, SAFE could diversify away from the dollar, at least at the margin, without spooking the currency markets and driving the dollar down in a disorderly manner.”

Source: Henny Sender, Financial Times , July 16, 2008.

Moneyweb: “Significant chance” of blow-out of South African rand

“Speculating where the rand is headed is a notoriously treacherous terrain, but Rand Merchant Bank (RMB) have ventured where angels fear to tread, predicting there is a ‘significant chance' the rand will see the wrong end of nine to the dollar this year.

“The bearish call is a contrarian view with the consensus forecast now estimating that the rand will end the year at around R8/$. It is also a step outside of the rand's current trading range of between R7.50 and R8.22.

“But in a lengthy report, RMB currency analyst John Cairns warns of the possibility of a ‘blow out' against all major currencies, although his most probable prediction is that the rand will decline to R8.50 by the end of the year.

“Cairns concedes that the rand is undervalued about 15% on a purchasing price parity basis, and also that the current-account deficit should gradually improve during the year.

“His argument is hinged on the ‘shocking state' of the balance of payments. At the same time, the usual array of countervailing forces, like portfolio inflows and fixed direct investment, that have up to now served to finance this deficit are drying up.

“The ‘massive' 9% of GDP 1Q08 current-account deficit didn't shock the market. But he said ‘it is a terrible number nonetheless, implying an annual funding requirement of close to R200 billion ($26 billion).

“Not all economists are so pessimistic. Brait economist Colen Garrow points to the ‘massive' interest rate differential that has opened up between SA and the US in particular. That interest rate differential, now a ten percentage point difference with the US and 7.5 point difference with the Euro zone, should encourage portfolio inflows.”

Source: Tim Cohen, Moneyweb , July 14, 2008.

Richard Russell (Dow Theory Letters): Cheap oil not coming back

“… what about oil? I've been expecting a top in oil (see daily chart below). Yesterday, for the first time since last February oil broke below its 50-day moving average. I believe there's a good chance that we've seen the highs for oil. Yesterday was the third day in a row that oil sank by over $4 per day. The final cap on oil will come if oil drops to the 120 level.

“So should you hang on to your gas-eating SUV or your yellow Hummer? My advice, ‘No, cheap oil will not come back. Cheaper oil – yes. Cheap oil – no.'”

Source: Richard Russell, Dow Theory Letters , July 18, 2008.

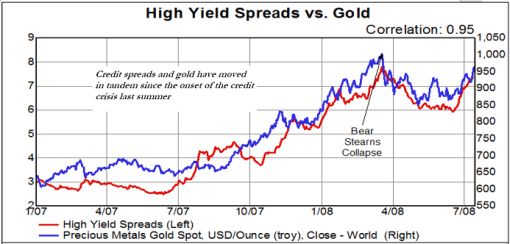

GaveKal: Gold closely correlated with high yield spreads

Source: GaveKal – Checking the Boxes , July 14, 2008.

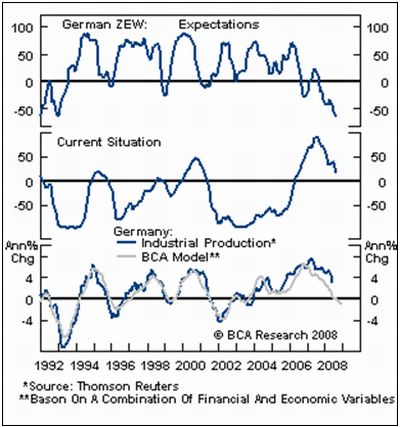

BCA Research: German ZEW Survey – Outlook deteriorates further

“Yesterday's ZEW release showed that the expectations component plunged more than expected to minus 63.9 in July (from minus 52.4). The current situations component also slipped sharply to 17 (from 37.6). Tight monetary conditions, rising input costs, and deteriorating exports have weakened the profit outlook, at a point when high food and energy prices are impacting household spending and putting further upward pressure on interest rates.

“Our industrial production and profit models warn that the regional economy is on track for a period of below-trend growth. Regardless, the ECB has been clear that it is willing to err on the side of weaker growth to ensure that price pressures subside.

“Bottom line: Remain underweight euro area bonds within a global hedged fixed income portfolio. We will wait to upgrade this market until the regional economic slowdown is further advanced.”

Source: BCA Research , July 16, 2008.

The Wall Street Journal: IMF Raises Global Growth Forecast

“The outlook for the world economy has improved in recent months, but governments face an increasingly difficult task of trying to tamp down rising inflation pressures without jeopardizing economic growth, the International Monetary Fund said.

“‘The global economy is in a tough spot, caught between sharply slowing demand in many advanced economies and rising inflation everywhere, notably in emerging and developing economies,' the fund said in its latest update to the World Economic Outlook.

