Russia: Tensions, Turmoil, and Western Hubris

Politics / Russia Jul 24, 2016 - 12:32 PM GMTBy: Andy_Sutton

"The 3 Big Stories NOT Being Covered – PART 1” With Graham Mehl. Anyone who has read this publication for any length of time knows that topics range from mainstream to the totally uncovered stories. As we look out not just across the economic landscape, but across the world in general, we are seeing an alarming increase of serious situations that are receiving little or no coverage at all from the western media. Thankfully there are hundreds if not thousands of reliable people who chip in with analysis and stories of their own on some of these topics.

"The 3 Big Stories NOT Being Covered – PART 1” With Graham Mehl. Anyone who has read this publication for any length of time knows that topics range from mainstream to the totally uncovered stories. As we look out not just across the economic landscape, but across the world in general, we are seeing an alarming increase of serious situations that are receiving little or no coverage at all from the western media. Thankfully there are hundreds if not thousands of reliable people who chip in with analysis and stories of their own on some of these topics.

We’ll start out by saying there many, many more uncovered stories, but these are the three we feel could be game changers in the near to medium term. We picked these three themes because, in terms of magnitude, they will have the biggest impact on the world if they continue on their present trajectories. Given the length of each analysis, we are going to break this into a three-part series.

PART 1 – Russia: Tensions, Turmoil, and Western Hubris

It will be hard not to sensationalize this topic. It will be harder still to explain the delicate intricacies of foreign relations and the consequences of missteps without scaring the daylights out of people. So if you get scared and wake up, that’s a good thing. We have nothing to sell you. There will be no newsletter offering at the end of this piece that promises to save you and your family – and make you rich off this crisis – for a mere $49.

Russia and its dealings with the world is perhaps one of the most misunderstood constructs in modern economics and current events. The reason for this disconnect is likely because many people have yet to leave the mental model of the Cold War. Let’s arrange some things before we get in too deep. That day in 1989 when the Berlin Wall fell and East and West Germany were reunited didn’t end the Cold War despite what you heard on television. Granted, relations between Russia and the US became slightly more amicable, but there were many instances during the Cold War where there was at least a modicum of cooperation – the SALT (Strategic Arms Limitation Talks) meetings coming immediately to mind.

The Cold War never ended, folks. The battlefields and tactics merely changed for a time. What we are seeing now is a rapid reversion to the old Cold War tactics of putting missiles all over the place and aiming them at various targets with the other side doing the exact same thing. Prudence demands it. People will argue for all time who started this spitting contest. But we’re going to make a statement, then ask the question. Russia has nukes aimed at us as, of course, we do at them. So from that standpoint, there is deterrence. Why then must the US and NATO continue to meddle and throw up missile batteries all over Europe? They claim it is to deter the Russians from striking Europe, NATO, and its allies. Why on earth would the Russians do this – they’d be attacking one of their biggest – if not the biggest – natural gas customer.

The week before the Brexit vote in England, a whopping 26% of Americans had even heard of Brexit at all. We wonder how many people know about all the military activity that is going on surrounding Syria, missile shields, NATO, and Russia? How many know about the close encounters between US/NATO jets and Russian MIGs? Or US ships and Russian ships getting so close to each other that Mike Phelps could swim between the two with cement blocks tied to his hands and feet? These are the matters we know about, which means we only know the tip of the iceberg.

Andy wrote in a 2013 issue of ‘The Centsible Investor’ regarding the Syrian situation and why Russia would not leave Syria’s side. We’re including that piece here for your information. In summary though, Russia currently enjoys a monopoly with regard to the sale of natural gas to Europe through its state-owned Gazprom. Qatar is sitting on a treasure chest of natural gas and the most expedient way to break the Russian monopoly in Europe is to take that gas via pipeline to the Mediterranean Sea – through Syria. Exxon Mobil cut a deal with the government of Qatar to do the pipeline (similar to Unocal’s deal with the Taliban in 1999 regarding a pipeline through Afghanistan). Saudi Arabia refused to allow the pipeline on its soil, so Syria instantly became an important chess piece. Miraculously, a country that had barely been mentioned is mainstream news for the usual reasons: human rights violations and a dictatorial government. Suddenly they need to be ‘liberated’. The Russians of course were not going to simply stand by and allow the Russian-friendly Assad government in Syria to be toppled by the US to Exxon could have its deal and the Russian monopoly ended. Our position on monopolies aside, as well as who is right and who is wrong, is irrelevant. This is the nature of the battle in Syria in a nutshell. The minutiae and details are in the article linked above and we encourage everyone to read it.

