Is It Time to Dump Gold and Buy Platinum?

Commodities / Platinum Jun 21, 2016 - 01:16 AM GMTBy: The_Gold_Report

Bob Moriarty explains why precious metals investors may want to look beyond gold to a commodity with a long history and an interesting relationship to the yellow metal.

Bob Moriarty explains why precious metals investors may want to look beyond gold to a commodity with a long history and an interesting relationship to the yellow metal.

I wrote a book a couple of months ago about some of the basics of investing. The book has done well and it seems to have struck a cord with readers. In the book I try to explain that by listening to the "Experts" investors are doing themselves a disservice. When the "Experts" get it dead wrong, they don't pay, you do. So why not take some responsibility for your own investment decisions? The Gurus don't care if you make money; they only care if they make money.

Much of what you hear is noise designed to match your fantasies. If you dream at night of gold going to $10,000 an ounce, you can listen to Jim Rickards. And maybe he's right. On the other hand you may belong to the choir that hates gold. If you do, perhaps you want to pay more attention to Harry Dent, who is calling for $400 to $800 gold in 2017. Or maybe they are both wrong but understand the best way to sell anything is to preach Armageddon of some variety and fill all the fantasies of your readers.

Jim Rickards rarely points out that he lost his first fortune while working for Long Term Capital Management. He had his entire fortune invested in LTCM stock. In my book I discuss what happens when someone controls over 50% of any market at all. They have to lose because in a zero sum market, due to transaction friction, the majority always loses.

LTCM became the market in their investments, so all anyone had to do to profit was to bet against them. When everyone loves the stock market, you should sell it. When everyone loves gold, you should drop it. When all people talk about at cocktail parties is real estate, dump it. I cover all of this in my book.

Likewise with Harry Dent. I haven't heard him say anything lately about his 1999 book titled "The Roaring 2000s," where he said the Dow would go to at least 21,000 and perhaps as high as 35,000 by 2008.

Harry Dent and Jim Rickards are brilliant at marketing. Being brilliant at making money for themselves does not necessarily translate into being brilliant at making money for you. And isn't that why you invest in the first place? If your intent in investing is to feed your fantasies, you can save yourself $3.99 because my book would be an utter waste for you. But if you want to make money, try investing a little in yourself.

You began reading this piece because of the title. If you love gold, you want to crucify me. If you hate gold you probably think I'm all wise. Actually all I wanted to do was point out a high potential investment that is pretty easy to make based on price movements in platinum during all of history.

Why should you dump gold and buy platinum? Before I answer that question, I need to fill you in with a short history of platinum.

The Indians of western Colombia, in the Choco Region, have been mining alluvial gold for thousands of years. When they were finding gold nuggets, they also came across a similar shiny silver-colored metal. Believing that this other metal was immature gold, they tossed it back in the rivers to grow. The heavy and shiny metal was platinum.

The first recorded recognition of platinum came in the writing of Julius Caesar Scaliger who came across platinum when he traveled to Colombia in 1557. A Spanish conquistador named De Ulloa has been given credit for the discovery of platinum after collecting samples of the metal while stationed in Colombia from 1735 until 1746. He later wrote a report about the metal, describing how the natives mined it and used it in traditional jewelry.

Due to the high temperatures required to melt platinum and a lack of commercial uses, platinum prices were low until the early years of the 20th century. During the 19th century, in response to the new discovery of platinum in Russia in 1820, the price of platinum was as low as 40% of the price of gold. From 1828 until 1845 Russia produced coins made of platinum, however the tests proved unsatisfactory. The few remaining coins from that era are highly valued today.

The First World War and the advent of the oil age brought new uses for platinum as an industrial metal and catalyst in oil production. From the late 19th century, prices for platinum increased due to the high cost of production and processing. Platinum almost always had a premium to gold since that time.