“The IMF raised its global economic-growth forecast for 2008 to 4.1% from an earlier estimate of 3.7% in April. Its 2009 projection was lifted a notch to 3.9% from 3.8%.

“The first-quarter slowdown wasn't as bad as expected. But the fund sees signs of a further deceleration in the second half, with a gradual recovery next year.

“The improvement in the growth forecasts is in large part due to a surprisingly resilient U.S. economy, which grew 1% in the first quarter. The IMF revised its US estimate for 2008 to 1.3% from a forecast of 0.5% growth given in April.

“US growth is expected to be flat or ‘decline modestly' in the second half of the year, owing to rising commodity prices and tighter credit conditions, then recover slowly next year, Mr. Johnson said.

“The 2009 US growth estimate also edged up to 0.8% from 0.6%, with the housing market expected to hit bottom in the next few quarters.

“The IMF's April forecasts, particularly those for the US and euro area, drew criticism from those countries' governments and even its sister institution, the World Bank, as being overly pessimistic.

“The IMF also raised its euro-area forecast, for the 15 nations of the European Union that use the euro as their currency, to 1.7% this year from its previous estimate of 1.4%, while keeping its 2009 projection at 1.2%. The U.K. is now expected to grow 1.8% this year and 1.7% in the next, versus previous growth estimates of 1.6% for 2008 and 2009.

“Japan's forecast for this year was adjusted higher by 0.1 percentage point to 1.5%, with the 2009 forecast unchanged at 1.5%.

“The overall forecast for emerging and developing economies edged up 0.2 percentage point to 6.9% this year, with a 0.1-percentage-point increase over the April forecast for next year to 6.7%.

“China's 2008 forecast was raised to 9.7% from 9.3% in April, with the 2009 estimate increasing to 9.8% from 9.5%. India is estimated to grow 8% this year, up from an earlier forecast of 7.9%, while the 8% forecast for 2009 was unchanged.”

Source: Tom Barkley, The Wall Street Journal (via Fullermoney ), July 18, 2008.

Financial Times: IMF warns emerging markets on inflation

“Emerging economies must make the fight against inflation their ‘top priority', the International Monetary Fund said on Thursday as it sharply raised its forecast for price increases in the developing world this year and next.

“Many emerging markets had to raise interest rates, cut government deficits and let currencies appreciate more to contain the inflation risk, the IMF said.

“The comments came as China announced mixed news on its efforts to combat inflation. Consumer price inflation continued to decline – from 7.7% in May to 7.1% last month – but factory gate inflation rose again from 8.2% to 8.8%.

“Beijing said the economy grew 10.1% in the second quarter, down from 10.6% in the first, and it was the fourth successive quarter in which gross domestic product growth slowed. The rate, slightly below analysts' forecasts, was the lowest since the last quarter of 2005.

“Simon Johnson, the IMF's outgoing chief economist, told reporters that emerging economies in Asia, in particular, were in danger of falling behind the curve on inflation. Brazil was praised for taking steps to curb price pressures.

“The IMF expects inflation to hit 9.1% in the emerging world this year and remain high at 7.4% next year. The fund also marked up its forecast for inflation in the industrialised world, but inflation there would subside more quickly, it said, from 3.4% this year to 2.3% next.

“The warning on inflation came as the IMF edged up its growth forecast for the US in the light of a better-than-expected performance in the first half of the year. But it said the US economy was likely to contract in the second half amid a general slowdown in global growth.”

Source: Krishna Guha and Geoff Dyer, Financial Times , July 17, 2008.

Sean Darby (Nomura International): Why intervention fails

“The current extreme levels in commodity, foreign exchange and equity markets have prompted a chorus of calls in Asia for government intervention – although such action would be unlikely to prove successful, says Sean Darby, analyst at Nomura International.

“He believes the only two successful cases of price intervention are in the diamond market, where a handful of producers control the supply and price of the jewels, and the Hong Kong Monetary Authority's purchase of the equity market in the late 1990s.

“Mr Darby argues that in many respects, Asia is its own worst enemy by still tying exchange rates to the US dollar to help exporters. Although the central banks in Asia don't necessarily run formal peg exchange rate mechanisms, they still intervene to maintain competitiveness against each other.

“‘Further, by running negative real interest rates while offering food and fuel subsidies to prop up domestic consumption, they are inadvertently raising demand for commodities further and fuelling domestic inflation rates.

“‘In conclusion, the history of intervention shows a very low success rate, and as global capital markets have developed, central banks and governments have found it increasingly difficult to control the price of domestic assets.

“‘The Asian authorities will need to refrain from fuel and food subsidisation, and raise real interest rates, if they are to keep inflation from taking hold.'”