The result of the situation in Syria is that the US is basically fighting a proxy war with Russia over a land that is a territory of neither, but is key to both in the game of global control. The situation hasn’t really changed. The Cold War is back in full force, on the front pages again, after never ending in the first place. This isn’t about communism, so don’t fall into that trap. Most of the countries of the world are now leaning fully towards socialism – some more than others. America is leading the way by many measures. This ‘war’ isn’t about the good guys and the bad guys. We are no big fans of the Russian leadership; it has its problems like any leadership. We will say they’re a trifle more honest than their counterparts in Washington, DC, London, and Brussels, however. Russian President Putin has been warning the West for some time now about NATO’s offensive military actions in the region and pointing out (accurately) that if there is a better way to turn a cold war into a hot one we haven’t found it yet.

Evidence of Growing Russian Dominance

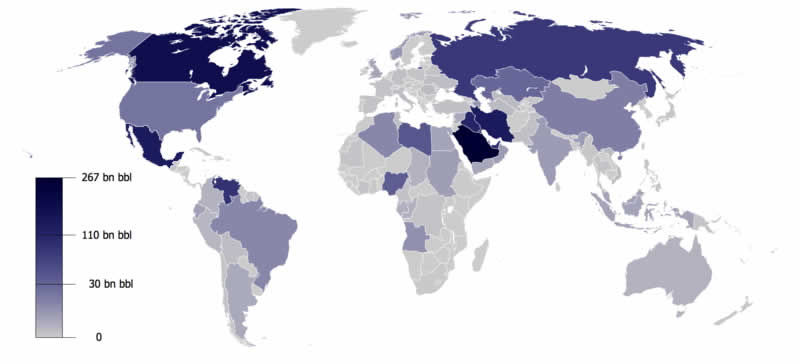

There also run rampant stories of Russian/Chinese cooperation. The BRICs Bank is a great example. Russian domination in the wheat markets is another. Previously, America had been known as the breadbasket of the world. The times are changing. According to World Atlas, Russia comes in ranked #7 in the world in terms of proven oil reserves. The only non-OPEC country ahead of Russia is Canada. The US is #11 and that includes recent ‘discoveries’ in the Bakken, which we have reason to believe are being overstated for geopolitical purposes. We will quickly grant also that it is also very likely that most of the bigger players overstate their reserves. OPEC nations have been caught constantly. We note a recent Financial Times article which states that the US has just passed Russia AND Saudi Arabia. The fact that ‘yet to be discovered’ reserves are included in a study of proven reserves is laughable. It sort of reminds of the Bureau of Labor Statistics and its ‘birth/death’ model for coming up with the unemployment numbers.

While a study of US oil reserves and its growth is not within the scope of this article, America’s reserves seem to always increase at politically expedient times. Unfortunately, (and this is the case with ALL the producers), we won’t know the truth until the holes run dry and the petroleum game ends. In any case, Russia is a major player on the world stage in petroleum.

The Reasons for the Ramp-Up in Tensions

The reasons behind the re-ignition of the Cold War are simplistic in concept, but the devil is in the details. Put simply, it’s about greed, power, and control. There are varying amounts of each on both sides of any geopolitical issue – not to mention ‘interested’ outsiders. George Soros is a good example. Of course calling him an outsider to the Russian/NATO/US mess might be inaccurate. Old Georgie (thanks to Peter for that one) might be smack dab in the middle of it, especially if when the word destabilization is used. Old Georgie is quite the pro.