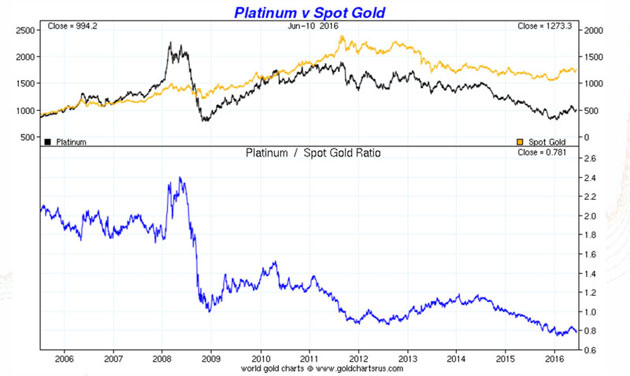

During periods of economic stability, platinum tends to carry a premium to gold, when the world faces economic instability, often the price of platinum will decrease relative to gold, even falling below the price of gold.

That is the situation today. Two years ago, platinum cost 116% of the price of gold. As of last Friday, the 17th of June, platinum stood at 74% of the price of gold. Gold was an incredible and record $331 higher per ounce than platinum. That has never happened before in the last 116 years.

For a relatively safe investment the market says investors should be selling gold and buying platinum. That can be done either by buying a platinum ETF and selling a similar amount of a gold ETF or simply by trading gold coins for a greater number of platinum coins. (See chart above.)

I try to make the point in my book that the best way to ever profit is to buy things when they are cheap and sell them when they are expensive. That sounds difficult but if you subscribe to a charting service such as that of Nick Laird's Sharelynx.com you will have all the data you need to make an intelligent investment decision. You don't need me or any other so-called guru to tell you what you should be doing.

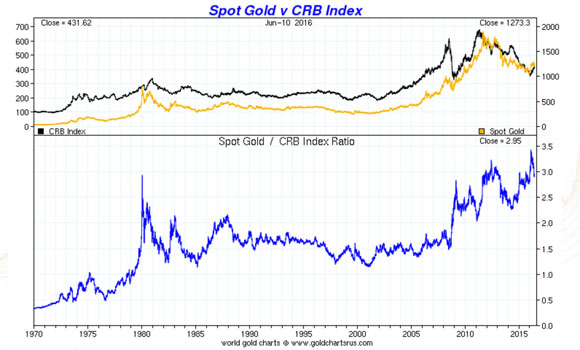

While there are many voices talking about how high gold is going to go and who knows, maybe gold will go to $10,000 or $50,000 an ounce, it is a fact that relative to the CRB Commodities index in general, gold is more expensive than at any time in history. If gold is going to go to $10,000 an ounce, commodities will probably go up a lot more. And so will platinum.

Buying platinum and selling gold is not a directional bet. You don't care if the both go up or both go down or one goes down relative to the other. You only care about the spread decreasing from a record $331 per ounce premium to gold to a more traditional premium of platinum over gold. This is an investment that you can enter and go to sleep at night knowing you have made a high percentage bet with low risk.

Yes, the premium of gold over platinum could go higher. That just makes it a better investment over time. All things change.

Gold and silver investors should be paying attention to the Commitment of Traders released on Friday. The speculators are at a near record long while the commercials are at a near record short. This is exactly the opposite of what I pointed out in late December. The COTs were the most favorable in 14 years back then. They are as unfavorable now as they were favorable then. Nobody ever went broke taking a profit. It would be a good time to be thinking about taking some money off the table. You do not need me to tell you that, you can figure it out for yourself if you read my book.

Nobody Knows Anything is available on Amazon in either Kindle version for $3.99 or in paperback for $9.99.

Bob and Barb Moriarty brought 321gold.com to the Internet almost 14 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 820 missions in Vietnam. He holds 14 international aviation records.

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Statements and opinions expressed are the opinions of Bob Moriarty and not of Streetwise Reports or its officers. Bob Moriarty is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation or editing so the author could speak independently about the sector. Bob Moriarty was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

3) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their families are prohibited from making purchases and/or sales of those securities in the open market or otherwise during the up-to-four-week interval from the time of the interview until after it publishes.

Charts courtesy of Bob Moriarty

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.