Gold Price and Political Business Cycle

Commodities / Gold and Silver 2016 Sep 02, 2016 - 04:19 PM GMTBy: Arkadiusz_Sieron

Many economists ask why economic activity fluctuates. Among many theories of business cycles, there is the politicalbusiness cycle, formulated in the 1970s. According to it, incumbents try to juice up the economy during election years to improve their chances of re-election. They use fiscal or monetary policy to stimulate the economy just before an election to increase their odds of remaining in office. However, although expansionary monetary and fiscal policies are politically attractive in the short run (due to increased spending), they might lead to some unpleasant consequences in the long term (like high inflation or excessive budget deficits). Therefore, after the election is over and the next election is far away, politicians reverse the course and restrict the fiscal and monetary stimuli. Thus, major elections produce economic booms and busts, as politicians try to create an artificial boom before everyelection and take advantage of voters’ short-sightedness.

Many economists ask why economic activity fluctuates. Among many theories of business cycles, there is the politicalbusiness cycle, formulated in the 1970s. According to it, incumbents try to juice up the economy during election years to improve their chances of re-election. They use fiscal or monetary policy to stimulate the economy just before an election to increase their odds of remaining in office. However, although expansionary monetary and fiscal policies are politically attractive in the short run (due to increased spending), they might lead to some unpleasant consequences in the long term (like high inflation or excessive budget deficits). Therefore, after the election is over and the next election is far away, politicians reverse the course and restrict the fiscal and monetary stimuli. Thus, major elections produce economic booms and busts, as politicians try to create an artificial boom before everyelection and take advantage of voters’ short-sightedness.

Indeed, some data seem to confirm this theory, e.g., Achen and Bartels (2004) from Princeton University found that in the period from 1947 to 2003, the average income growth rate was 1.4-1.5 percentage points (or 80 percent) higher in presidential election years than in other years.

Researchers point out that stimulation comes from the fiscal policy rather than from the monetary policy, as the Fed is an independent central bank. Indeed, Drazen (2001) sees no evidence of opportunistic expansion of monetary policy before elections, but of pre-electoral increases in transfers and other fiscal policy instruments. However, the Fed passively accommodates fiscal policy in an election year to avoid any critique.

How does it all relate to the gold market? Well, history shows that the U.S. central bank tries to avoid, if possible, any major monetary actions as an election approaches. Therefore, the Fed is unlikely to raise interest rates until December. It would imply a flatter expected path of the federal funds rate, which would be positive for the gold market (however, the expectations of a federal funds rate change may fluctuate due to hawkish FOMC members’ comments or strong economic data).

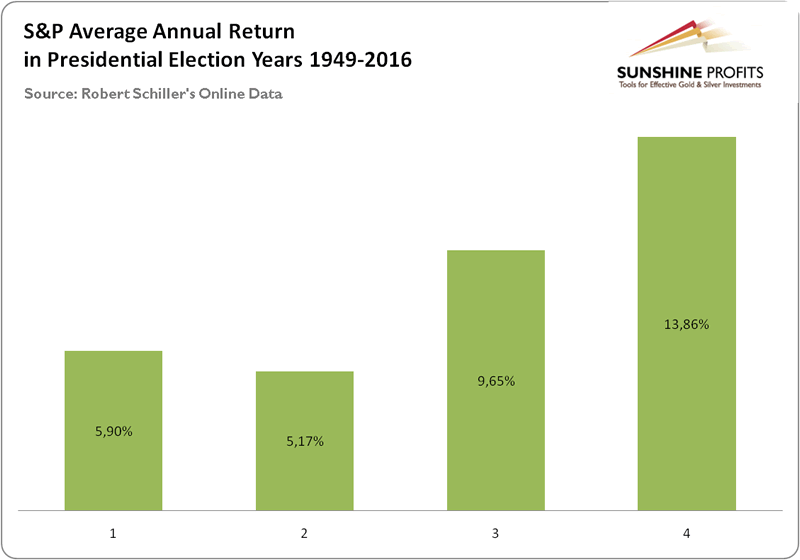

Moreover, the knowledge of how politicians influence the economy can help when undertaking investment decisions. The political pattern described above affects the financial markets –some evidence (see the chart below) suggests that equities generally prosper in the second half of a president’s term, while they often have a relatively weak first half.

Chart 1: The average annual return of S&P Index in presidential election years in the post-war period.

It makes some sense as, in the beginning, a president usually takes a more restrictive stance, whereas towards the end of the presidency his fiscal stimulation is more generous (and the Fed follows the presidential cycle, being relatively more restrictive during the first half of the term). In the first years of the term, there might also be elevated uncertainty about the president’s projects.

Therefore, given the alleged negative relationship between the stock market and gold, the shiny metal should perform relatively well during the first half of the term and relatively weakly during the second half of the presidency. If this pattern is true (we will examine this in the next part of this Market Overview), the next two years should be positive for the gold market and might be even better than 2016.

However, the political business theory does not come without any caveats. First, it is based on relatively few observations (due to the low number of presidential election cycles), so its statistical significance is questionable. Second, gold is not always negatively correlated with the stock market. In the medium term (250 day) the correlation is practically zero. Third, the Fed may not follow the presidential cycle, and just passively accommodate the fiscal policy. Actually, since the Great Recession the U.S. central bank has actively stimulated the economy, even in times of restrictive fiscal policy. On the contrary, the Fed now seems determined to raise interest rates in the near future (at least, rhetorically). Although the stock market may not have warm feelings toward the Fed hike, it does not mean that gold would get a boost. Actually, this year, the price of the yellow metal has been shaped to a large extent by expectations of the Fed hike. Fourth, the version of the political business theory presented is too simplistic and does not take into account many important details. Gold may behave differently depending who wins: the Republican or the Democrat, an incumbent or a newcomer, and finally, whether the president’s party controls the U.S. Congress or not, or whether there is an open election or not (like this year, which seems to increase uncertainty the most). We will address these issues in the following articles on the relationship between the U.S. presidential elections and gold.

Thank you.

If you enjoyed the above analysis and would you like to know more about the gold ETFs and their impact on gold price, we invite you to read the April Market Overview report. If you're interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts . If you're not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Arkadiusz Sieron

Sunshine Profits‘ Market Overview Editor

Disclaimer

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Arkadiusz Sieron Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.