The Gold Manipulators Not Only Will Be Punished, They Have Been Punished

Commodities / Gold and Silver 2016 Oct 15, 2016 - 01:21 PM GMTBy: Gary_Tanashian

I have not gone off the deep end and joined the “community” of boosters, promoters, pompom waving cheering squads and general cult figures who you can just tell not only want you to adore gold, but in some cases need you to act on your adoration and buy gold or gold stocks. Read into that what you will, but the history of investors burned by the pitch, which tugs at peoples’ morals, sense of right and wrong and plain old common sense, is a long and storied one.

I have not gone off the deep end and joined the “community” of boosters, promoters, pompom waving cheering squads and general cult figures who you can just tell not only want you to adore gold, but in some cases need you to act on your adoration and buy gold or gold stocks. Read into that what you will, but the history of investors burned by the pitch, which tugs at peoples’ morals, sense of right and wrong and plain old common sense, is a long and storied one.

As in any market, you are the mark, the target, the food… unless you do the educational work to the degree required in order to have your own – not some expert’s – view on things. That includes we would-be geniuses who think we can write for you and provide worthwhile information along the way in your decision making process. The day I stop learning and working to be better is the day I stop doing this, and that’ll be the day they fit me for a pine box.

By educational work, I don’t mean understanding the difference between a Fibonnaci retrace percentage and a time cycle. I don’t mean understanding the difference between a bottoming pattern and a consolidation pattern, an open pit mine and an underground mine or any other of the very real things that an investor or trader considers. I mean you have to do work on yourself because no one has got definitive answers and you should not be seeking those… from anybody!

The reason I am being so presumptuous as to assume there are people who fall victim to the pitches and the plays on peoples’ greed, fear and naivete is because I know you are out there. I know because this gentleman is presumably writing to an audience…

Gold Manipulators Will Be Punished

I agree with him, gold manipulators not only will be punished, they were punished in unrelenting fashion for four long years. When the HUI Gold Bugs index lost key support (as we noted in real time about the 460 area) in 2012, still they cheered and poked monetary authorities in the eye with dogma and belligerence about the coming of QE3. This kept the gold bug faithful in the game. After we noted distinct signs of economic firming in early 2013 and gold proceeded to crash major support in the 1500’s, still they pumped. The PTB, the PPT and the unholy Goldman/JPM/Fed trinity were putting the poor gold bug army to the test. ‘Stand up to it boys, I’m right here with you!’ cried the generals from well behind the front lines, ‘it’s just paper gold manipulation!’

You only need the first paragraph to know where the above-linked article, published today, is going.

“The selling of gold we saw last week was another desperate attack by the BIS and some central banks, together with the bullion banks, to manipulate the gold market lower. We saw over 40% of annual production of gold being sold last week which is 1,000 tons. The physical market continues to be strong which I will discuss further on.”

Actually, the first sentence is all that is needed. We heard that physical demand, China demand, Russia demand crap all through the bear market. It did not matter then and it does not matter now.

The article appears at TalkMarkets, a website that is an equal opportunity presenter of market views. As luck would have it, Steve Saville checks in at the same site on the same day with a distinctly different view.

The Gold Manipulation Silliness Continues

While we are on the subject of level headed analysis, on Tuesday right after the latest CPI report, ‘Inflation Guy’ Michael Ashton will be doing a live video Q&A event (sign up available at the end of his most recent article linked below). Inflation is another thing that the promoters have totally screwed up with respect to gold. Only sometimes will gold be an inflation play (hint: rising yield curve, rising inflation expectations; hint: ignore academic experts Harvey & Erb’s generalities because there are anti-gold promoters as well, which is a whole other kettle of fish).

You’ve seen me write about it time and again, and the details are beyond the scope of this article. Inflation is more complex than ‘they are inflating, buy gold!’ (from the ‘got gold?’, ‘go gold!’ crowd) or ‘see, gold is a bad inflation hedge!’ (from the Harvey & Erb crowd) that we are fed in the media. But this guy knows inflation and he knows the mechanics behind it as well. It just so happens that our preferred view is an inflationary one for a phase, and I am going to try to tune in to this video Q&A.

These two writers and others are also posted routinely at Biiwii.com for a reason and that reason is that right or wrong, they give well thought out arguments for a particular stance. Ashton is must reading, especially after each CPI release. Anyway, there it is in Ashton’s headline; the word “Dogma”.

Shifting back to the gold sector, let’s consider “Dogma”: noun; a principle or set of principles laid down by an authority as incontrovertibly true

The quote above is by someone who incontrovertibly knows that gold is being manipulated. There is no questioning there, no theorizing or mitigating phrasing. “The selling of gold we saw last week was another desperate attack by the BIS and some central banks, together with the bullion banks, to manipulate the gold market lower.”

Okay, the manipulators are desperate. Got that? The manipulators were desperate when gold crashed 1500 in 2013. The manipulators were desperate when Ebola threatened to “trigger a rebirth in gold and silver prices” in 2014. Tell me, who the hell was desperate? The powers that be? I don’t think so.

Who was desperate was who is back to being looked to for professional guidance about gold; the usual gold bug suspects, the authorities on the subject (and their dogma). This is where the gold bug “community” needs to take a time out with each individual participant asking himself and herself some hard questions. After the lessons of the bear market, I think many now do. But all too many do not. I know this because Mr. BIS manipulation up above is not alone. They have come back out of the woodwork and a troubling number of people seem to think ‘well, they’re the gold experts and I think gold’s in a bull market so it’s okay to take their advice again’.

