How Will Brexit Impact the Gold Market? A Historical Perspective

Commodities / Gold and Silver 2016 Aug 19, 2016 - 04:33 PM GMTBy: Arkadiusz_Sieron

We know why Britons voted to leave the EU and what the UK’s options outside the EU are. Now, let’s analyze how Brexit could affect the gold market. We covered this topic in the latest edition of the Market Overview, as well as the daily updates of the Gold News Monitor, but today we will examine how the shiny metal performed during the past disintegrations of economic unions.

We know why Britons voted to leave the EU and what the UK’s options outside the EU are. Now, let’s analyze how Brexit could affect the gold market. We covered this topic in the latest edition of the Market Overview, as well as the daily updates of the Gold News Monitor, but today we will examine how the shiny metal performed during the past disintegrations of economic unions.

There are many examples of break-ups or exits from monetary unions (since 1945, more than sixty distinct countries or territories left a currency union), but these cases are not especially relevant for us, as Britain is not in the Eurozone. History also witnessed several break-ups of economic and political unions, like the collapse of the Austria-Hungary, Yugoslavia, the Soviet Union and Czechoslovakia. The Austro-Hungarian Empire ended in the very specific context of the First World War, when the gold market looked very differently, so we will confine ourselves to the last three cases.

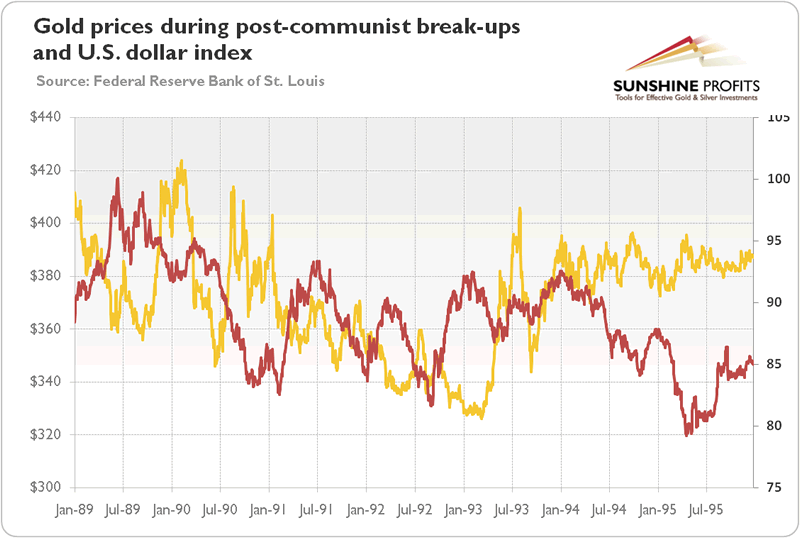

As one can see in the chart below, gold was in the downward trend in the beginning of the 1990s, despite the turmoil in the Soviet Union, violent break-up of Yugoslavia and peaceful dissolution of the Czechoslovakia. There were big rallies in 1989 and 1990, but they were associated with the weakness of the U.S. dollar and American stocks (in 1990-1991, there was a recession in the U.S.). But these rises were temporary and gold quickly returned to the long-term downward trend. This behavior suggests that the price of gold does not react significantly to the political or economic break-ups. However, investors have to be cautious in drawing conclusions from this comparison. While Yugoslavia and Czechoslovakia were not globally significant unions, Brexit means an element of disintegration of the European Union, which would increase the risk of a full break-up of the biggest economic and political bloc in the world. The Soviet Empire was a major geopolitical player, but its dissolution actually diminished risk connected with the Cold War and increased the position of the Western world. Brexit, on the contrary, would increase uncertainty and diminish the role of West. This is why Brexit would be a real precedent even for the global economy and the gold market.

Chart 1: Gold prices during post-communist break-ups in the 1990s.

Now, let’s focus on the previous exits from the European Union, as the Brexit – contrary to some popular claims – would not be the first withdrawal from the European Union. Indeed, in 1962, Algeria gained its independence from France and left the European Economic Community, the EU’s predecessor. However, since the gold market was not free at the time, we cannot examine the impact of this breakup for the yellow metal.

The next withdrawal from the EU happened in the 1980s, when Greenland, a part of Denmark, left the EU. It was an interesting case, as Greenland held a referendum in 1982, but the exit was formalized only in 1985 by the Greenland Treaty. We shall add that the only controversial issue was fishing, and eventually the country did not fully exit from the EU, but adopted Overseas Country and Territory status, instead (it means that it remains subject to the EU treaties). If negotiations with Greenland (which is economically and politically less important that the UK) lasted three years, imagine how long Brexit might take (it could be great news for gold if the process increases anxiety and uncertainty, but it can be bearish for gold if the additional time makes investors think that there will be no Brexit after all or the final result will be close to Bremain anyway)!

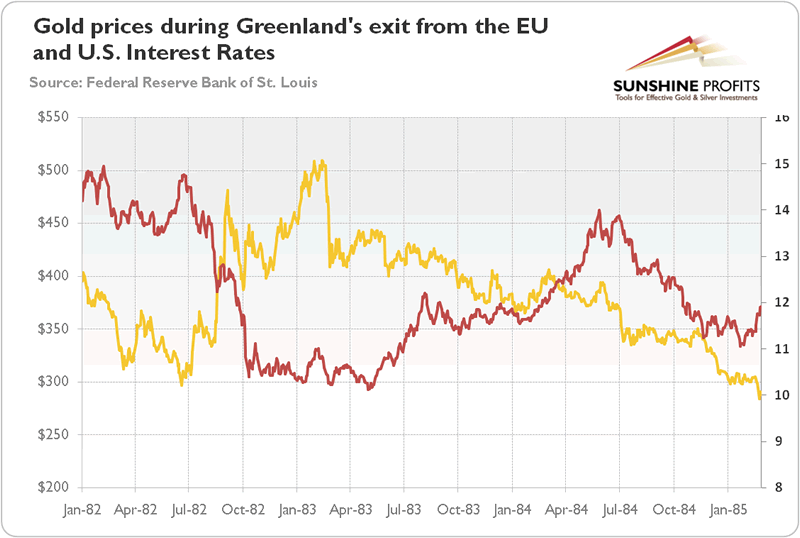

As one can see in the chart below, the Greenland’s exit from the EU did not trigger a boost in the gold prices. Actually, the shiny metal entered into bear market in 1983. There was a rally in the summer of 1982, but it was caused by the recession in the U.S., the cuts in the Fed’s fund rate, and the fall in the U.S. interest rates.

Chart 2: Gold prices (yellow line, left axis) and the U.S. nominal interest rates (red line, right axis, in %, 10-year Treasury Constant Maturity rate) from January 1982 to February 1985.

The third withdrawal from the EU occurred in 2012, when Saint-Barthélemy, a small Caribbean island, left the EU and became one of the EU’s Overseas Countries and Territories. It would not come as a surprise that this small change did not shock the world and the gold market.

The review of the past withdrawals from the EU shows that the Brexit could be really unique. So far, only dependent territories exited from the EU, and since they were certainly not as economically and politically important as UK, they are not the best to guide how the UK departure might look. And the famous Article 50 of the Treaty on European Union, which set out the rules for exit, has not been tested yet. Hence, Brexit would be a whole new ball game, which should have much greater influence on the gold market.

If you enjoyed the above analysis and would you like to know more about the structure of the gold market, we invite you to read the March Market Overview report. If you’re interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you’re not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.