Here’s One Currency That Could Go to Zero

Currencies / Fiat Currency Jul 25, 2016 - 03:15 PM GMTBy: John_Mauldin

BY JARED DILLIAN: Shinzo Abe just scored a decisive victory in the upper house elections. Let me explain why that is not boring.

BY JARED DILLIAN: Shinzo Abe just scored a decisive victory in the upper house elections. Let me explain why that is not boring.

Abenomics was conceived in 2012 as a way to combat Japan’s never-ending deflation and pseudo-depression. It included a truly massive program of quantitative easing. This involved the printing of yen to buy all sorts of assets—including stocks!

Abenomics has continued for four years… with mixed results.

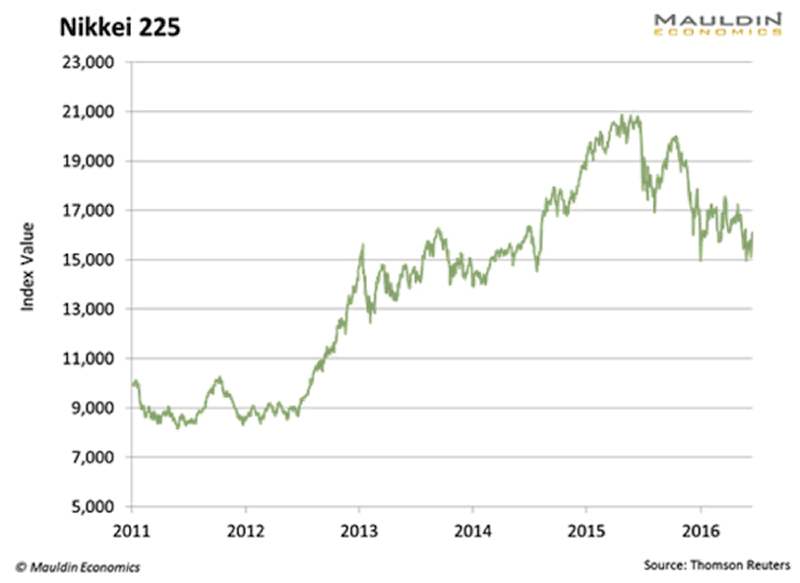

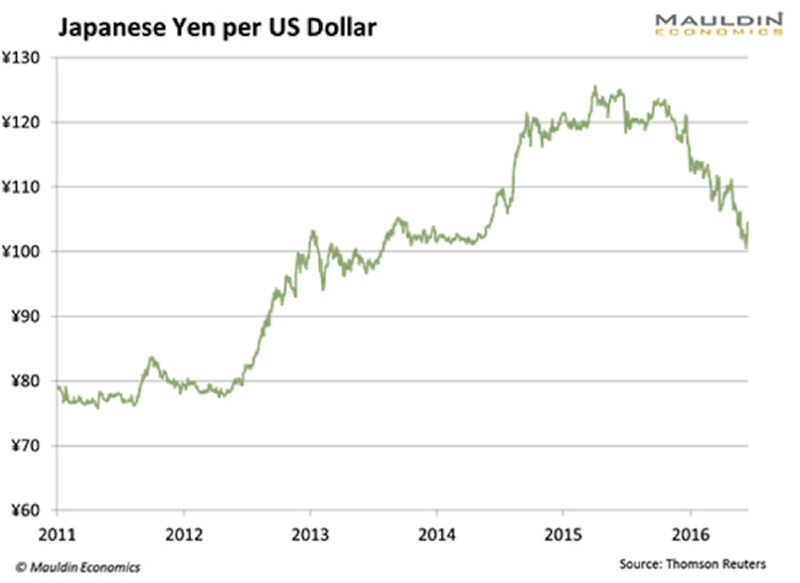

Stocks are up about 150%, interest rates are negative, and the yen is appreciably weaker. But there is still no economic growth.

It might have, if Japanese retail investors owned stocks. But they really don’t—foreign ownership of Japan’s equity market is quite high.

Low interest rates might have sparked off a residential construction boom, but they didn’t. Why? Because there is nobody to build houses for. Japan suffers from chronic depopulation, as the birth rate is well below the replacement rate.

The Economics of Depopulation

I say this a lot, but I will say it quite explicitly here: the Earth has experienced explosive population growth for decades, but the rate of growth is slowing. Before long, we will have reached peak population, and the number of people on this planet will actually be declining.

I imagine it will happen faster than people think.

The Malthusians were discredited years ago, but they are really discredited now. What are they going to say when the planet is depopulating?

That may be great for the environment, but the economics of the situation are not so clear. You see, the whole profession of economics was conceived and practiced during periods of rising population. It’s easy to get economic growth when your population is increasing. More people working produce more output.

Let’s review, again, how you get economic growth:

- More people working

- Same number of people working more hours

- Productivity increases

If you have fewer people working, the remaining people have to either work longer, harder, or more efficiently to get the same level of output. Ain't happening in Japan.

Economics as an academic discipline gets weird when the population drops. Here’s why. These declines in output (otherwise known as GDP) become the norm rather than the recessionary exception.

Japan is basically in recession all the time, except for brief intervals. On a per capita basis, they aren’t necessarily getting poorer—and perhaps that is what people should focus on—but strictly speaking, yes, as long as Japan’s population keeps going down, there is really no way to reverse the deflation.

Enter Abenomics, which has caused the BOJ to print massive amounts of yen and to take all sorts of assets onto its balance sheet. With the trillions of extra yen floating around the banking system, you might think you’d get inflation. But not yet—money velocity continues to plummet. So Japan is caught in this vicious cycle of deflation and QE.

Meanwhile, the government debt continues to be effectively monetized (taking the primary dealers out of the equation would accomplish just that).

Someone said on Twitter recently (and I am paraphrasing), “Japan is the biggest hyperinflation risk in the world, and USDJPY is only at 100?”

Makes no sense.

The One Currency That Could Go to Zero

Remember The Dillian Loop as it applies to Japan:

Japan does quantitative easing.

- If it works, it is declared a success and they do more.

- If it doesn’t work, it means they need to do more.

Right now, it’s not really working, so they’re going to do more.

It is possible that the BOJ will print an infinite amount of yen. The helicopter drop is being seriously discussed.

I don’t care what you think of the dollar or the euro or the pound or the Swiss franc. If you print an infinite amount of a currency, it’s going to decline in value.

I was about to say that it was an easy trade, but it hasn’t been an easy trade over the last 12 months. The yen has rallied massively as the market had serious concerns over the political will in Japan to truly reflate.

But after the election, there should be no doubt about the political will. They are going to reflate.

Full disclosure: I am short the yen and I own DXJ, and I have been in those positions since 2012.

If you are a yen bull, you should be very, very nervous about these election results.

Subscribe to Jared’s Insights Into Behavioral Economics

Click here to subscribe to Jared’s free weekly newsletter, The 10th Man, so you won’t fall prey to the herd mentality that so often causes mainstream investors to make the wrong decision.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.