However, extraneous activities notwithstanding, Russia has an economic interest as does the US/NATO. It surrounds oil/gas among other things. With the global economy at stall speed, everyone is competing for an edge or advantage, no matter how small. We’d strongly encourage everyone to read the piece above regarding Syria then consider everything that has happened since that article was written. The US has been trying to take down Assad’s government to get the pipeline, using ISIS/Qaeda/Mujahideen (yes the ties really do go back to the 1980s). The Russians are defending Assad’s government and fighting against ISIS. The funny thing about it though is if you listen to the Western media they will tell you that the US is fighting ISIS in Syria, while at the same time it has become somewhat common knowledge that the US is arming ISIS.

We believe it becomes easier to understand when you look at the governments of the world – with a few exceptions – as nothing more than enforcement arms for the multinational corporations that exert influence in that particular country. Look at the plethora of alphabet soup US agencies and the companies they enrich by virtue of their policies. Then look at the leadership of these agencies and you’ll find that there is a veritable revolving door between those agencies and the executives of companies involved in the business activities those agencies regulate. Interlocking directorates is a more direct term. The same situation exists in much of the developed world.

In the case of Russia and its natural gas, Gazprom is state owned (for all intents and purposes) to begin with so we can discard any thoughts of autonomy for Gazprom. The Russian government creates policy and takes actions beneficial to Gazprom and Gazprom in turn does what it is told. With the US, it is the opposite – the companies own the government. The definition of such an arrangement is one of constant debate. Fascism has been used to describe such a close and tidy relationship between business and government. Others insist that in order for there to be fascism, there must be a dictatorial power present (ex: Italy, Mussolini). Regardless, when one better understands the role of governments and its interactions with both citizens and corporations, irrespective of the nomenclature used, there is a much better chance at understanding geopolitical affairs.

Summary

The rhetoric has been heating up as of late between Russia and the United States, with each accusing the other of various transgressions. Weapons are being moved into position by both sides. Nuclear weapons, still present and capable of destroying the globe many times over are possessed by both nations. Deterrence has worked so far, but with some of the pure insanity we have witnessed in relation to geopolitical affairs of late, it is probably prudent to ask if deterrence will continue to be enough. The US is fighting the same ‘terrorists’ it is funding in the form of ISIS/Qaeda because doing so is essential to the US agenda of not only being the policeman of the world, but on being the biggest watchdog of its own citizens. The Russians aren’t any better in this regard, although they are a bit more discreet about it.

For now, the encounters have been limited mostly to close-range fly bys, ships passing in the night, lots of talk and posturing, but fortunately nothing worse. The movement of strategic weapons systems is troubling to say the least. Provocation is beginning to mount on both sides and the rhetoric recently has begun to include the term ‘pre-emptive strikes’ from both sides with Russia’s Putin maintaining Russia’s right to use pre-emptive strikes to stop the deployment of missile shields by NATO. American defense analysts linked to the Pentagon have pushed the idea of using pre-emptive strikes against Russia in order to maintain the dominance of the US Military in the Middle East and also in Europe – as well as to preserve the relevance of NATO. Put bluntly, when the talking stops and the hardware starts flowing in the direction of the enemy’s hardware and then the talk shifts to ‘taking out’ this or that, the situation has escalated far beyond anything that is desirable – for either side. Yet, the American media is nearly silent on the issue, save for the usual political tripe, and the American people are woefully unprepared for the escalation that recent actions have made all the more likely.

Graham Mehl is a pseudonym. He currently works for a hedge fund and is responsible for economic forecasting and modeling. He has a graduate degree with honors from The Wharton School of the University of Pennsylvania among his educational achievements. Prior to his current position, he served as an economic research associate for a G7 central bank.

By Andy Sutton

http://www.andysutton.com

Andy Sutton is the former Chief Market Strategist for Sutton & Associates. While no longer involved in the investment community, Andy continues to perform his own research and acts as a freelance writer, publishing occasional ‘My Two Cents’ articles. Andy also maintains a blog called ‘Extemporania’ at http://www.andysutton.com/blog.

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.