More Good News For Gold Bugs: The Bottom Is Getting Closer

Commodities / Gold and Silver 2016 Oct 16, 2016 - 01:59 PM GMTBy: John_Rubino

In the latest gold and silver commitment of traders (COT) report (click here for an explanation of what this report involves), paper players made big strides in bringing the market back into balance — and setting the stage for an eventual rebound.

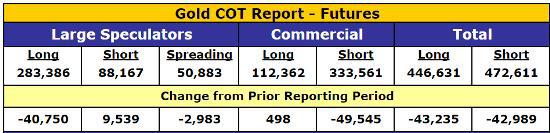

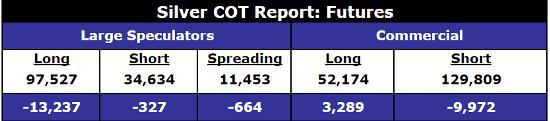

Speculators – who tend to be emotional and therefore wrong at the extremes – scaled their long positions way back, while the commercials – who time-and-again sucker the speculators into those emotional extremes and then fleece them – are now considerably less short. Here’s the raw data, courtesy of GoldSeek:

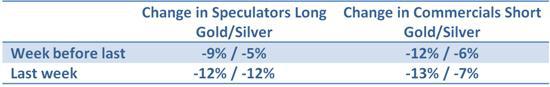

And here are the changes from the past two weeks in percentage terms.

When speculators are scaling back their longs and commercials are scaling back their shorts, that’s a sign that the market is moving towards balance. The longer these trends continue, the more likely it becomes that precious metals prices will rise in the ensuing six or so months.

That inflection point (when downtrend becomes uptrend) may still be a ways off, however. The players in this market had placed such extreme bets that even after two weeks of slimming they’re still positioned fairly aggressively. In other words, speculators are still pretty long, so if this indicator remains valid more price declines are in the cards.

But another few weeks like the last two and we’ll be close. So now might be a good time to start nailing down target prices for favorite miners and perhaps entering some low-ball bids.

This bottom, when it comes, could be an important one for a variety of reasons, including the sea change taking place in the thinking of the world’s major governments. Since their recent aggressive monetary ease didn’t work, they’ve apparently decided to repeat the experiment with an extra zero or two (see The Floodgates Begin To Open). This combination of low-to-negative interest rates and insanely high government deficits will create an environment in which gold and silver – bought at the right price – should be among the best things to own.

By John Rubino

Copyright 2016 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.