Investment in Cell and Gene Therapies Ramps Up

Companies / BioTech Jun 08, 2016 - 06:10 PM GMTBy: TLSReport

After decades of disappointment, cell therapies and gene therapies are finally seeing light at the end of the tunnel. Investors, investigators, clinicians, and patients with serious unmet needs are watching pivotal trials move into the home stretch. Yes. . .pivotal data are actually on the way.

After decades of disappointment, cell therapies and gene therapies are finally seeing light at the end of the tunnel. Investors, investigators, clinicians, and patients with serious unmet needs are watching pivotal trials move into the home stretch. Yes. . .pivotal data are actually on the way.

Though the roadblocks that have held back development of cell and gene therapies since the mid-1990s have been expensive in terms of a lingering hangover with depressed valuations, investors are now looking at achievement in terms of meaningful endpoints.

This progress follows on a long and troubled history. From their introduction into human research and development pipelines, cell therapies have been encumbered by the improbable combination of polarized conservative politics juxtaposed with vastly inflated investor expectations. For a combination of reasons, big pharmas and biopharmas watched from the sidelines as tiny biotechs with scarce financial resources struggled to find unparalleled and unheard-of regenerative medicine solutions to problems never before addressed.

That went double for gene therapies. From a practical standpoint, it was understandable that big pharma took itself out of the running: These modalities could draw fire, subpoenas could arrive to appear in front of congressional subcommittee hearings, and could require investment—almost blindly in many respects—in areas where protocols and endpoints had not even been defined.

Gene therapy research was set back in the United States when investigators and developers found themselves on the defensive after the September 1999 death of 18-year old Jesse Gelsinger, who succumbed while taking part in a gene therapy safety trial at the University of Pennsylvania. He suffered massive, multiple organ system failure and ultimate brain death. The tragedy was compounded by the fact that the youthful and altruistic Gelsinger was not very sick. He was born with a genetic enzyme deficiency that was well controlled, but he had a stated desire to help infants born with severe, life-ending disease.

Cell therapies never saw that kind of gut-wrenching moment of drama, but the early focus of regenerative medicine was on cells derived from embryonic and fetal tissues that would presumably propagate immortal cell lines and would be both immune-privileged and pluripotent. The origin of these cells became an attention-grabbing campaign issue in politics, and ultimately in government policy when President George W. Bush signed an executive order in 2001 preventing government agencies—most notably the National Institutes of Health—from performing embryonic or fetal cell studies with any new cell lines going forward. Only existing cell lines could be used. President Obama rescinded that order six weeks into his presidency in March 2009, but the Bush order had already delayed research and thwarted capital for eight years, which caused investors to turn their attention to other areas.

After the human genome sequence project was completed in April 2003, pharma and biotech shareholders found themselves wondering when the anticipated wellspring of cures would begin to materialize. Investor time horizons are typically 12–18 months, which does not fit the cell therapy development timeline from basic wet-lab bench research to human clinical trials. It would take more than a decade to begin leveraging what was, in effect, a genomic table of contents, and not a recipe book with step-by-step directions on how to cure genetic diseases.

All along, big pharma remained reluctant to jump in. Although politics had been an initial impediment, the pharma business model was, in fact, not ideal for development of gene and cell therapies, which require bioreactors and totally different handling protocols. The pharma way of doing business is the pill-in-a-bottle. Tablets and capsules containing small molecules are modular and, therefore, lucrative. Pills can be packaged, shipped and stored with less fuss, weight and expense than boxed-up food products. The small molecule is, in fact, perfect for every aspect of the pharma business, from basic research to massive pivotal studies with thousands of patients. The pill in a bottle also supports patient compliance, because it's easy to swallow. The ultimate prize for big pharma is approval of a small-molecule product that can be stocked in pharmacies and given to clinicians in brightly colored blister-pack samples by fresh-faced, ultrafriendly drug reps.

This model is not possible with cell and gene therapies, which require special handling. Cell and gene therapy platforms are, by definition, not driven with small molecules that can be delivered in a simplified and modular fashion.

Against this backdrop, the Alliance for Regenerative Medicine (ARM) held its fourth annual cell and gene investor day in March, with more than 30 advanced therapy companies on hand to explain their technologies, science and growth propositions. Milestones—share-moving catalysts—were a major component, and overall the conference was very upbeat.

Edward Lanphier, former president and CEO of Sangamo BioSciences Inc. (SGMO:NASDAQ), is chairman of ARM and no stranger to the business partnering concept. Sangamo's gene therapy platform is addressing HIV/AIDS, hemophilia, lysosomal storage disorders and serious inherited blood diseases such as beta-thalassemia and sickle cell disease. The company, like other gene therapy enterprises, is looking to offer functional cures, not just disease management and symptomatic relief. Some of Sangamo's noncore assets are partnered with a major European pharma and a very large U.S. biopharma.

