S&P 500 Suggests Much Higher Prices Coming In 2016 And 2017

Stock-Markets / Stocks Bull Market Jul 22, 2016 - 11:42 AM GMTBy: InvestingHaven

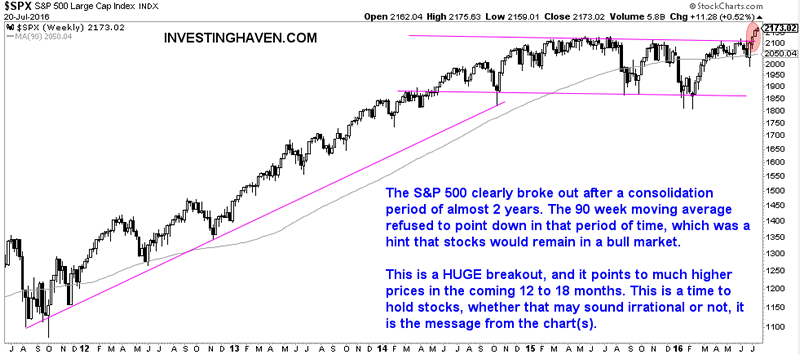

Let’s get things straight: when an asset consolidates for more than 2 years, refuses to break down when the whole world seems to be falling apart, but then decides to break out from its consolidation pattern, it is a clear message that it has sufficient energy to go much higher.

We are talking U.S. stocks.

Admittedly, the above forecast may sound counterintuitive, given the headlines we were reading only a couple of months back:

Stock market’s terrible start to 2016 just got worse (CNN Money)

Stock-market crash of 2016: The countdown begins (Market Watch)

Stock markets hit by global rout raising fears for financial sector (The Guardian)

One smart stock market analyst thinks this is where we’re headed … gulp (Business Insider)

Warren Buffett Predicting Upcoming Stock Market Crash? (Profit Confidential)

Analyst: Here Comes the Biggest Stock Market Crash in a Generation (Fortune.com)

Which stock market crash? Are we saying that all those gurus, analysts, talking heads, with so much knowledge and investment wisdom, all got it wrong? The short answer: yes.

Admittedly, it was looking ugly during those dark days in January and February of 2016, but one thing all those gurus from the above mentioned articles failed to do is watch the most basic thing that all investors have at their disposal: charts. As we said many times throughout the first months of this year, the stock market refused to break below some important price levels, and that is sufficient proof to conclude there is NO bear market developing. Read for instance this article Stocks about to collapse or rally to all-time highs? which we wrote in Feburary/March of 2016, right at the time when all those doomsday articles appeared.

The one and only thing that investors have to do is read and correctly interpret charts. All the rest is noise. Let’s repeat that to ensure the message is clear: all the rest is noise.

Whether we agree or not with the next statement we are going to make in a second is unimportant; our opinion is noise, just like the ones from gurus and billionaires. The fact of the matter is that U.S. stock markets are trending higher, and will trade much higher in 2016 and 2017. We could find this counterintuitive, but that’s not important, that is an opinion which falls in the category “noise”. The charts are fact based, and that is the only thing that matters.

The S&P 500 chart, the bellwether of U.S. stocks, is sending a clear message to investors. It wants to go higher as it is breaking out from a 2-year consolidation pattern.

Let’s not forget that the longer a consolidation, the more energy is built up for the next trend.We expect much higher stock prices in the coming 12 months. However, stock market investors must not forget this important rule in our “new world”: a thoughtful selection of companies in your portfolio is a key success factor (source: Investing Paradox 2016: Why Buy And Hold Is Still A Good Strategy).

Analyst Team

The team has +15 years of experience in global markets. Their methodology is unique and effective, yet easy to understand; it is based on chart analysis combined with intermarket / fundamental / sentiment analysis. The work of the team appeared on major financial outlets like FinancialSense, SeekingAlpha, MarketWatch, ...

Copyright © 2016 Investing Haven - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.