Gold And Silver – Merkel: Example Of How Clinton Is A Globalist Puppet

Commodities / Gold and Silver 2016 Jul 30, 2016 - 03:40 PM GMTBy: Michael_Noonan

Americans have faced mass murder tragedies over the last few decades, all home- grown killers: Columbine high school shootings, the Sandy Hook elementary school shooting, [a false flag?], the recent Orlando shooting, to name a few amongst so many others. The taking of innocent lives in such a senseless manner is a heartfelt reaction experienced by the entire nation.

Americans have faced mass murder tragedies over the last few decades, all home- grown killers: Columbine high school shootings, the Sandy Hook elementary school shooting, [a false flag?], the recent Orlando shooting, to name a few amongst so many others. The taking of innocent lives in such a senseless manner is a heartfelt reaction experienced by the entire nation.

It is with empathy that we identify with the terrorist events that occurred in Germany, equally senseless but attributable to a common external trigger: Islamic terrorists. We use the term Islamic to describe the terrorists with no concern to be “politically correct.” The source of the murderers is beyond question. We also feel for the French and what that nation has been suffering as a consequence of allowing foreign Middle East immigrants to freely enter the country.

German Chancellor Merkel has been very vocal in support of “welcoming” the growing tsunami of immigrants from war-torn Middle Eastern countries. The United States globalist leaders are directly responsible for unleashing the onslaught of immigrants and inevitable terrorists upon Europe. It has been a purposeful effort to destabilize and weaken Europe, and tyrant George Soros has been the leading champion behind the elite’s Problem-Reaction-Solution effort to rid Europe of its individual sovereign nations and national identities.

Angela Merkel could care less about the citizens of Germany. From the economic weakening of the German economy due to the US-induced European sanctions against Russia to the obvious weakening of German nationality, favoring the protection of unwanted Middle East immigrants against the interests and safety of German citizens,

Merkel exhibits no legitimate concern for stemming the immigration problems.

Here is a political quote from the “deeply concerned” [cough, cough] Merkel:

“We are doing everything humanly possible to ensure security in Germany,” she noted, but added, “Anxiety and fear cannot guide our political decisions.”

Who is “We,” Angela? The elites to whom you pledge your allegiance? Doing “everything humanly possible,” everything except dealing with the source of the undermining of security of Germans. How about using reality as a guide for your political decisions! The German anxiety and fear are real and demand attention and protection over the misdirected protection of a handful of immigrant terrorists.

German Chancellor Angel Merkel is a treasonist sell-out to the German people. Shame on her and every other political hack trying to preserve the political European Union She is an example of what Americans can expect from Hillary Clinton should the globalists prevail and elect this megalomaniac to the presidency of the corporate federal government.

Hillary Clinton has a history of scandal attached to every aspect of her political career.

That Americans purposefully choose to ignore the facts and remain ignorant of her Machiavellian personality says a lot about how much the globalists have successfully used a propaganda-propelled media to keep Democratic voters fooled by this most transparent of a globalist acolyte who has no regard for the people she uses to get her elected in the same way Merkel shows no regard for German citizens. Globalist politicians only serve one master, and the general population is of no concern,

Where Barack “Yes we can!” Obama turned out to be intellectually deficient George Bush squared, if elected, Hillary Clinton will be Bush/Obama cubed. The majority of Clinton’s political contributions are from Wall Street and mega-corporations like Monsanto, the corporation bent on poisoning the world, with strong support from Clinton. The Clinton

Foundation has billions in contributions from those nations supporting war around the globe in partnership with Obama and the US. Clinton is a known war hawk with a track record to prove it.

The Clintons did not rise from being penniless after leaving Arkansas to becoming worth hundreds of millions of dollars from backing the people. Every dime of their now outrageous wealth came from Wall Street and major corporations. She does not mind being owned by them for they have rewarded her well, financially.

Clinton will epitomize the worst in every politician but on steroids. It is hard to get people to change their beliefs, especially when it comes to religion and politics. Anyone who takes the time to research the facts will have an incredible political awakening about Clinton.

The fear and anxiety Merkel mentions is what will prevail around the world, and those

who own and hold physical gold and silver will be the beneficiaries from the corrupt globalists who do everything to discourage gold, while a the same time, they do everything possible now to accumulate it.

