Gold Stocks INDEPENDENCE DAY -> HELL TO PAY !!

Commodities / Gold and Silver Stocks 2016 Jul 04, 2016 - 12:33 PM GMTBy: Denali_Guide

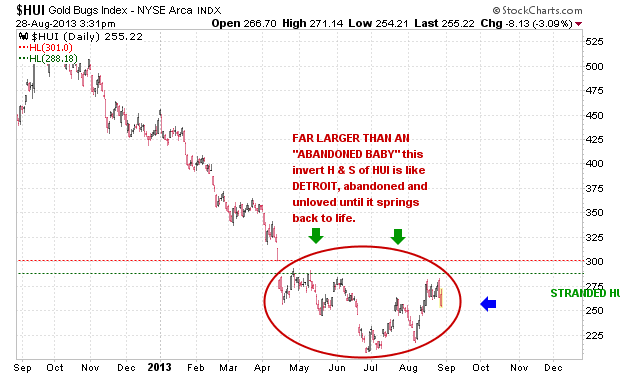

Imagine the anger and angst if you were a baby abandoned this way.

Imagine the anger and angst if you were a baby abandoned this way.

Fig 1 (Aug 28, 2013)

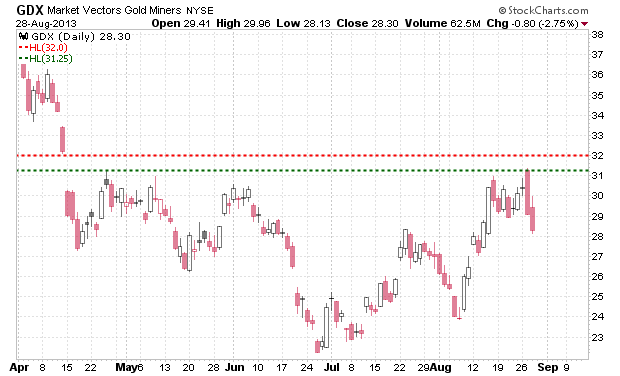

Fig 2.

Now to quote John Murphy: “ 'Any Time Dimension' "

"All of the (above) chart types can be employed for any time dimension. The daily chart, which is most popular time period, is used to study price trends for the past year. For longer range trend analysis going back five or ten years, weekly and monthly charts can be employed” CHART SCHOOL LINK at STOCKCHARTS.

Now history is NOT going to tell us what is going to happen, only that it has in the past, or not. This math is not to tell you WHAT will happen but intends to show WHAT CAN happen.

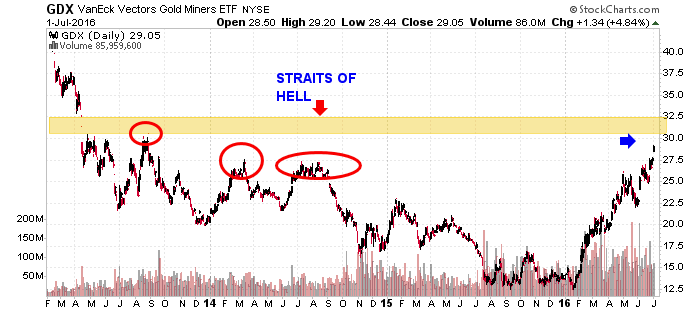

FIG 3

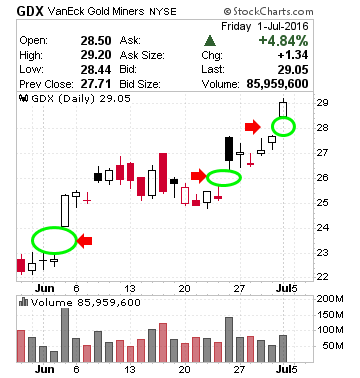

FIG 4

This leg has already seen 3 GAPS in the Month of JUNE, 2016.

Here is the math for the JUNE Gaps:

June2-3 = 1.11 / unfilled

June23-24 = 0.60 / unfilled

June 30-Jul 1 = 0.69 /unfilled gap unfilledSo we have about $2.40 GDX of

Figure for yourself if you think it could jump GDX $ 1.97 ->

I find that a credible threat.

One measure partially implying the upward pressure under GDX is the HUGE estimated Upside target

of 52.5. It ain't real till it happens but its like a bird dog, he knows there is a big bird in that thicket, and it wants to flush, like a big ***** pheasant, skyward.

To reference, please ck Blog Posts on 9/10/13; 9/23/13;

10/29/13; 3/6/16 which all relate to The Straits of Hell and WHALE Island.

So what have we got here ? My assessment is we have a trend going on,

warped by years of suppression, holding down demand until it could no longer be suppressed. So was it a big surprise when the GDX would not go below a level comparable to 1942, when the US Govt stopped Gold Mining and diverted those assets and that energy to the War Effort? No because there was no profit then, as there was no profit anticipated by the GDX dropping to 12.5. GDX clawed its way back and refused to die, so the gapping activity is no surprise given the vicious surpressionfrom 2012. THE TREND IS WARPED !! TO THE UPSIDE !!

Thus in a betting situation, I am betting on it staying warped. But to what end?

Well if the GDX fords the Straits of Hell, like an Amphibious Military Division, and the beachhead will be established north of 32.64 GDX. If like a Crown Fire, in a forest fire in a Spruce or Pine forest, the GDX leaps over and Gaps over The Straits of HELL, there will be one helluva fire on the other side, AND we will have WHALE ISLAND, a 3 year long ISLAND BOTTOM, an Abandoned Baby. ! ! ! !

Just to review WHY this Might be Important, we have: The John Murphy Quote: “ Any Time Dimension

All of the above chart types can be employed for any time dimension. The daily chart, which is most popular time period, is used to study price trends for the past year. For longer range trend analysis going back five or ten years, weekly and monthly charts can be employed.” CHART SCHOOL LINK at STOCKCHARTS.

So while it is far from a sure thing, it is, just as surely possible to see a 3 year long ISLAND BOTTOM. Add in the fact that the STRAITS OF HELL are 18 points off the Bottom, it is just as true that, adding those 18 points to the north side of The STRAITS of HELL would take us very close to the Estimated Target of 52.5, adding credibility to this potential. Bears watching............

Either scenario is bullish, but given the massive suppression, something must give in order to balance what is to come. Given the horrendous fundamentals for most things other than Gold, I don't think I'll be on the Gold Bears.

GET the WHOLE Story, more on this possibility and the whole shootin' match, Hot stocks, hot stocks to be, rankings, ratings, targets and stop losses, as well as a No-Risk Guarantee. And you heard this from PEAK PICKS and ONLY Peak Picks !!

SUBSCRIBE TO our PEAK PICKS Independence Day Special, at the old rate!!

Once we get to the end of next week, July 8, our prices will go up !!

By Denali Guide

http://denaliguidesummit.blogspot.ca

To the the charts involved, go here, to my Public Stock Charts Portfolio, and go to the last section. All charts update automatically. http://stockcharts.com/public/1398475/tenpp/1

© 2016 Copyright Denali Guide - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.