Australian Emerging Gold Stocks- Big Bang For Your Buck

Commodities / Gold & Silver Stocks Jul 23, 2008 - 07:53 AM GMTBy: Neil_Charnock

Big bang for your buck – isn't that what investors want – the ten bagger or better. But where is it going to come from next. Haven't the easy pickings already been taken this far into the PM bull? After all the low hanging fruit has been taken hasn't it? You can see that from the charts on the HUI and the XAU can't you? That is not to say these magnificent indices will not go higher but I am talking about the easy pickings and leverage.

Big bang for your buck – isn't that what investors want – the ten bagger or better. But where is it going to come from next. Haven't the easy pickings already been taken this far into the PM bull? After all the low hanging fruit has been taken hasn't it? You can see that from the charts on the HUI and the XAU can't you? That is not to say these magnificent indices will not go higher but I am talking about the easy pickings and leverage.

You may say risk is a big concern and so it should be – I will cover more about this in this article. You may not have to turn to the penny dreadful stocks or the Zimbabwe Stock Exchange for this type of opportunity however as there is a frontier with superb low sovereign risk and quality companies in solid growth phases that have been hammered to stupidly low valuations. Most of the solid growth Countries have certain risks attached – sovereign risks - so I want to take some time to cover why one Country in particular stands out which may not be getting the coverage it deserves.

As global corporate activity, technology and resource demand continue to shrink the sovereign boundaries between nations we will gradually move towards equilibrium of all sorts of things – the financial world moves the fastest (usually). I refer to international stock markets following the Dow, banking regulations, broad contagion of sentiment particularly, even fashion and diet (and weight problems) as the Corporate machine moves forward towards a One World standardized system. One day the demand for gold stocks will simply overwhelm the limited number of companies in this small global sector and the demand will spill over into all gold stocks make no mistake.

Of course resources are internationally priced, varied only by exchange rates and price rises in commodities have outpaced any and all currency strength as a trend and I for one believe this will continue. Equities have been out of favor and dire financial conditions precipitated by the sub prime debacle have forced stocks out of the weak or less fortunate hands. This is going to be regretted as the savvy have accumulated the soon to be coveted Australian precious metals sector. There are also other areas of great interest, productive farmland, other commodities and technologies reaching their day in the sun such as Underground Coal Gasification here in Australia .

Case in point – Sovereign Risk – Take a careful look

You have to be mindful of risk (hence the Zimbabwe reference) and this is also a lesson learned and yet repeated over and over by the banking industry over time as they move from over easy credit and greed to restricted credit and fear along with the business cycle. An important aspect of risk is Sovereign Risk which is measured by political stability, business climate and currency / repayment risk. This is not effective as a predictive mechanism however because crisis events manifest quickly even if they do evolve slowly. The Asian and sub prime crisis events are perfect examples of this point.

The mechanism of Sovereign Risk Rating does offer useful comparison on a country to country basis (also across time) and provides an easy to measure quantitative approach to measure safer investing regimes. However individual systems can also be over simplistic and the weightings of the various factors in their makeup do not necessarily reflect their individual influence on risk. This is not to invalidate this rating process – merely to recognize and measure its efficacy (or ability to be effective, produce the desired result).

A combination of many of these types of analysis however can be combined to form a more useful and accurate picture of Country risk and potential compatibility for your hard earned investment capital. From an institutional risk rating system in 2007 - a score of 1 being the highest ranking down to 100 being the lowest - Australia scored a rank of 18 which is highly credible.

Australia also has asset backing in terms of our mineral wealth which is comforting, like a strong company balance sheet – and an optimum A1 Coface Credit Rating for 2008 which is the top rating. Another index that essentially measures integration or interface of a Country into the global market place is called the Globalization Index and Australia ranks highly again at 13 th in the world.

On a Competitive Scale Index Australia ranked 12 th in the world and in terms of the ease of doing business here the World Bank rates us at 9 th from the top position. An Economic Freedom Index rated Australia at number 4 ahead of the USA , Canada , Chile , Switzerland , the UK and Singapore . The UNDP Human Development Index which essentially measures quality of life and purchasing power parity rated Australia at number 3 in the world only behind Iceland and Norway . Source MH Bouchet / Ceram – Global Finance.

Australia is a great place to live in and invest capital by all of these standards and this is why I absolutely question the validity of the current international investment sentiment in our gold and broader mining industry at present, particularly the mid cap and emerging gold producers.

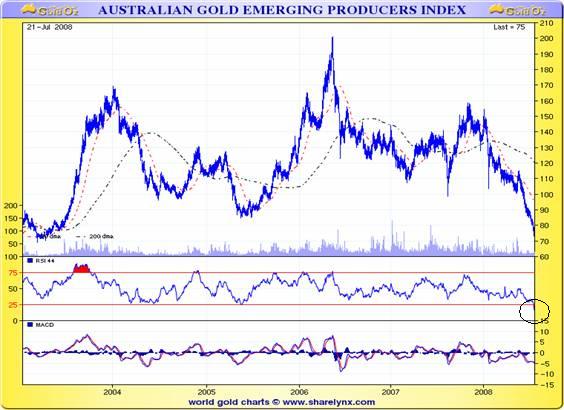

So how deeply is this market oversold? Here are a couple of index charts to illustrate this for you.

