Teen Labour, the Workforce Proves to Be Valuable Education

Politics / Employment Sep 06, 2016 - 06:46 PM GMTBy: Rodney_Johnson

I lied to get my first job.

I lied to get my first job.

The minimum required age was 15, and I was only 13. Luckily, I was 5’ 10” at the time, so I could pass for a couple of years older. I proudly drew my first paycheck as a fry cook at the Dairy Bar, a local burger joint in Southeast Texas. I learned a lot more on the job than just how to flip burgers.

On this Labor Day, I was reminded of my days on the food line… and a celebrity hashtag theme #firstsevenjobs that began trending recently. The woman that started it listed her early employment history and many of her followers have since followed suit.

As I’m sure you’re doing right now, I immediately thought of my personal list of first seven jobs, which are listed below:

- Fry Cook

- Dishwasher

- Busboy

- Car Washer

- Shipyard Oiler

- Grocery Stocker

- Hotel Front Desk Clerk

It’s notable that I held all of these positions before I went to college.

That’s the rub.

As others following this trending theme have noted, fewer kids are working these days. They aren’t gaining the skills that come from those first jobs until they’re in their 20s, which goes a long way to explaining the millennial attitudes showing up in the workplace. It puts them at a tremendous disadvantage when they start their “real” careers. It also affects our workforce as a whole.

Some of the on-the-job-training is obvious. You have to show up on time and actually do the work, or you risk getting fired. Such rules can be new to people whose only commitments were in school, where the institution is required to keep you at least through age 15, and through age 18 as long as you want to hang around.

Then there’s the issue of your boss.

At 13, my supervisor was a lady about 35 years old. She had attained the rank of Kitchen Manager of this tiny fast food outlet. This was her sole means of support, and even at my young age I recognized her working life had plateaued at a very modest level. But my trajectory – presumably through high school, then college and beyond – compared with hers didn’t matter one bit.

What counted was that she knew how to run the kitchen, and my job was to show up and follow her instructions. Period. This wasn’t a democracy, or even a meritocracy. It was an autocracy, and the owner of the place set the rules as he saw fit. If I wanted to remain employed, I had to work within the rules.

On the plus side, I wasn’t always lumped with my co-workers, as was the case in school. There were no “group projects” at work. If I did well, I was rewarded with continued employment and extra shifts. If my co-workers chose to goof off or show up late, they were fired. Each of us was assessed on our individual merits.

And the education didn’t stop at the front door. When I received my first paycheck it took me a while to figure out who FICA was, and why he got so much of my money. Then I had to deal with opening a bank account, depositing and writing checks, and eventually, W-2s and taxes.

It wasn’t the coddled world of education. Employment could be mind-numbingly boring, fast-paced, infuriating, rewarding, and even depressing. But learning to navigate the workplace early allowed me to develop interpersonal skills and understand employment dynamics long before I started my career. Apparently I wasn’t alone.

After spiking above 25% after the downturn, unemployment among teens from 16 to 19 dropped back near its long-term average of 16%.

But that doesn’t tell the whole story.

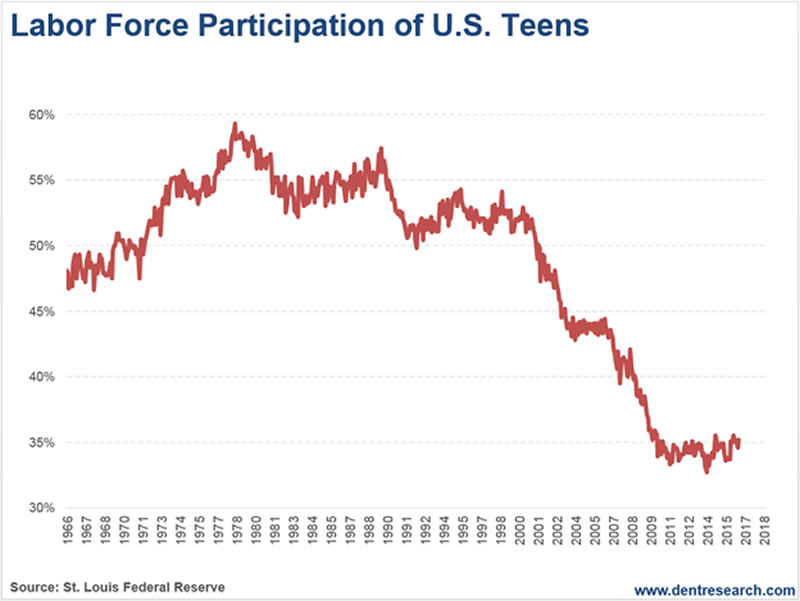

Unemployment statistics only apply to those who want to work. A better way to understand the change that took place is by considering the labor force participation rate of those from 16 to 19 years old. This statistic counts how many people are either working or looking for work compared with the entire population in that age range.

As the chart below shows, from the 1970s through the 1990s, more than half of all teens were in the labor force. But since 2000, things have changed dramatically. Only about one-third of our teens are either working or looking for work.

I don’t think all the others are sitting at home playing video games, although some certainly are. Many are probably involved in sports, camps, band, or a myriad of other activities. That’s great, and I know that such interests are beneficial. But there’s a world of education that can’t be obtained anywhere but the workforce, and waiting until your 20s just slows down the process for the workers as well as the employers that have to deal with them.

And now we have another hurdle to teen employment – rising minimum wage.

Forcing companies to pay more will only shrink the limited employment opportunities that are available to this age group.

As more cities and states increase what employers must pay at the bottom rung of the work ladder, it will make more sense for companies to automate. We’ll see more kiosks for ordering at fast food restaurants, and more tap-to-pay systems at retail stores. Such changes might keep companies competitive, but they’ll also limit the employment opportunities for teens, so even fewer of them will have the menial jobs of our youth that paid so little, but taught so much.

Rodney

Follow me on Twitter ;@RJHSDent

By Rodney Johnson, Senior Editor of Economy & Markets

Copyright © 2016 Rodney Johnson - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.