It’s Not Just Deutsche Bank. The Whole Financial Sector Is Dying

Companies / Financial Crisis 2016 Sep 30, 2016 - 09:34 PM GMTBy: John_Rubino

These are great times for financial assets — and by implication for finance companies that make and sell them, right?

These are great times for financial assets — and by implication for finance companies that make and sell them, right?

Alas, no. Just the opposite. Each part of the FIRE (finance, insurance, real estate) economy is imploding as “modern” finance hits the wall.

Interest rates, for instance, have fallen for three decades…

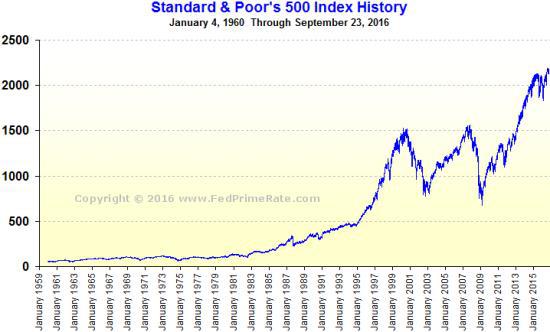

Stock prices are at record levels…

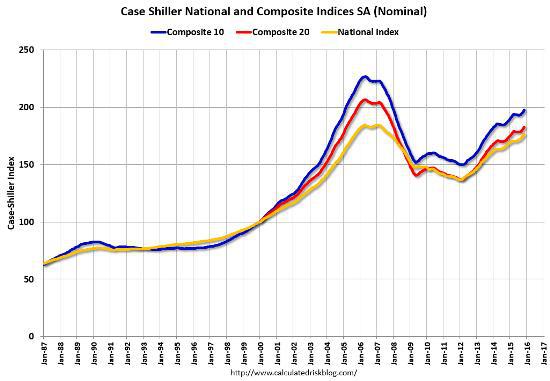

And real estate is revisiting its recent bubble.

In this kind of paper paradise it’s no surprise that banks and their cousins have grown fat, happy and arrogant. And with the above trends now ending, it’s also no surprise that business models premised on their continuance are failing. Everyone by now knows the Deutsche Bank story of bloated costs, horrendous derivatives exposure and debilitating criminal penalties. But lots of other finance companies are staring into the same abyss.

If every part of the financial sector hits the wall simultaneously, the resulting crisis will overwhelm the ability of governments and central banks to keep the game going. Their last, desperate policy experiment will involve coordinated currency devaluations to make debts less onerous. When this fails because everyone responds by borrowing even more — thus making the total debt burden more rather than less onerous – most of what remains of the FIRE economy will die a noisy death.

This will be a disaster if you work on Wall Street, rely on a public sector pension and/or own a bunch of bank stocks. It will be hard but survivable if your wealth is in real rather than financial assets. Gold, as always, is the safe haven.

By John Rubino

Copyright 2016 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.