As you see the RSI above is now below the 25 level (black circle) for the first time in five years which is proof that this is a deeply over sold sector. Note: the Australian XGD (gold index) is weighted and therefore dominated by a few heavy weight gold miners and this tends to hide the true state of the rest of the sector. Those few stocks have held up in a high risk environment when only the heavy weights have maintained a measure of support. Thanks to Nick Laird at Sharelynx for this chart series which are available for free reference at the Gold Index page on GoldOz and a far greater range for a modest cost at his Sharelynx site .

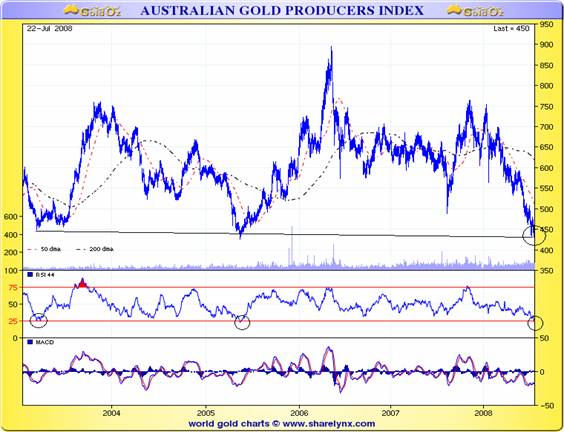

Now the five year producers chart from the same series…

Looks similar right? – but made up of different companies which shows again the value of the non weighted index again - and this time I have circled the three distinct RSI bottoms at the red line – the 25 over sold level. I have also circled the current bottom at support on price which corresponds with the latest RSI low. I have been holding off but now I am willing, the first time since November last year, to tentatively say we are most likely here now – in a highly circumspect manner.

Some stocks may find new lows however I now firmly believe the worst is over for this gold sector in a general sense. We may not see fireworks for the next few months but from many of these levels the stock price leverage is tremendous. This is now a prime trading environment or a “buy sit and wait” opportunity for the coming end of year seasonal rally. But caution too as further shocks to the financial system will occur and resets on the sub prime sector are not over either. Gold has held up and so has silver and this is indicative of a continuation of the bull market for precious metals at least.

Picking the right stock

One method which is obvious, is to find the oversold stocks which have been punished for the wrong reasons. Many Aussie gold stocks currently fit into this category - so we may have to search for “degree of mindless or forced selling / punishment” due to some other factor than company risk or failure. But most of all I currently look for over sold, plus increasing production plus solid management as opposed to spectacular crash and burn operators. So you have to aim for producers that are increasing production due to their own internal success, slow and steady is fine as long as they begin to accelerate at the right time and you get on board as they leave the station. Technicals really assist in that timing issue but so does careful observation of a Companies progress.

It is important to get a full knowledge of ground positions, operating mines, which stocks make up the sectors and segments within – all these elements, are now covered for free in the GoldOz web site Investment Information and Mining Education pages until we lock them away for subscribers only. We are promoting this to readers of this site for free at present until we add still deeper levels of data to aid investment decisions in this awesome opportunity.

Good trading / investing.

Regards,

Neil Charnock

Links to gold reviews:

http://www.goldoz.com.au/fileadmin/goldoz/editorials/CTO_Editorial.pdf

http://www.goldoz.com.au/fileadmin/goldoz/editorials/Focus_Minerals_Editorial.pdf

GoldOz is currently developing a Member area and building further resources for free usage.

Copyright 20078 Neil Charnock. All Rights Reserved.

REGISTERED ADVISOR – WHO THE ADVICE COMES FROM IN THE GOLDOZ NEWSLETTER: Colin Emery is currently a Branch Manger and Senior Client Adviser of a Stock Broking Company in Queensland Australia. Prior to his work in Share broking he spent nearly 20 years in Senior Management and Trading positions in Treasuries for major International Banks such as Bank Of America, Banque Indosuez, Barclays Bank, Bank Of Tokyo and Deutsche Bank AG. He spent a number of years as a Senior trader in New York , London , Singapore , Tokyo and Hong Kong with these institutions. He also was Global Head of emerging energy, emission and commodity products for the leading Energy and Commodities brokerage firm of Prebon Yamane Ltd – Prebon Energy for four years before moving to Cairns in 2003 to focus on the Stock market and Private consulting work. The private consulting and advisory work currently undertaken is with companies involved in Resources, Energy and Renewable Energy and Forestry.

Neil Charnock is not a registered investment advisor. He is a private investor who, in addition to his essay publication offerings, has now assembled a highly experienced panel to assist in the presentation of various research information services. The opinions and statements made in the above publication are the result of extensive research and are believed to be accurate and from reliable sources. The contents are my current opinion only, further more conditions may cause my opinions to change without notice. The insights herein published are made solely for international and educational purposes. The contents in this publication are not to be construed as solicitation or recommendation to be used for formulation of investment decisions in any type of market whatsoever. WARNING share market investment or speculation is a high risk activity. Investors enter such activity at their own risk and must conduct their own due diligence to research and verify all aspects of any investment decision, if necessary seeking competent professional assistance.

Neil Charnock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.