Deutsche Bank #1 Systemic Risk at $100 Billion (BNP Paribas 2nd, Societe Generale 3rd)

Companies / Financial Crisis 2016 Oct 03, 2016 - 06:01 PM GMTBy: Mike_Shedlock

Inquiring minds may be interested in a cornucopia of relevant numbers on Deutsche Bank including market cap, leverage, capitalization, deposits, liquidity, derivatives multiple ways, and systemic risk.

Inquiring minds may be interested in a cornucopia of relevant numbers on Deutsche Bank including market cap, leverage, capitalization, deposits, liquidity, derivatives multiple ways, and systemic risk.

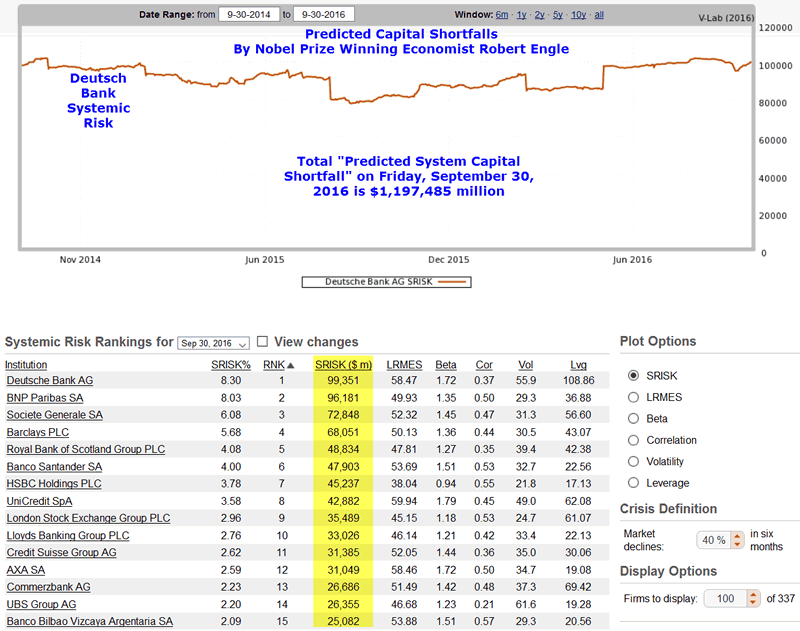

Systemic risk numbers are from Nobel Laureate Robert Engle.

Deutsche Bank by the Numbers

- Systemic Risk: $100 billion (see explanation and chart below)

- Notional derivatives: €42 trillion, an amount about the size of the German economy

- Market value of Derivatives: €18 billion

- Equity: €67 billion

- Assets: €1.6 trillion

- Leverage Ratio: 25-1

- Level 3 assets: (Illiquid potentially mark-to fantasy assets) €32 billion

- Outstanding Fines: €12.47 billion ($14 billion)

- Ready liquidity: €220 billion

- Investment bank employees: (Risk takers – M.R.Ts in EU regulatory circles) 1,871

- MRT salaries: €2 billion

- Market Cap: €16.2 billion

All numbers except market cap from Deutsche Bank's Appetite for Risk Throws Off Its Balance.

Here are some interesting snips, interspersed with my comments in brackets.

More than eight years after the collapse of Lehman Brothers sent shock waves around the world, the fear is whether Deutsche Bank and its highly leveraged balance sheet of 1.6 trillion euros might teeter and set off another bout of financial contagion.

Those worries calmed down somewhat late last week as Deutsche Bank's shares rose after reports that the bank may be close to cutting a deal with the United States Justice Department regarding the fine it must pay for selling toxic mortgages during the financial crisis. [Those are unsubstantiated rumors. Recent reports suggest there is no settlement in progress.]

There has also been a growing realization that Deutsche Bank, even with its thin cushion of cash, is in much better financial shape than Lehman Brothers was. In a letter to employees on Friday, Deutsche's chief executive, John Cryan, highlighted the "strong fundamentals" of the bank. [BS by Cryan hardly constitutes a growing realization of anything. Shares had a one day bounce based on a rumor that as of now appears false.]

It has €220 billion, or $247 billion, in ready liquidity, compared with $45 billion for Lehman in 2007, and the bank can also tap central banks in the United States and in Europe for a financial lifeline if need be. [Won't that be fun?]

"What makes Deutsche Bank systemic is their sheer size combined with the leverage that is required to stay in the flow and be an intermediary," said Anthony J. Perrotta Jr., an expert in the structure of financial markets at TABB Group, a consulting firm. "But as capital becomes more scarce, this becomes a fragile equation."

Deutsche Bank has €67 billion ($75 billion) in equity that supports assets of €1.6 trillion ($1.8 trillion), which mean it is levered at a ratio of 25 to 1.

By comparison, JPMorgan has $224 billion in cash backing $2.4 trillion in assets, which produces a far healthier ratio of 9 to 1.

Making Deutsche Bank's ratio more troubling is that many of these assets are of the most illiquid variety, called Level 3 securities, for which establishing a price is guesswork and finding a buyer near impossible.

Stuart Graham, a banking analyst with Autonomous Research in London, says that Deutsche Bank has more high-paid risk takers than any other bank — including JPMorgan, Goldman Sachs and Credit Suisse.

Most analysts believe that Deutsche Bank needs to raise an extra €5 billion to €7 billion from investors in order to calm concerns about its financial health, especially in light of the fact that the Justice Department may require the firm to pay a penalty of at least this amount. [€7 billion will not do squat. Where did they dream up that number? Add €7 billion to equity and you have €74 billion in equity vs. €1.6 trillion in assets of which €32 billion are level-3 assets likely marked to fantasy. Anyway, another €7 billion would bring the leverage ratio down to a bit under 23-1.]

$100 Billion Undercapitalized?

Robert Engle, an economist at New York University who was awarded the Nobel Prize for his work on volatility and capital markets, has designed a model that ranks financial institutions in terms of their systemic risk.

The barometer takes into consideration leverage, the bank's stock price and its equity base, and as such it represents a real-time measure of the dangers a bank poses to the financial system at a given moment in time.

Global regulators use it as well to complement their own internal models.

As of now, Deutsche Bank is ranked at the top among European banks in terms of risk, requiring close to €100 billion in fresh cash to ensure that it could survive a sustained sell-off in the markets.

German Economy Minister Blasts Deutsche Bank

On Sunday, Sigmar Gabriel, the German Economy Minister Accused Deutsche Bank of Making Speculation its Business.

"I did not know if I should laugh or cry that the bank that made speculation a business model is now saying it is a victim of speculators," Gabriel told reporters.

Systemic Risk

"There is just a lot of risk for Deutsche Bank right now," Mr. Engle said. "We have been worried about European banks for quite a while."

Systemic risk chart from NYU economic Robert Engle.

Don't worry, the total "Predicted System Capital Shortfall" on Friday, September 30, 2016 is only US$1,197,485 million.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2016 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.