The Fortune at the Bottom of the Pyramid: Golden Opportunity for Frontier Asia

Stock-Markets / Asian Economies Oct 21, 2016 - 12:58 PM GMTBy: Dylan_Waller

The concept of the “Fortune at the Bottom of the Pyramid” was introduced by CK Prahalad, and it describes business strategies used to profit from selling products to the poorest populations in the world. This approach can also be applied to frontier market investing. Frontier market investing often requires an asset-based approach (viewing opportunities presented from less developed populations/countries/industries, rather than focusing on the challenges), as well as a futuristic view of growth trends. Select frontier markets have the potential to economically be on par with other emerging markets in the next 20-30 years.

The concept of the “Fortune at the Bottom of the Pyramid” was introduced by CK Prahalad, and it describes business strategies used to profit from selling products to the poorest populations in the world. This approach can also be applied to frontier market investing. Frontier market investing often requires an asset-based approach (viewing opportunities presented from less developed populations/countries/industries, rather than focusing on the challenges), as well as a futuristic view of growth trends. Select frontier markets have the potential to economically be on par with other emerging markets in the next 20-30 years.

Cognitive Dissonance in Consumption Trends: The Fortune at the Bottom of the Pyramid

One of his most memorable quotes that portrays the contrarian method of finding opportunity where others would typically not look includes the following:

If people have no sewage and drinking water, should we also deny them televisions and cell phones?

Prahalad goes on to note that some poor populations may accept that the option of having sewage and running water is not a realistic option, but also still have a strong preference to consume things that are actually within their reach. The cognitive dissonance in consumption habits is something I have personally observed on the ground in multiple frontier markets, and has resulted in my strong optimism for the potential of rising domestic middle-class consumption in these markets:

- Mongolia: A ger or house will not have access to running water, is heated by fire, yet it is not at all uncommon for a ger/house to be equipped with a TV.

- India: Some rural areas I stayed in would only have electricity for 2 hours a day, yet a large number of people had TVs, cell phones, and the internet in these areas.

Companies that have noted these potential markets, in areas such as FMCG, have already benefited strongly from their international expansion. This concept should be implemented not only by domestic companies but companies wishing to expand their export revenue by tapping into other markets. India offers significant opportunity as an export market due to its current low GDP per Capita, low wages, strong trends of consumption, and the massive population.

On top of some observations that can be made on the ground, statistics can show how trends of growth in these markets are strong, demographics are much more favorable, and that the growth potential for these markets is ample. Many of these markets can be described as the “Thailand, South Korea, or Taiwan” of 20-30 years ago. I will include a long list of statistics and some thoughts on which markets stand out during Part 1 of this insight. Part 2 will include some investment takeaways for multiple frontier and emerging market locations, which fully capture the growth of the “bottom of the pyramid”.

Demographics

Frontier Asia offers much more favorable demographics, with an extremely high youth population, which has been an investment case for many funds choosing to target frontier Asia.

