Americans favour Coffee over Financial Freedom

Stock-Markets / Investing 2016 Jul 13, 2016 - 04:08 PM GMTBy: Sol_Palha

A little and a little, collected together, becomes a great deal; the heap in the barn consists of single grains, and drop and drop make the inundation.

A little and a little, collected together, becomes a great deal; the heap in the barn consists of single grains, and drop and drop make the inundation.

Saadi

Towards the end of last year, we published an article titled Americans favour coffee to stock market investing where we demonstrated that an overwhelming majority drink coffee as opposed to investing in the stock market’ 61% of Americans drink coffee on a daily basis as opposed to the 48% that invest in the market. On aannual basis, Americans spend about $1200 on coffee. If they put this money into the market and allowed compound interest to do its magic, it could grow into a nice tidy sum over a period of 20 years.

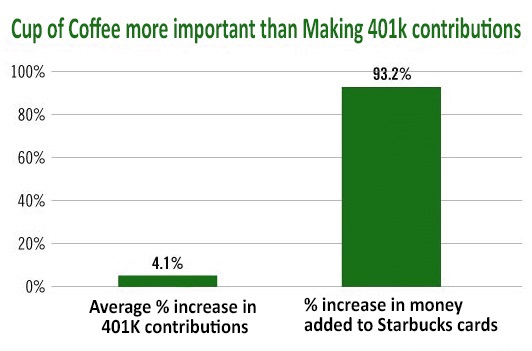

The latest data provides even more attention-grabbing data. Starbucks is one of the most popular places to get a cup of Java from, even though (in our opinion) it does not come close to ranking as the best place to have a cup of coffee. The picture below illustrates just how much people love their daily coffee.

Individuals are more interested in loading their prepaid Starbucks cards with money as opposed to contributing to their 401K plans. This is a clear illustration of how people today are more concerned with how they look or what image they portray as opposed to building a sustainable nest egg. S&P Global Market Intelligence states that Starbucks has $1.2 billion in unspent funds; these are funds that customers have added to their prepaid cards. In 2014, the same customers added $614 billion, so the jump to $1.2 billion is truly stunning. This is more than the total deposits some banks take in for the year. In the same period, the average contribution to a 401K increased by a measly 4.1%.

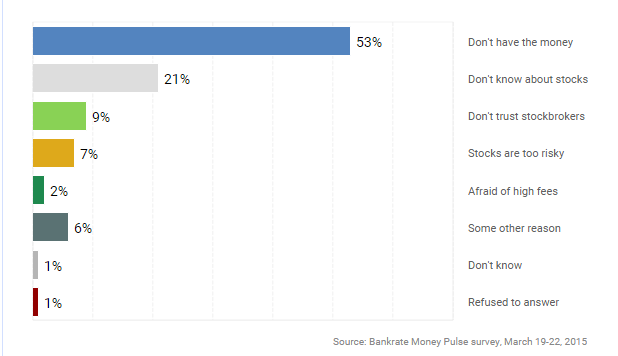

From a psychological perspective, it reveals that the majority have still not embraced the markets. According to bankrate.com, a large portion of the population states that they don’t have enough money to invest in stocks. Based on the chart below, 53% don’t have enough money to purchase stocks, and 21% don’t know enough about stocks; this does not bode well for the current generation. However, these chaps seem to have no qualms about purchasing an overpriced cup of coffee that they could easily make at home.

Source: www.bankrate.com

Negative rates

We have spoken at length on this topic and as we have noted previously the tiny miserable rate hike the Fed initiated is not the beginning of a new trend but a desperate effort on its part to convince the masses that this economic recovery is real. Any person with a grain of common sense understands that the only thing driving this economic recovery is hot money; if the supply of hot money is cut, the recovery will end instantly. This is why nation after nation continues to jump onto the negative rate band waggon and it is just a matter of time before the Fed is forced to join the party. When negative rates hit the US, it will propel corporations into taking, even more, risk. We suspect share buybacks will surge to levels that might make the current purchases seem sane in comparison.

Conclusion

The Fed’s strategy all along has been to foster an environment that favours speculators and punishes savers and they have succeeded in achieving their objective. The next stage will be to force these savers to speculate, and that is when we can expect this market to enter into the bubble phase. The Fed’s sole purpose since it began interfering with free market forces has been to facilitate boom and bust cycles. This bull market will only end when the masses finally give into it and in doing so set the stage for a bubble. History is replete with examples of how bull markets end. No bull market has ended without mass participation; the crowd has to turn euphoric before the bull kicks the bucket.

Play not with paradoxes. That caustic which you handle in order to scorch others may happen to sear your own fingers and make them dead to the quality of things.

George Eliot

by Sol Palha

Sol Palha is a market analyst and educator who uses Mass Psychology, Technical Analysis and Esoteric Cycles to keep you on the right side of the market. He and his partners are on the web at www.tacticalinvestor.com.

© 2016 Copyright Sol Palha- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.