Ah, folks? You might want to check that view. Dogma was dogma in the last bull market and it got people killed when the bear came around. Dogma remained dogma all through the bear and today in a potentially potent new bull market dogma is dogma still.

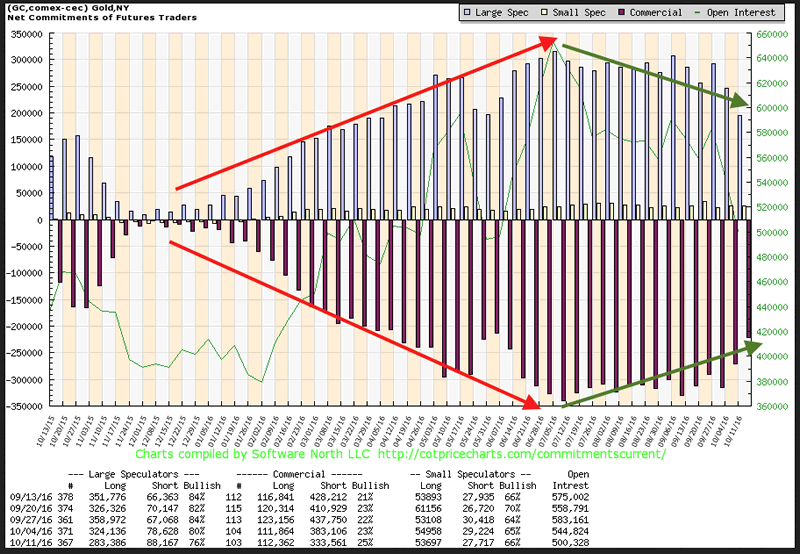

The BIS did not take gold down. What took gold down was unhealthy leadership that kept piling on until well past the top in the sector in July/August. We know this because we look at the Commitments of Traders each week and they have been historically stretched to the ‘high speculative net long with correspondingly high commercial net short’ side of things. That’s all there is, folks.

Of course there are reality manipulators trying to tell you about the take down in gold at the hands of the evil commercial entities. You know, the mining companies hedging product, various other industry players hedging by necessity if not choice and yeah sure, some good old fashioned banker manipulation in there to boot, at least to some degree. All markets are manipulated to one degree or another. It’s the markets and people should not personalize it.

Frankly, I wonder what took gold so long to correct. The Commitments of Traders remained at a strained configuration for a long time before the sector finally cracked, as it needed to in order to purify the investor base of the various momentum freaks that had finally caught on during the course of the first half of 2016.

Last week commercial entities reduced their hedges and the substance abusers reduced their longs, both to significant degree. That kicks off a bullish trend. But if some pumper starts sounding the all clear you might want to realize that while the precious metals complex is due for a bounce, only a completed trend back toward a bullish CoT configuration like January’s would be likely to signal THE bottom.

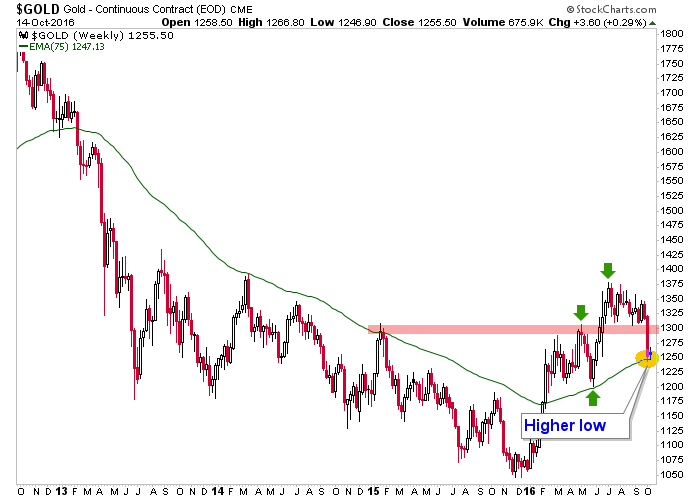

Look, for several weeks leading up to the corrective breakdown, I dumbed down NFTRH‘s charting to this simple view of gold’s weekly situation. I wanted subscribers (and myself) to calmly remain aware of the test that was likely out ahead. As gold dwelled above then-support at 1300, we noted that a breakdown would not be the end of the world because the weekly EMA 75 lay down below (currently 1247) like a magnet. The test, a very logical and technically healthy test, is now ‘on’.

Why is it a healthy test? Because if gold holds there to keep its bull market intact (we kept the ‘higher low’ parameter in view week after week as gold topped out) it will have taken out the momentum addicts, the trend followers and the come-lately greed heads, and most of all, it will have taken out those who listened to the promoters who were on top of the world a few weeks ago but are now practicing damage control with the old GOLD MANIPULATION!!! manipulation (of peoples’ capacity to remain naive).

Subscribe to NFTRH Premium for your 25-35 page weekly report, interim updates (including Key ETF charts) and NFTRH+ chart and trade ideas or the free eLetter for an introduction to our work. Or simply keep up to date with plenty of public content at NFTRH.com and Biiwii.com.

By Gary Tanashian

© 2016 Copyright Gary Tanashian - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Gary Tanashian Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.