Junior Gold Stocks Benefit from Stabilizing Equity Markets

Commodities / Gold & Silver Stocks Jul 23, 2008 - 06:29 AM GMTBy: Chris_Vermeulen

Junior Gold Stocks - With the Stock Market Panic behind us - for now - we are settling in for a range bound, relatively calm, second half of '08. Junior Gold Stocks should finally start to benefit as the wet blanket smothering equity markets lift.

Junior Gold Stocks - With the Stock Market Panic behind us - for now - we are settling in for a range bound, relatively calm, second half of '08. Junior Gold Stocks should finally start to benefit as the wet blanket smothering equity markets lift.

The New York Stock Exchange indicator for new lows reached an extreme of 1304 on Tuesday the 15 th of July. That was even worse than the 1100 new lows reached on the 22 nd of January. Such extremes spell one thing P-A-N-I-C.

Whilst it's difficult to infer any far reaching conclusions about one day sell-offs, even panics, the odds now favour a bounce in very oversold equity markets. As for how high and how long the stock market will bounce is anyone's guess, but here again, probabilities favour the market to move higher and longer than anyone expects so that sentiment indicators return to their old complacent Bullish state!

What will work during this period of ‘relative' calm?

We had noticed a very definite flight to safety since market volatility began in October '07.

Firstly, a flight away from common Dow stocks to Gold Stocks:

(The following charts show relative performance of asset classes to each other. That is, when the chart is falling the first asset class (DOW) is underperforming against the second (Gold Stocks).

Chart 1 - Large Cap Gold Stocks (GDX ETF) have outperformed the Dow (DJIA) since August 2007

Within the Gold market this has manifested itself as a flight to bullion and away from Junior Gold Stocks:

Chart 2 - Gold Stock ETF has underperformed against Gold Bullion ETF since August 2007

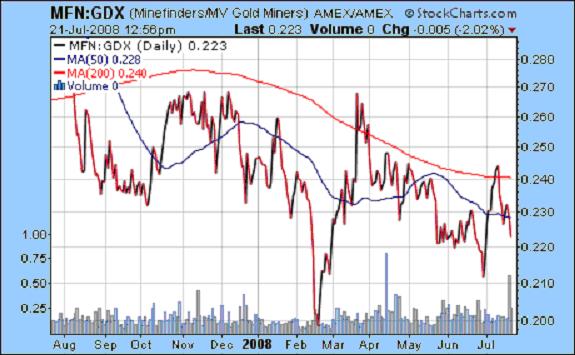

And a shift from smaller more speculative junior Gold mining companies to their large caps cousins:

Chart 3 - Minefinders (for example) has under-performed against the large cap Gold Stock ETF

Now that there is a good chance equity markets will stabilize, the above trends will moderate and reverse. This means Junior Gold stocks prices should begin closing the valuation gap and discounting higher earnings based on $900+ Gold.

The remainder of 2008 looks set to be very bullish for Gold Stocks and Gold Stock Juniors in particular!

More commentary and stock picks follow for subscribers…

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.