SPX Appears "Heavy"

Stock-Markets / Stock Markets 2016 Jun 02, 2016 - 02:01 PM GMT The SPX Premarket appears heavy, but not down enough to make a difference. So we are in a sideways consolidation until a breakout or breakdown occurs. So far, the market has reacted to its Pi date on Tuesday. We may not get follow-through until tomorrow, when the monthly Jobs Report comes out.

The SPX Premarket appears heavy, but not down enough to make a difference. So we are in a sideways consolidation until a breakout or breakdown occurs. So far, the market has reacted to its Pi date on Tuesday. We may not get follow-through until tomorrow, when the monthly Jobs Report comes out.

ZeroHedge reports, “There are just two drivers setting the pace for today's risk mood: the OPEC meeting in Vienna which started a few hours ago, and the ECB's announcement as well as Mario Draghi's press statement due out just one hour from now. Both are expected tonot reveal any major surprises, with OPEC almost certainly unable to implement a production freeze while the ECB is expected to remain on hold and provide some more details on its corporate bond buying program, although there is some modest risk of upside surprise in either case. So while we await the outcome of both key events, European stocks rose, U.S. index futures declined, oil held near $49 a barrel, and the yen gained notably for the third day in a row. “

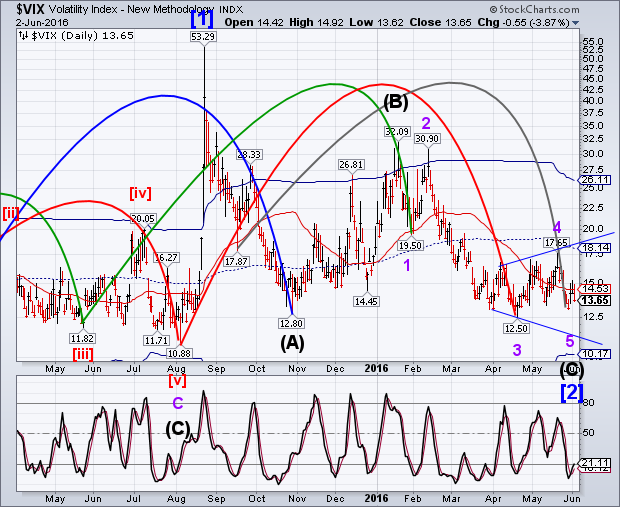

So far, VIX appears to have made an impulse higher and only a moderate retracement. This is a positive sign that may confirm the turn in stocks.

I am still counting this decline as a Wave 5, due to the Broadening formation. It is not unusual for the fifth and final point to fail going the distance. Should this remain the case, it would be very bullish for VIX, with a potential target near 25.00.

TNX has turned back down this morning, but we may not have seen the end of the consolidation in an [a]-[b]-[c] fashion. Should TNX bounce at the 50-day Moving Average, we may see it revisit yesterday’s high at 18.49.

All-in-all, today may be another quiet day until the direction of the market can be resolved.

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.