Source: Sean Darby, Nomura International (via Financial Times ), July 14, 2008.

James Pressler (Northern Trust): China – economic “slowdown” is relative

“Throughout the developed world, an economic growth rate in double digits would almost certainly send central banks into tightening mode, but China is a different case. Today's announcement that Q2 GDP growth was 10.1% on the year suggested that the economic slowdown shows no signs of bottoming out immediately.

“And to complicate matters, inflation remains uncomfortably high at 7.1% on the year, pushed by sharp increases in food prices.

“This is the Chinese version of stagflation – and now analysts are pondering about the direction of monetary policy in the next few months.

“We feel that for the rest of the quarter and perhaps throughout 2008, the central bank will adopt a neutral, wait-and-see approach.

“It is already understood that the economy will be supported this quarter by tourism activity from the Beijing Olympics and by the massive reconstruction effort underway in the wake of the devastating Sichuan earthquake.

“Then in Q4 the economy will likely catch its breath, with growth touching the nadir of this cycle at about 9.5% on the year.

“At this point there will be more information about whether food prices have stabilized or if any second-wave effects have crept into the pricing equation, thus prompting a need for further tightening. We expect prices will be relatively contained, and the PBoC will consider a little monetary stimulus to get the economy going again. However, until that time we will be watching for resurgent price pressures, especially in nonfood CPI, that could move the PBoC to go back to tightening mode.”

Source: James Pressler, Northern Trust – Daily Global Commentary , July 17, 2008.

Financial Times: China on brink of electricity shortfall

“China faces its worst power shortage in at least four years as soaring coal prices and government-set electricity tariffs force dozens of small power plants to shut down rather than face mounting losses.

“Nearly half of China's provinces have started to ration electricity as the country enters the peak summer season, facing what analysts describe as its worst coal shortage.

“Analysts warn that this year's electricity shortfall could be more severe than in 2004, when the country was affected by its worst power shortage in decades because of soaring demand for power as the economy boomed.

“China's problems mirror those of other Asian countries, where the rising price of fuel and other commodities has had an impact on governments that traditionally subsidise everything from the cooking kerosene used by the poor to the electricity used by industry. Companies in Indonesia, for example, have complained of rolling blackouts and action by the government to force them to shift factory production to weekends.”

Source: Jamil Anderlini and Geoff Dyer, Financial Times , July 16, 2008.

Ifo: Russian economy – state guided and dependent on oil exports

“In recent years, the Russian economy has grown at an average pace of 7% annually. Whether this pace can be maintained if the economy continues to be regulated by the state and dependent on exports of raw materials is questionable in the opinion of Philip Hanson, Royal Institute of International Affairs in London. In the current issue of CESifo Forum he points out the possible risks.

“The strong dependency on oil, especially at the currently high prices, can hamper the diversification of the economy and slow down economic growth in the long term.

“A further retarding factor to economic development Hanson sees in R&D policies, which are concentrated on state-run large enterprises. Technology co-operations and technology transfers of foreign firms with Russian enterprises are limited. This stands in contradiction to the intention of the Russian government to transform Russia into a modern and broadly diversified economy.

“In terms of patent applications, which are very modest in an international comparison, Russia is also not reaching this goal.”

Click here for the full report.

Source: Ifo , July 2008.

Financial Times: India's financial woes

“Ridham Desai, Morgan Stanley's managing director and equity strategist in India, explains why India is more vulnerable to global financial market events than China.”

Source: Joe Leahy, Financial Times , July 11, 2008.

Did you enjoy this post? If so, click here to subscribe to updates to Investment Postcards from Cape Town by e-mail.

By Dr Prieur du Plessis

Dr Prieur du Plessis is an investment professional with 25 years' experience in investment research and portfolio management.

More than 1200 of his articles on investment-related topics have been published in various regular newspaper, journal and Internet columns (including his blog, Investment Postcards from Cape Town : www.investmentpostcards.com ). He has also published a book, Financial Basics: Investment.

Prieur is chairman and principal shareholder of South African-based Plexus Asset Management , which he founded in 1995. The group conducts investment management, investment consulting, private equity and real estate activities in South Africa and other African countries.

Plexus is the South African partner of John Mauldin , Dallas-based author of the popular Thoughts from the Frontline newsletter, and also has an exclusive licensing agreement with California-based Research Affiliates for managing and distributing its enhanced Fundamental Index™ methodology in the Pan-African area.

Prieur is 53 years old and live with his wife, television producer and presenter Isabel Verwey, and two children in Cape Town , South Africa . His leisure activities include long-distance running, traveling, reading and motor-cycling.

Copyright © 2008 by Prieur du Plessis - All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Prieur du Plessis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.