Silver Price Ignition or Money Reasserting: When Silver Investment Demand Merges with Industrial Demand

Commodities / Gold and Silver 2016 Jul 20, 2016 - 06:42 PM GMTBy: Dr_Jeff_Lewis

A long time reader and forum member posted the following with a question regarding silver industrial demand:

A long time reader and forum member posted the following with a question regarding silver industrial demand:

“The question that begs an answer, is how will this ultimately effect the monetary value of Silver and does that foretell a change in investment strategies?” (Full comment below).

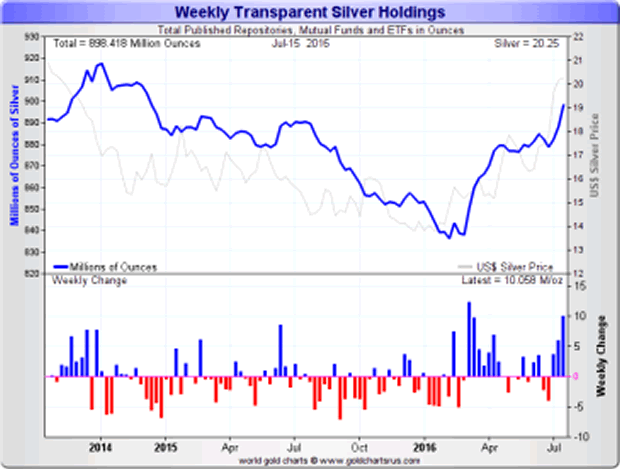

Courtesy of GoldChartsRUS.com

In a market like silver, where price has not reflected true supply and demand for decades, an interesting syndrome evolves.

It can be somewhat of a curse -- and a rational reaction when something seems too good to be true.

We are constantly look over our shoulders for that final clever explanation we overlooked for why current prices may actually be a natural expression.

This cord vibrates loudest surrounding discussion of industrial demand. Again, as our subscriber points out below, there will be at some point replacements for certain uses.

But ultimately, many of the more 'price-inelastic' uses will remain for years to come.

(Our silver battery expert pointed out the US military submersible programs are slated for silver zinc batteries for the next 60 years).

Another problem with this curse - or the (natural) resistance for believing in something that seems too good to be true (in large part because we collectively believe the system that created the mismatch is eternal) - is that for silver, investment demand has been essentially stifled along side of price.

When that side of the proverbial coin is expressed in just a small portion of it's potential... it's a game changer like nothing else.

At that point silver's importance as a industrial commodity may pale in comparison with it's role as a wealth asset or simply money itself.

At that point, COMEX doesn’t matter, though it may ‘function’ as a propaganda tool.

Obviously, many will simply assert that ‘they’ will not let that happen.

As if ‘they’ were unlimited in their power to suppress nature.

That discussion is for another day.

Full reader comment:

Thanks for the great 'uses' article, quite compelling in a few ways.

Clearly the industrial demand for Silver is constantly growing, I would say primarily in Electronics, Solar PV and Anti-Microbial applications. While the white metal offers unique physical properties above and beyond other metals, it is also true that the scientific based innovating companies/academia circles are forever skeptical about the constantly changing price/oz reality of this precious metal. Scientists are forced to understand the formulas of finance and commerce, much to their disgust usually.

One of the most significant 'rules of thumb' in the creative laboratory environment (especially when sourcing raw material replacements for commerce) is to not waste time formulating with any material that is an unknown or a moving target in pricing/cost.

However, matching or beating the desirable properties of Silver with something from the lab is a very daunting challenge. I believe Silver will be entrenched in technologies up until the point where the price skyrockets and begins to change the profitability picture in those technologies.

Then, old projects will come off the shelf, new ones started and the game will be on......fortunately for us 'stackers' this process will take a decade or so to ultimately replace Silver in some key applications, if ever.

So the question that begs an answer, is how will this ultimately effect the monetary value of Silver and does that foretell a change in investment strategies?

For myself, my primary investment strategy in Silver is to protect my discretionary wealth (and to grow it) for the next 2-10 years, as I am convinced we are at the threshold of very meaningful upswings in value.

And if all goes well, my children might reap the benefits long after I am gone. As my grandfather taught us tadpoles in my day, 'they don't put pockets in caskets ya know'.

I will sleep well tonight, thank you!

1. To receive early notification for new articles, click here.

2. Or to view all of our products and services, click here.

3. Or...support the cause, and buy me a cold one!

By Dr. Jeff Lewis

Dr. Jeffrey Lewis, in addition to running a busy medical practice, is the editor of Silver-Coin-Investor.com

Copyright © 2015 Dr. Jeff Lewis- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Dr. Jeff Lewis Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.