Stock Market No New High?

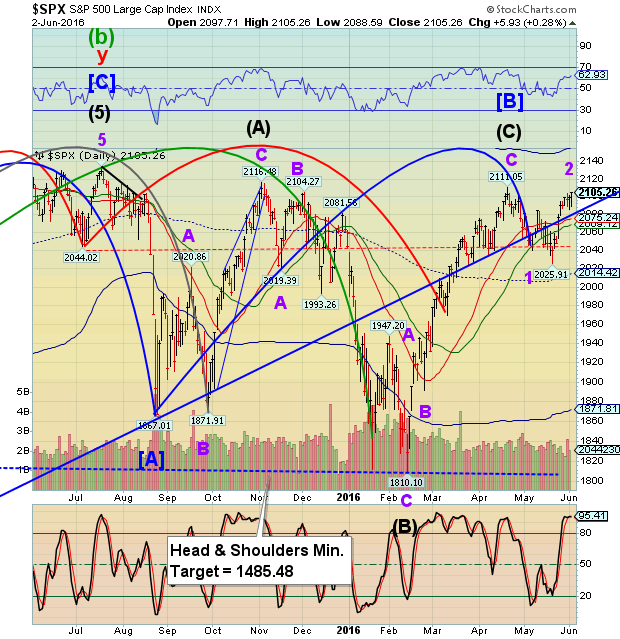

Stock-Markets / Stock Markets 2016 Jun 03, 2016 - 07:14 AM GMT This Wave [B] at the 2111.05 high appears to be a 3-3-3 wave affair. It would be more acceptable to have a Wave 5 at today’s high and maybe it may happen tomorrow, changing the Wave [B] to a 3-3-5 wave pattern, which is more familiar to most analysts. However, the pattern works, as is.

This Wave [B] at the 2111.05 high appears to be a 3-3-3 wave affair. It would be more acceptable to have a Wave 5 at today’s high and maybe it may happen tomorrow, changing the Wave [B] to a 3-3-5 wave pattern, which is more familiar to most analysts. However, the pattern works, as is.

Should today’s high remain as labeled, it would be an end to a long, speculative affair. As Frost and Prechter write in Elliott Wave Principle, (page 79) “B waves are phonies. They are sucker plays, bull traps, speculator’s paradise, orgies of odd-lotter mentality or expressions of dumb institutional complacency (or both).” Think…central banks, pensions, stock buybacks and hedge funds.

There is a good probability of a gap down in the morning, if this analysis is correct.

The April 20 high at 2111.05 occurred on the second day from its Pi date. Today’s high is three days from its Pi date. The next Pi date occurs on July 3. This give us 52 market days of decline from the April 20 high, should it hold. It also gives us 22 market days from today to the low. Things may get interesting.

VIX appears to have made its Master Cycle low on May 27 at 13.07. Wave (Point) 5 in the Broadening formation did not make a lower low, which may be considered quite bullish for this formation. Its minimum target is 25.00 and it may go considerably higher. A breakout of the upper trendline may tell us the formation is “locked and loaded.”

Regards,

Tony

Our Investment Advisor Registration is on the Web.

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals.

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.