London Housing Market Bubble 2016, London Bridge Comes Falling Down…

Housing-Market / UK Housing Sep 20, 2016 - 05:33 PM GMTBy: Harry_Dent

I just got back from a seminar in London. I spoke there late last year for Graham Rowan, who heads the Elite Investor Club. This time, my promoters in Australia, Greg Owen and Steve and Corinna Essa, decided to team up with Graham to promote a two-day “Secure the Future” seminar in London.

I just got back from a seminar in London. I spoke there late last year for Graham Rowan, who heads the Elite Investor Club. This time, my promoters in Australia, Greg Owen and Steve and Corinna Essa, decided to team up with Graham to promote a two-day “Secure the Future” seminar in London.

I was more than happy to do that. I love London, even though it’s always cloudy and drizzly. But it was also a great opportunity to promote my new book, The Sale of a Lifetime (out now!), because it touches on many of the same themes I wanted to discuss with my British audience.

My first message to them was that the Brexit represents the peak of the massive globalization trend going back to the 1970s. Going forward, the UK is likely to become the safe haven of Europe because Germany’s demographic trends sink in the coming years – and the euro and Eurozone with it – just like Japan’s did in the 1990s.

In other words, the UK was smart to exit first!

The markets have already rewarded the FTSE stock market there versus the continued lagging markets in Germany (DAX) and broader Europe (The Stoxx 50 and 600).

But the main point is that Europe is going to continue disintegrating in the years ahead. I even think the social divide in the U.S. could cause a similar “Brexit” here, with Trump leading that – especially if he loses.

Travels in London

London really is a great city. This time around I got to see more of it thanks to several media appearances and dinners.

Andy Pancholi from markettimingreport.com is my favorite cycles guy there and will be speaking at our Irrational Economic Summit next month in Palm Beach, FL. A friend of his just happens to be my favorite actor there… James Cosmo. He’s the John Wayne of Scotland, starring in films such as Braveheart and Troy.He was even featured in the infamous Game of Thrones TV series.

I was lucky enough to sit down to dinner with him twice on this latest visit. And there were some other interesting entrepreneurs at the table with us. They included John Morris who runs a recruitment consultancy… Steve Briese of Smart Money Investor and his wife Jeanette… and Hamish Risk of the research firm Substantive Research, Ltd.

John is my idol in entrepreneurship. He’s always looking to invest in socially beneficial ventures like bringing low-cost Internet access to Africa and India – and he does it successfully. I know how hard that is, having lost much money myself doing similar investments.

Steve is an expert when it comes to analyzing the Commitment of Traders (COT) reports that the Commodity Futures Trading Commission (CFTC) releases. I’ve featured some of those same reports in recent articles to suggest that gold and T-bonds are about to turn down. (He and his wife now live in Malta. We compared notes on living there versus my new home in San Juan and Culebra, Puerto Rico.)

One of the Largest Real Estate Bubbles in the World

Many of your fellow subscribers came out to hear me speak at this London “Secure the Future” conference – and got an advanced electronic copy of The Sale of a Lifetime.

Besides telling them that the UK could likely be the cleanest dirty shirt in Europe in the deflationary spiral ahead, my main message regarded London’s real estate.

London is one of the largest real estate bubbles in the world – among all of the world’s great English-speaking cities. They attract affluent foreign buyers that are laundering their money from other countries, trying to escape their own bubbles, corrupt governments… or both.

London attracts more of the Russian and Arab buyers, but also the Chinese. And I’ve seen it firsthand.

The last time I was there, I stayed in Kensington. I was in a very nice boutique hotel, and almost all of the channels on the TV were in Arabic. Everyone there kept complaining that the Arabs and Russians had taken over downtown London.

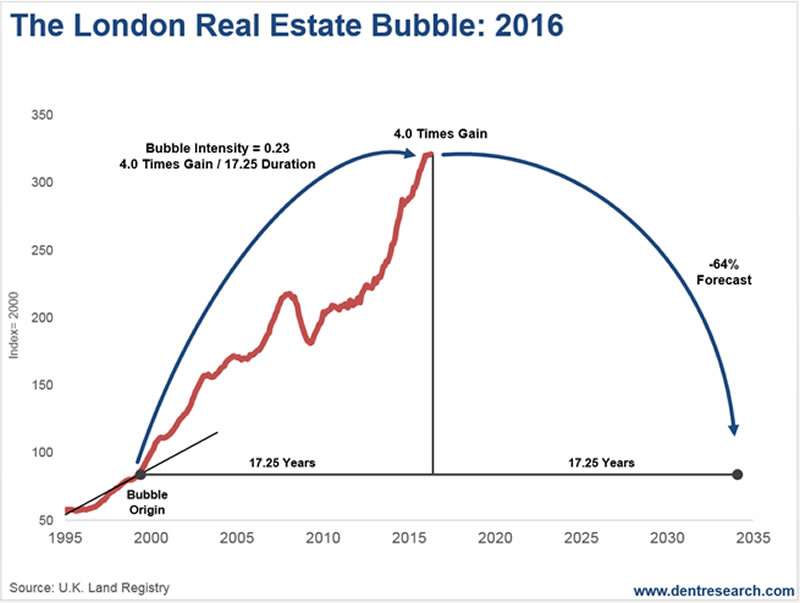

At the conference, I showed the audience the following chart on London real estate:

Real estate there has gone up four times since 1999 and, using my new Bubble Model, I project that it will go down 64% or so. That’s actually a bit less compared to other markets like Manhattan, San Francisco and Shanghai.

Demographically speaking, the UK is actually a bit stronger than the U.S. longer-term, and much better than most of the rest of Europe outside of Scandinavia and France. Germany, of course, is the worst, along with all of Southern Europe and Austria.

And don’t even ask me about Russia and East Europe!

My view is that if Germany goes down like Japan did in the 1990s (with even worse demographic trends), there is no way that the euro and Eurozone holds up. This will make the pound the safe haven currency in Europe, while the U.S. dollar becomes the safe haven currency of the world. The same goes for their respective economies… at least in the early stage of the next great depression… as debt and financial assets deleverage.

Get Out Now

After seeing the greatest bubbles in debt and financial assets in modern history, we finally look due for a major correction – and worse.

This bubble is already showing signs of bursting in the high-ends of the leading cities – from London to Manhattan to Miami. Others, including Singapore and Vancouver, are already down 22% and 24%, respectively.

Italy is already bankrupt with bad bank loans at about 18%. It will likely default by early 2017…

China’s massive real estate bubble also looks dangerously close to bursting…

Major events like these will send a tidal wave around the world in the next year or so. And there’s nothing the central banks can do about it this time!

So, be like Baron Rothschild and get out a bit early. That way, you can preserve your capital when everything goes on sale.

And make sure you get my new book, The Sale of a Lifetime, today to get the complete story on bubbles and bubble bursts and why you need to prepare NOW for the wreckage ahead. It is both the best-written (with the help of my editor Teresa van den Barselaar at Dent Research) and the most-timely book I have ever written! It is officially available on Amazon now – get your copy.

Harry

Follow me on Twitter @HarryDentjr

Harry studied economics in college in the ’70s, but found it vague and inconclusive. He became so disillusioned by the state of the profession that he turned his back on it. Instead, he threw himself into the burgeoning New Science of Finance, which married economic research and market research and encompassed identifying and studying demographic trends, business cycles, consumers’ purchasing power and many, many other trends that empowered him to forecast economic and market changes.

Copyright © 2016 Harry Dent- All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.