Having headed up a small-cap biotech that must ultimately partner many of its programs, Lanphier understands the big drug company mindset. "Pharma hates risk," he told me. "They'd rather spend 10 times as much for a derisked product candidate than invest early." Decision-capable executives at deep-pocket megapharmas worry about their careers at all times, and that's especially true if they are committing company capital and human resources to an entirely new paradigm. A failed program carries the decision maker's signature and prestige, and a letdown can mean a limit on advancement or even the end of a career.

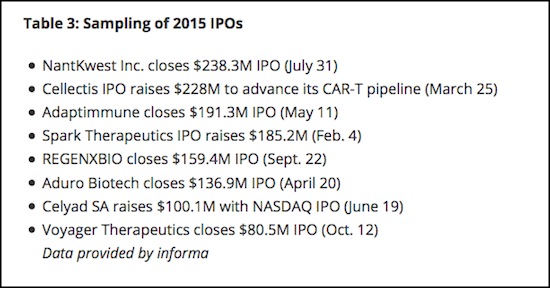

The good news is that things are changing. According to business intelligence firm informa, total financings in gene and cell therapy companies totaled $10.8 billion ($10.8B) in 2015, which represented a 106% increase over 2014. A total of $6.8B was invested in gene and gene-modified cell therapy during 2015, versus $3.6B in 2014, an 84% increase. Cell therapy brought in $7B in investment during 2015, versus $3.4B in 2014, a 104% surge. Big pharmas and big medtech are the driving forces [Table 1].

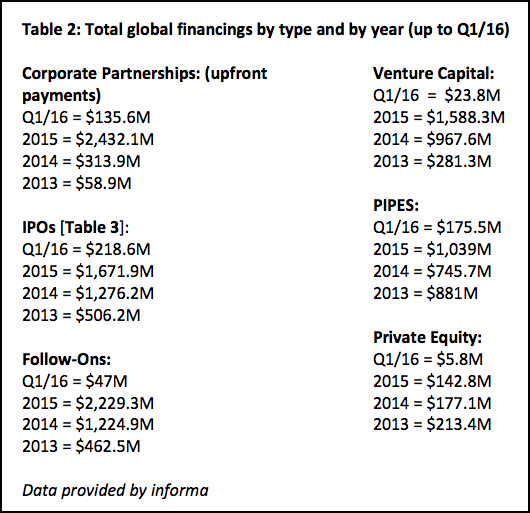

Institutional investors are significant, but industry or corporate investment is what gives technology platforms validity. Look at the extraordinary growth in just three years. The total from corporate investment was $58.9 million ($58.9M) in 2013, $313.9M in 2014, and a whopping $2.432B in 2015, which represents a one-year surge of 675%. It is only a matter of time before investments like these begin to deliver data [Table 2].

Immunotherapy Drivers

The advent of immunotherapies has given a lift to both cell and gene technology platforms. Immune therapies can be cellular, antibody or small molecule, or a combination of all of three. It's interesting to hear industry voices discuss their thought processes on this technology.

For example, ARM conference panelist Jeff Till of EMD Serono, the innovation-seeking specialty care biopharmaceutical division of Merck KGaA (MKGAY:OTCPK) noted that, "Manufacturing these cells in bulk quantities and reproducibly is a very challenging manufacturing paradigm." In thinking this through, Till and his associates began talking about adding CAR (chimeric antigen receptor) T-cell technology to complement EMD Serono's immuno-oncology space. With the CAR T mindset, the company announced in March 2015 that it was embarking on a collaboration with Intrexon Corp. (XON:NYSE), which has a synthetic biology platform. That provided the company with "the tool box of Intrexon. . .which is really a DNA technology tool box," Till said.

The Intrexon collaboration also provides EMD Serono with the skill sets and technology of ZIOPHARM Oncology Inc. (ZIOP:NASDAQ), a company collaborating with Intrexon. "It's really a three-way agreement," he says. "What's different [is that] our core focus at the company is around antibody therapeutics, small molecules and the marriage between them—antibody conjugates." It is this kind of outside-the-box thinking—the new raging interest in immunotherapies—that is driving cell therapies once again.

Investors are now seeing the major big pharma/big medtech contingent enter the cell therapy field. This door opener gives credibility and validation to the regenerative medicine field, and is exactly what has been missing over the last two decades.

Mark Zimmerman's story exemplifies how the paradigm is changing. Zimmerman, a bioengineer who spent 20 years in orthopedic research involving cartilage and bone therapies, joined Johnson & Johnson (JNJ:NYSE) in 1997, and is the founder and venture leader of J&J's program focusing on cell therapies to treat diabetes through its Janssen Pharmaceuticals unit. At Janssen, Zimmerman headed up a new company called LifeScan Inc. to develop an ectopic site for islet cell transplantation using biodegradable scaffolds. Zimmerman has some autonomy, and he has the flexibility to develop programs and enterprises either internally or externally.

