Silver Prices - The Rise and Fall of the Specs With No Clothes

Commodities / Gold and Silver 2016 Jul 10, 2016 - 05:11 PM GMTBy: Dr_Jeff_Lewis

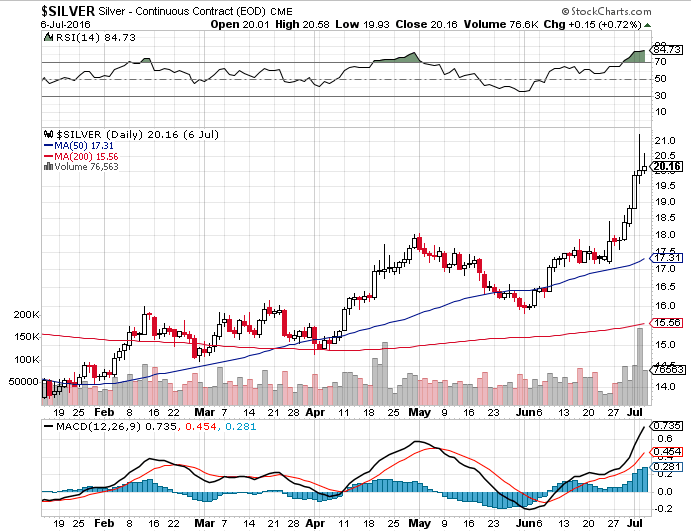

The mainstream financial media, as well as some retail investors, have awakened to the surge in the price of silver, relative to just about everything else in 2016.

The mainstream financial media, as well as some retail investors, have awakened to the surge in the price of silver, relative to just about everything else in 2016.

And while this rally feels different, are we there yet? Or are we close to the point where COMEX doesn't matter as far as price discovery is concerned?

I realize the question always comes down to if not now, then when? But “how?” is a close second.

Right now the “how” is crystal clear. An unprecedented, historic, commercial net short is sitting right out there for everyone to see.

(And it's very likely that if we were sitting at price lows for the cycle, we would be witnessing high, if historic managed money shorts).

In the past, it has simply a matter of volume and moving averages and the dance between these two dominant categories of traders as evidenced by the weekly reporting schedule submitted by the largest traders to the CFTC. (I.e., The Committment of Traders (CoT) report.

No one has followed the silver market trading mechanics for as long or as closely as Ted Butler.

His multifaceted, and bi-weekly comprehensive analysis of trade positioning on the COMEX are invaluable for understanding where price arises in addition to shining the light on the evidence for how it is manipulated, controlled or managed - up and down and sideways - on a daily basis.

While not predictive per se, the Commitment of Traders reports reveal clear patterns that impact the more important spectrum of probability.

One data point that consistently drives directional probability in silver (and other markets) is the so called managed money category of traders.

The CFTC defines the this category as a “registered commodity trading advisor (CTA); a registered commodity pool operator (CPO); or an unregistered fund identified by CFTC.

These traders are engaged in managing and conducting organized futures trading on behalf of clients.

In other words - other people’s money.

Collectively they are a pool of speculation-driven funds that attempt to objectify decision making by ignoring fundamentals and using tools of technical analysis.

Technical analysis - in this world of painted tape and intervention - is merely a pseudo science. A irrational system that is leveraged to the hilt with easy money and most importantly, no skin in the game.

The perfect exhibition of this is a look at how the managed money positioning coincides with the price action.

Simply put, managed money traders pile on (buy or sell) according to direction. On cyclical highs, they are long. On cyclical lows they are short.

Aside the fact that these price cycles are artificial to begin with, the danger or opportunity - or potential asymmetry comes these positions are blind to everything except price direction.

So much so that there is a guarantee, notably for silver short contracts that cannot possibly be delivered - that they will be extinguished at some point.

A guarantees that at some point, whenever the cycle becomes extreme, I.e., when the price is at the low end or high end, they always cover.

