George Soros Making Big Bets on Gold

Commodities / Gold and Silver Stocks 2016 Jun 14, 2016 - 02:23 AM GMTBy: The_Gold_Report

George Soros has joined fellow billionaire investors Stan Druckenmiller and Ray Dalios on investing big in gold. Precious metals expert Michael Ballanger explains what is behind these moves.

George Soros has joined fellow billionaire investors Stan Druckenmiller and Ray Dalios on investing big in gold. Precious metals expert Michael Ballanger explains what is behind these moves.

This week George Soros once again came out with his very large directional "bets" for the S&P 500 and for gold and, needless to say, Mr. Soros is once again shorting the S&P and buying gold and gold miners, joining Ray Dalio, Stanley Druckenmiller and Michael Ballanger (just kidding) in a decidedly unpopular stance. Carl Icahn came out in agreement during a CNBC interview this week that left the interviewer near-speechless and groveling in the mud of anti-Wall Street rhetoric.

In the meantime, some of the smartest investors I know are SOOOO bullish on gold that they are buying huge baskets of penny explorers under a nickel because of the leverage contained when the public finally decides to re-allocate to include gold (and mining stocks). A fund manager I know said to me, "Must be the top!" in reference to this, but it really can't be the top after a five-month rally representing the largest recorded quarterly advance in mining shares since recordkeeping began.

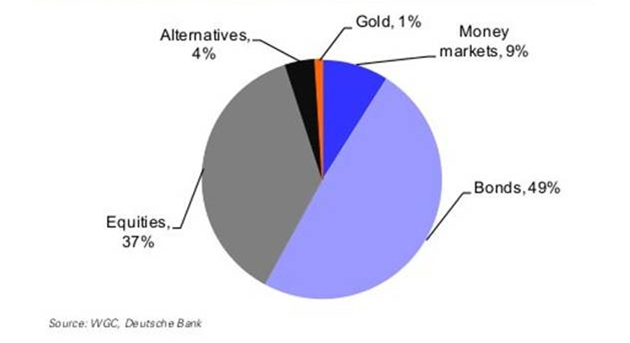

Look at the chart above and think what would happen if we were to get a shift from bonds to gold; 49% of global asset allocations reside in bonds while 1% reside in gold. Now, consider these two facts:

1. Since the 2008 financial crisis, governments have issued $57 TRILLION in new, fresh-off-the-press, paper in order to keep the system afloat.

2. Most of the global banking cartel has made a move toward negative interest rates, which means that there is tremendous risk in carrying a 49% allocation to bonds.

Now imagine the impact given that the total dollar value of all aboveground gold reserves plus the value of every major gold producer on the planet is a mere fraction of the value of the global bond market. The panic-driven rush to the gold sector seen in the first quarter will pale by comparison if, as and when the larger pension funds decide that maybe—just maybe—a reduction in bond exposure in favor of gold exposure might be considered "prudent."

As far as the indiscriminate inhaling of penny mining issues with little or no regard for quality or valuation, I commented on the TSX Venture Exchange on May 23rd with the TSXV at around 680, and in a few short weeks it has broken to 715 on big volume. Whether or not it is well-advised to buy penny mining issues up nearly 60% in a few months is NOT the issue; it is losing one's position when one has been a buyer all through 2014 and 2015 and is now finally up money and in some cases, HUGE money. You take all of the risk in 2015 and then sell at a breakeven or small profit in 2016? I don't think so. . .

On May 31, I posted a chart with the following comment: "I am tiptoeing back into the world of 'Long Volatility' with a one-fifth position in the UVXY (ProShares Ultra VIX Short-Term Futures) July $10s for $2.40," after which the VIX (Volatility S&P 500) cratered for a week, taking the UVXY down from $10.45 to $9.35 and the calls down into the $1.80 range. Today (June 10), the VIX has exploded out of the gate with a 17.3% move to above $17 with the triple-leverage, public-screwing ETF (UVXY) gaining a similar 17% move to over $12.00. I added a few more of these calls on Tuesday at $1.95 and am now sitting on a 40% position and might add more this afternoon. I will be selling 50% at $5.50 and riding the balance to what I think could be $15–25 if we get the storm that I see on the horizon.

COT Report

More of the same shenanigans we have been forced to live with since Day One.

There are very large and very ominous storm clouds way off on the horizon and the reason I know they are coming our way is that there is a lot of pacing, panting and scratching going on with strange snarling and growling noises emanating throughout the room. That's always an omen of volatility coming down the road because that type of behavior is consistent with trouble.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Statements and opinions expressed are the opinions of Michael Ballanger and not of Streetwise Reports or its officers. Michael Ballanger is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation or editing so the author could speak independently about the sector. Michael Ballanger was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

All charts courtesy of Michael Ballanger

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.