How exactly did this kind of important project come about in a huge pharma/medtech? "The short story is that Dave Holbeck, who was the CEO at Centocor Inc., (now Janssen Biotech Inc., a unit of J&J) had a vision of startups inside of a big pharma," says Zimmerman. "So we became an internal venture. We were managed with a board of directors, and we had a scientific board, and we had a single vision and mission, which was to develop a cell therapy for diabetes. The company spent about four years working on different adult cell therapies."

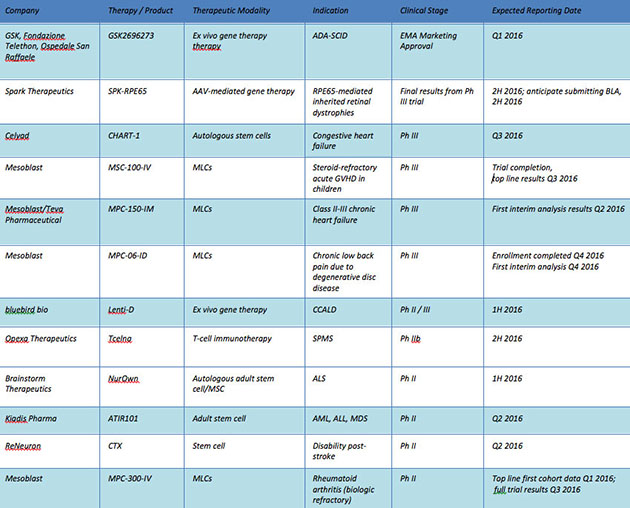

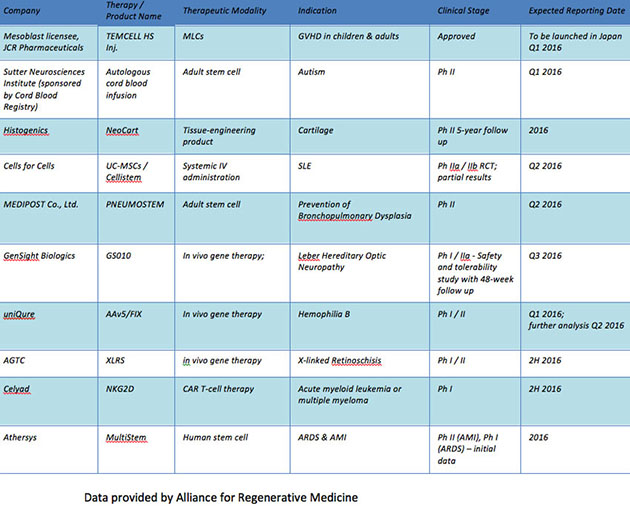

Though the development in the cell and gene therapy fields has come in stages, the upshot is that investors should expect to see data this year and next that will move shares. [Table 4].

Table 4

And in the end, it's all about doing clinical trials and learning from the errors. Failures will occur, as they inevitably do, but the future is bright for cell and gene therapies. These advanced interventions will bring humankind real solutions and actual cures.

Dr. George S. Mack is an analyst at consulting firm BioDecade where he is managing director. He performs biotechnology equity research for investors. His focus areas are oligonucleotide, cell and gene therapies. For a number of years he served as a consulting analyst at Decision Resources, and he has been published in Nature Medicine and Nature Biotechnology, the latter of which focuses on the science and business of biotechnology. At Nature Biotechnology he wrote lengthy main features on drug development in the areas of microRNA, systems biology, epigenetics and metastasis. He has been a contributor to financial publications that include Buyside and Wall Street Research, where he wrote for institutional investors. He is a contributor to The Life Sciences Report where he interviews biotechnology CEOs and sellside analysts. Dr. Mack is a 1970 graduate of the University of South Carolina in Columbia where he earned his BS degree in biology and a 1974 graduate of the Medical University of South Carolina in Charleston where he earned his DMD degree. He can be reached at gmack@biodecade.com.

Disclosures:

1) Dr. George S. Mack: I own, or my family owns, shares of the following companies mentioned in this article: None. I personally am, or my family is, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. I was paid by Streetwise Reports for producing this article. Comments and opinions expressed are my own comments and opinions. I determined and had final say over which companies would be included in the article based on my research, understanding of the sector and interview theme.

2) The following companies mentioned in this article are sponsors and/or billboard advertisers of Streetwise Reports: None. The companies mentioned in this article were not involved in any aspect of the article preparation or editing. Streetwise Reports does not accept stock in exchange for its services. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

4) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.