Keep buying and holding,

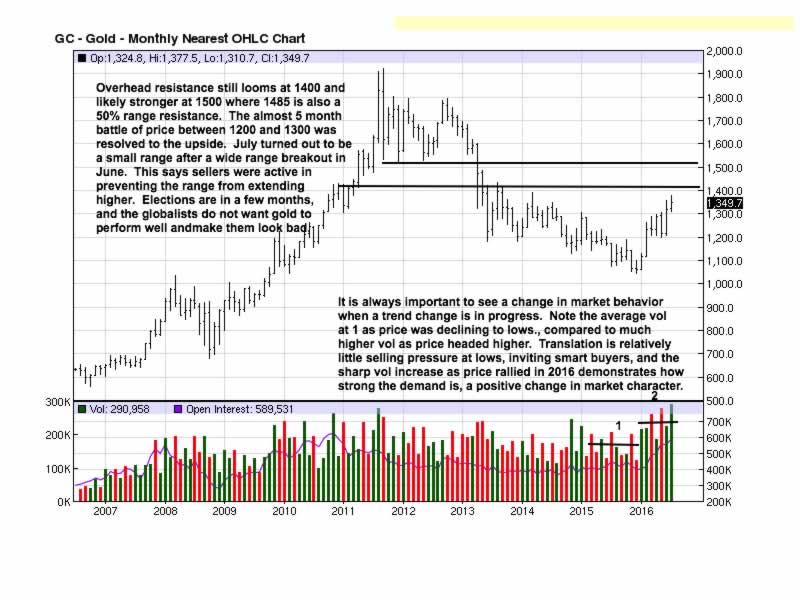

That the shortened range for July stopped short of reaching nearer the 1400 area can be viewed as a red flag, a caution for a pull-back. Because monthly charts are not used for market timing, the lower time frames will be viewed to see if the caution on this chart also shows on the weekly and daily charts.

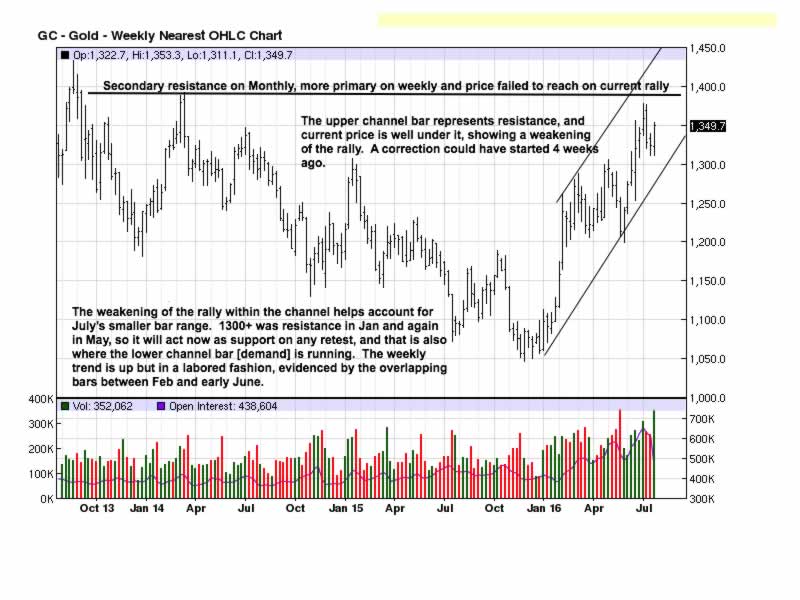

The caution is warranted based on how price is negotiating its way within the up channel shown below. The last seven weeks have evolved within the half-way area of the channel. The failure of price to work higher and nearer to the upper channel line tells us price is laboring, and there could be some more corrective activity in the next few weeks. This is not a sound for alarm for the trend remains up.

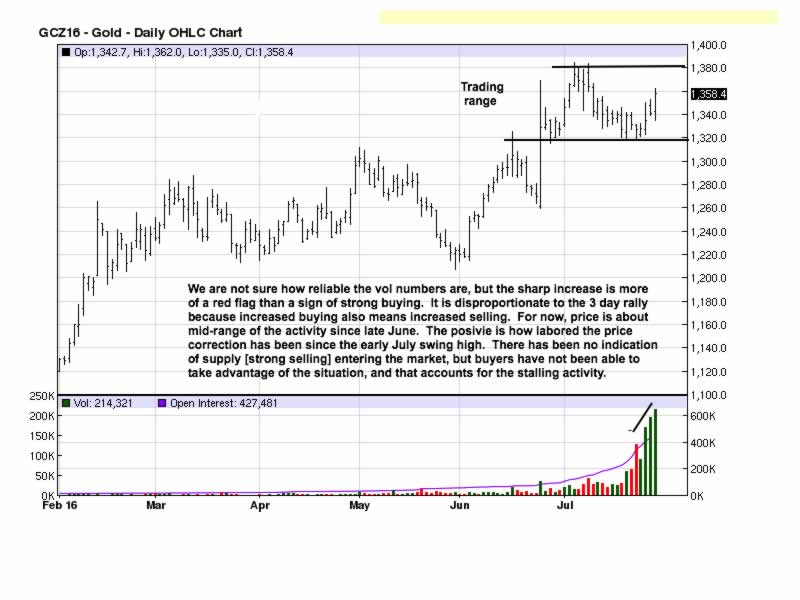

The small range on the monthly chart can be seen as the side by the sideways move since the BREXIT rally near the end of June. You can see since the July swing high, the recovery rally attempt, really just the last 3 TDs, remains about mid-range, and mid-range in any sideways move is where the level of knowledge is at is lowest, for price can retrace to the upper or lower part of the range and not violate anything but increase the possible risk within the range. The increased volume adds to the note of caution.

