China’s Property Bubble Showing Parallels to the Subprime Crisis

Housing-Market / China Housing Market Aug 02, 2016 - 04:34 PM GMTBy: Harry_Dent

The menacing fury of economic triggers that began piling up after the Great Recession are only getting larger and we can’t do much but watch it unfold and stay alert.

The menacing fury of economic triggers that began piling up after the Great Recession are only getting larger and we can’t do much but watch it unfold and stay alert.

I wrote about this in a letter late last year, but now here we are more than halfway through the year and it’s only getting worse. So much worse that the Chinese property bubble is now

The catalyst that will reset markets will likely be one large event that cascades across the globe. I’m convinced that what finally puts an end to central banker madness and the incessant stream of QE will be the Chinese real estate bubble.

Massive doesn’t even begin to describe the situation with China’s property market, but that’s somewhat expected with a population of 1.4 billion people.

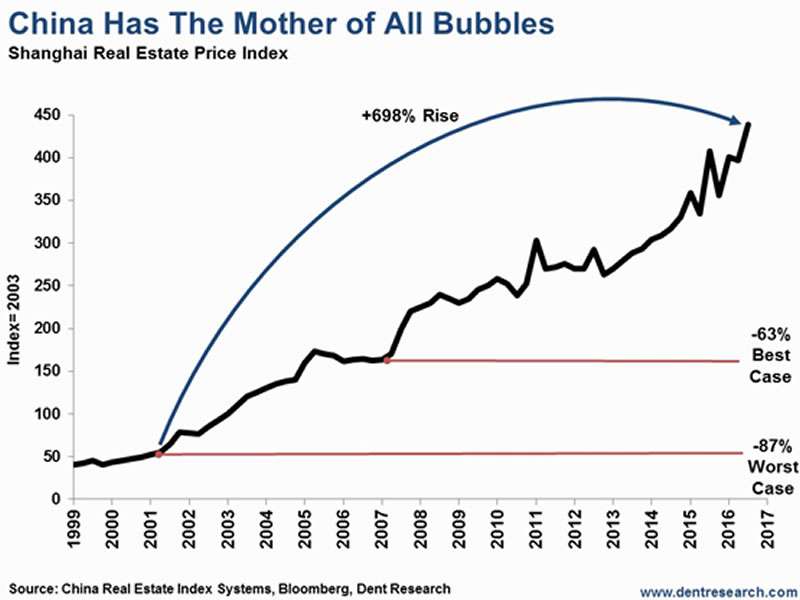

And as the chart below shows, the bubble keeps on getting bigger!

See, China has stepped firmly into Japan’s slot as the economic force du jour of the Pacific Rim. In the 1980’s, at the peak of its post-war boom, Japan dominated global markets and dove deeply into U.S. real estate.

At the peak of its stock and real estate bubble, in 1989, the Japanese were buying expensive, high-visibility properties hand-over-fist, from Pebble Beach to Rockefeller Center.

Of course, when the economic realities of Japan’s demographic shift became impossible to ignore and its economy slowed drastically those properties sold to the highest bidder.

It was ugly and the end of a very impressive post-World War II boom. As bad as that was, the Chinese make the Japanese look prudent!

Chinese buyers are still bidding up the high end of the top coastal cities in English-speaking countries like prices will never go down and like they can’t get enough.

We’re talking all OVER the world from Sydney, Melbourne, Brisbane, Auckland, Singapore, San Francisco, L.A., Vancouver, Toronto, New York, to London…

These are considered the “Teflon-proof” markets, but they’re not! “Teflon-proof.” They’re not!

In fact, they’re some of the greatest bubbles that exist today. For the first quarter, residential prices in Shenzhen are up nearly 80% year-over-year, while those in Shanghai were up by roughly 65%, according to figures cited by Capital Economics analysts Mark Williams and Julian Evans-Pritchard in a recent note to clients.

Williams and Evans-Pritchard also point out that because of loosening lending standards introduced to keep the housing bubble going, China now looks alarmingly like the U.S. before its run-up to the subprime mortgage crisis.

Guess what happens when the bubble wealth in real estate that has built up in China finally collapses?

So does the capacity of the more affluent Chinese to buy real estate around the world. And these are the guys who have, by-and-large, been driving this global real estate bubble at the margin on the high end!

Bear in mind that Chinese real estate has been slowing and prices falling for over a year. That is precisely why China’s stock market bubbled up 160% in less than one year. When Chinese investors realized they could no longer make easy money in the real estate bubble, they turned to stocks. And after the dumb money piled in, the Shanghai Composite stock index fell 42% in just 2.5 months!

What did the Chinese government do? What any government in denial would do – buy its own stock market with hundreds of billions of dollars! That’s what the U.S. government did when its stock market crashed in late 1929. And sure enough, China’s stocks are following the same pattern to a tee:

After that first crash, Chinese investors pulled back on their speculation in markets like New York and London. When you doubt your own economy, you feel less okay about speculating in others. It’ll only get worse when their stock market drops dramatically again.

But broader, look at the steady decline in residential investment in China since 2010. This is the leading indicator of China’s slowdown and the CPC continues underestimating its government-manipulated statistics.

It’s gone from about 34% in 2010, down to near-zero at the start of the year.

China is going down. The China Beige Book (which is much more accurate) recently showed that, across the board, economic conditions are unraveling.

There will be no soft landing in China. It will bring down the entire world’s unprecedented debt and real estate bubble. And it’s only a matter of time… Be on alert.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2016 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.