We are at that extreme point now.

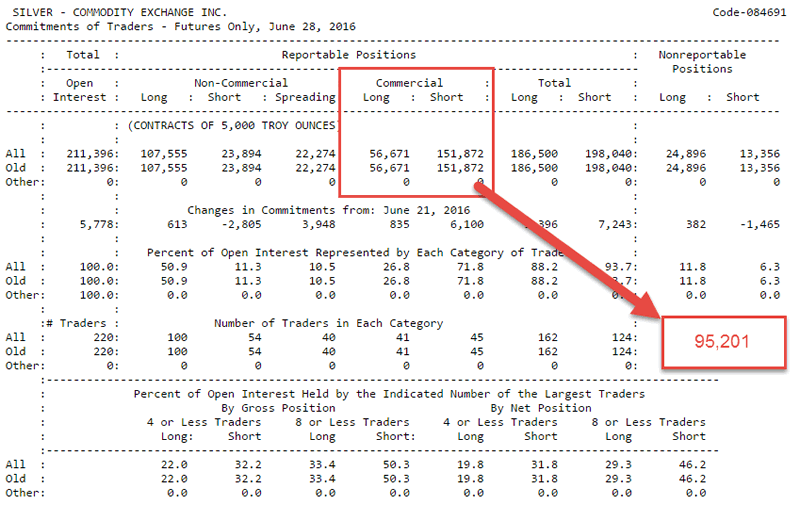

As of June 28th, according the commercial category of the aggregated COT report, the commercials held net short 95,291 contracts, over 476 million (paper) ounces.

Given, the subsequent move up in price, coinciding with unusually high volume, that number is very likely higher now.

According to Butler, a level never before seen, and again, directly coinciding with price highs of recent weeks.

The managed money longs are now the proverbial low hanging fruit. The fuel that will flame the fires that culminate with the next move down.

When we are at a ‘cyclical’ commercial net short high, the risk of a “HFT-induced” event instigated by the big banks - who as a result of this high point - are deeply underwater in terms of open positions.

While there is never an intention of delivering physical metal, it would be impossible for them to deliver.

If accumulating or looking for an opportunity to time purchases, this would be a place to be cautioned.

Is this time different? And how can the managed money traders acting in unison be so blind to this risk?

First of all these are obviously speculative positions. It’s not their nature to deliver or take delivery. These are naked “Arbitrageurs”. Guided here by the will of the big players — the 4 largest traders in the commercial category.

Collectively, these funds are not all in silver. Far from it. Silver likely represents a small portion of their overall book, diversified to some degree across the spectrum of asset classes.

Out of fiduciary obligation to their clients, they abide by the standard of care trade according to price direction, volume, and momentum programmed by computer algorithms. Wildly bullish supply/demand, macro-economic, or financial market risk be damned.

As the current cycle becomes long in the tooth and the commercials face unnerving (especially to the smaller of the group of eight big shorts), the question naturally arises - is this it? Do the commercial banks finally get overrun triggering the long-awaited so-called commercial signal failure, leading to a short covering panic?

Thursday's price action points toward the negative. Past experience here would say 'look out below'.

Wading into the murky (and much less confirmed) waters of 'real world' influence, it would be 'convenient' to have metals prices lower on the eve of another monetary intervention post-Brexit.

On the positive side, physical movement into and out from registered COMEX warehouses continues at a pace unmatched by any other commodity.And deposits of metal into the big silver ETF seem to be catching up with price.

No one knows when we cross the Rubicon of moving averages. But the probability is high that it will come sooner, rather than or later.

To receive early notification for new articles, click here.

Or to view our products and services, click here.

By Dr. Jeff Lewis

Dr. Jeffrey Lewis, in addition to running a busy medical practice, is the editor of Silver-Coin-Investor.com

Copyright © 2015 Dr. Jeff Lewis- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Dr. Jeff Lewis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.