Is a “$46 TRILLION” Lehman Brothers Event Just Around the Corner?

Companies / Financial Crisis 2016 Sep 28, 2016 - 04:41 PM GMTBy: Graham_Summers

The financial world is abuzz with talk of the first Presidential debate.

The financial world is abuzz with talk of the first Presidential debate.

Meanwhile, one of the largest derivatives books in the world is imploding.

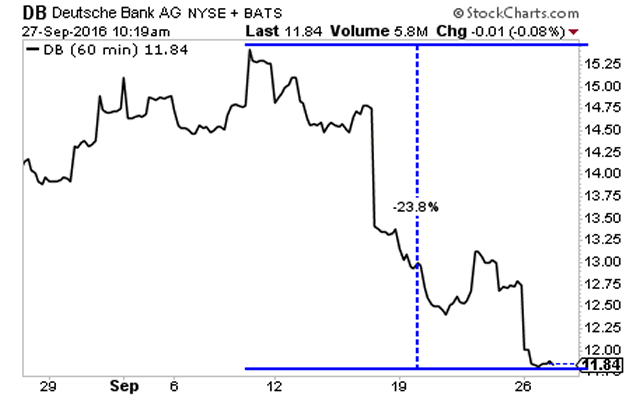

Deutsche Bank (DB) is the 11th largest bank in the world. And it has over $61 TRILLION (with a “T”) in derivatives on its books.

AND IT HAS LOST NEARLY A QUARTER OF ITS VALUE IN THE LAST THREE WEEKS.

DB is not alone here. Across the board, we’re getting signs of an impending banking crisis in Eurpoe.

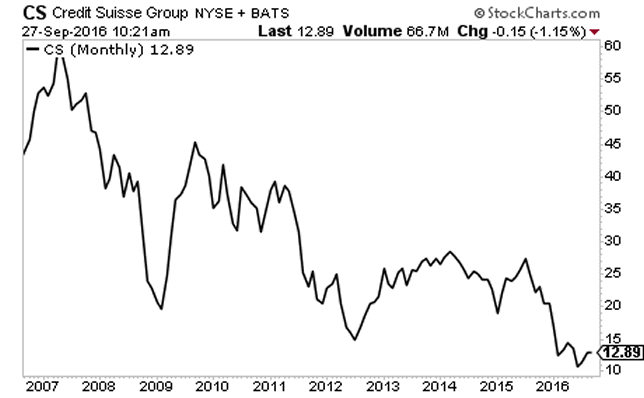

Credit Suisse (CS) is trading BELOW its 2012 banking crisis lows.

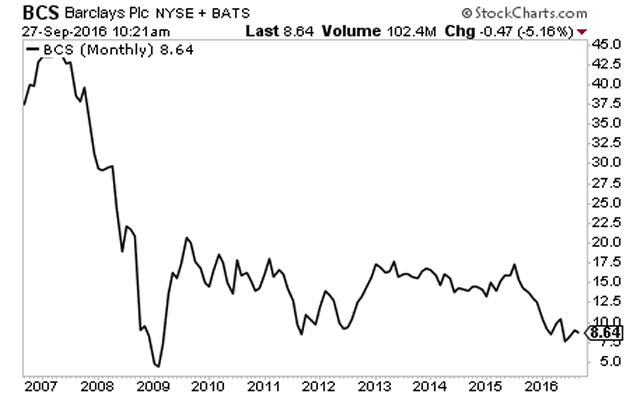

So is Barclays (BCS)

The EU banking system is $46 TRILLION in size. This is THREE TIMES larger than the US banking system, which nearly imploded the markets in 2008.

And the EU as a whole is leveraged at 26 to 1. Lehman Brothers was leveraged only slightly higher than this at 30 to 1.

We believe the global markets are on the verge of another Crisis.

2008 was Round 1 triggered by Wall Street banks. This next round, Round 2, will be even worse as faith in Central Banks collapses.

If you’ve yet to take action to prepare for this, we offer a FREE investment report called the Financial Crisis “Round Two” Survival Guide that outlines simple, easy to follow strategies you can use to not only protect your portfolio from it, but actually produce profits.

We made 1,000 copies available for FREE the general public.

As we write this, there are less than 100 left.

To pick up yours, swing by….

http://phoenixcapitalmarketing.com/roundtwo.html

Best Regards

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2016 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.