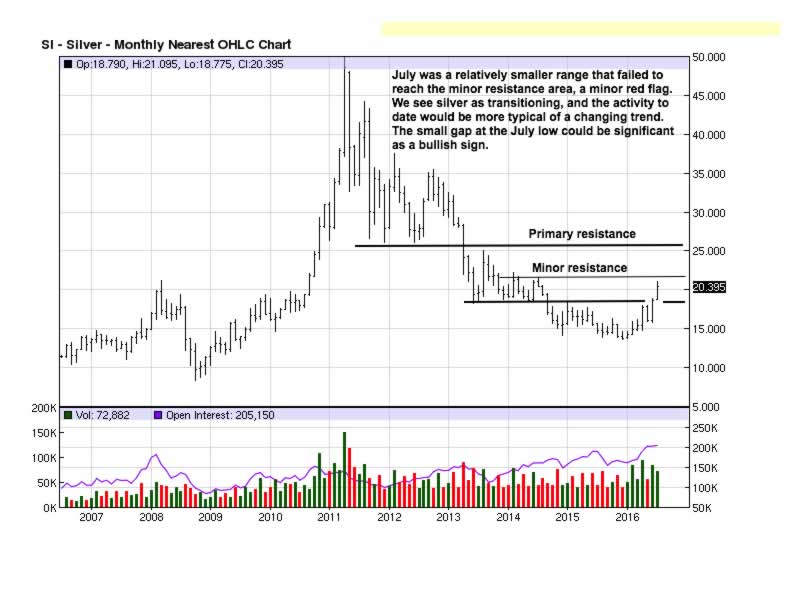

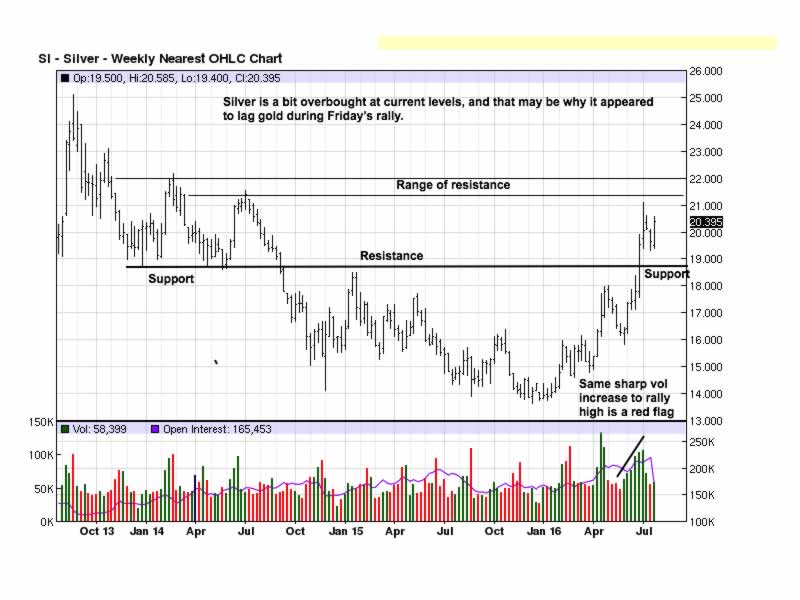

Silver does not appear quite as dynamic as the gold charts, yet it continues to quietly outperform relative to gold. We mention the small gap apparent on this chart because little gaps can signify the beginning of an eventual major move, to the upside in this case.

Like gold, silver stalled in its rally falling just short of reaching resistance, which is a relative indication of weakness in the rally, but still a rally. The volume increase as price rallied is usually not a positive sign, and for this reason, we take the cautionary view that price may correct more. That remains to be seen, but at least one can be prepared.

Higher than normal volume on the rally is the theme that cannot be ignored. The cautionary note may prove wrong and price continues to work higher. That is always a possibility, but it is not a higher probability. Again, one can only be prepared for what the market will do.

The discussion is focused on the paper market as our measure, but until something happens otherwise, it is the only current measure available. The physical market is severely underpriced, and so we keep saying to keep buying. All fiats are losing ground relative to gold and silver, and that will be the eventual reality for the months and years ahead. The debt spiral created by the globalist moneychangers is doomed to fail, but at considerable damage to the masses at large who remain unprepared.

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2016 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.