| 0-14 | 15-24 | 25-54 | 55-64 | 65 and Older | Median Age | |

| Bangladesh | 28.27% | 19.53% | 39.39% | 6.77% | 6.04% | 26.3 |

| Cambodia | 31.24% | 19.02% | 40.18% | 5.43% | 4.14% | 24.9 |

| India | 27.71% | 17.99% | 40.91% | 7.3% | 6.09% | 27.6 |

| Laos | 33.4% | 21.3% | 36.1% | 5.36% | 3.85% | 22.7 |

| Nepal | 30.93% | 21.86% | 35.99% | 6.22% | 5.02% | 23.6 |

| Mongolia | 26.92% | 16.76% | 45.45% | 6.68% | 4.19% | 27.9 |

| Myanmar | 25.77% | 17.13% | 43.54% | 7.49% | 5.47% | 28.6 |

| Pakistan | 31.99% | 21.31% | 36.87% | 5.43% | 4.40% | 23.4 |

| Sri Lanka | 24.35% | 14.70% | 41.71% | 9.89% | 9.35% | 32.5 |

| South Korea | 13.45% | 13.08% | 45.93% | 14.01% | 13.53% | 41.2 |

| Thailand | 17.18% | 14.47% | 46.5% | 11.64% | 10.21% | 37.2 |

| Vietnam | 23.84% | 16.69% | 45.22% | 8.24% | 6.01% | 30.1 |

Source: IndexMundi/CIA

Some of the demographic hot spots include Vietnam, where there is not only a large youth population, but the median age is at a point where consumption is strong, at 30 years old. This has been a catalyst for the increased growth in consumption and urbanization, while the country’s past compelling high youth population was less powerful since teenagers/people in their early 20s are not the strongest consumers in an economy. On the other hand, markets such as Pakistan, Nepal, Laos, and Cambodia will be at a more favorable point further down the line, due to the following shared characteristics: more than half of the population is under 24 years, and over 30% of the population is under 14 years old.

The Rise of GDP in Frontier Asia

Many frontier markets can be considered similar to emerging markets 20-30 years ago, in terms of GDP, and have the potential to catch up to other emerging markets.

| Country | GDP(USD Billion) | GDP Per Capita(USD) |

| Mongolia | 11.76 | 3,973.4 |

| Laos | 12.33 | 1,812.3 |

| Cambodia | 18.05 | 1,158.7 |

| Nepal | 20.88 | 732.3 |

| Myanmar | 64.87 | 1,203.5 |

| Sri Lanka | 82.32 | 3,926.2 |

| Vietnam | 193.60 | 2,111.1 |

| Bangladesh | 195.08 | 1,211.7 |

| Pakistan | 269.97 | 1,429.0 |

| Philippines | 291.97 | 2,899.4 |

| Singapore | 292.74 | 52,888.7 |

| Malaysia | 296.22 | 9,766.2 |

| Thailand | 395.28 | 5,816.4 |

| Indonesia | 861.93 | 3,346.5 |

| South Korea | 1,377.87 | 27,221.5 |

| India | 2,073.53 | 1,581.6 |

| Japan | 4,123.26 | 32,477.2 |

| China | 10,866.44 | 7,924.7 |

Source: WorldBank/Trading Economics

GDP Per Capita: Markets such as Pakistan, Bangladesh, and Vietnam are some frontier markets that are lagging behind in terms of GDP per capita, and also have large enough populations to potentially emerge as some of the most dominant economies in Asia in the future. India’s GDP per capita also substantially lags behind its emerging market peers in Asia, leaving the market open to experience ample growth in the future.

Examining the Past: Markets such as South Korea, Taiwan, and Thailand provide a benchmark of how some of these frontier markets can eventually achieve substantial growth in GDP, heavily catalyzed by low-cost manufacturing advantages.

Annual GDP

| South Korea | Taiwan | Thailand | |

| 1980 | 65.2 | 42.3 | 33.4 |

| 1986 | 115.5 | 78.2 | 44.5 |

| 1996 | 598.1 | 292.7 | 183.0 |

Source: Knoema (Billion USD)

South Korea’s GDP was $115.5 billion 30 years ago, which significantly lags behind the current GDP of markets such as Pakistan, Bangladesh, and Vietnam. Moreover, the current population for these markets greatly exceeds South Korea’s current population (especially true for Bangladesh and Pakistan), providing select frontier markets with the opportunity to emerge as leading countries in Asia.

Taiwan’s GDP was only $78.2 billion 30 years ago, which is lower than the current GDP for Sri Lanka and the above-mentioned markets.

Thailand’s GDP was $183.0 billion 20 years ago, slightly below Vietnam and Bangladesh’s current GDP of $193.6 and $195.1 billion respectively. The country’s GDP was substantially lower, at $44.5 billion, 30 years ago.

Population

The higher population found in select frontier markets is another selling point for frontier market investing. Frontier markets such as Vietnam, Pakistan, and Bangladesh stand out for having substantially higher populations, as compared to other emerging markets.

| Country | Population(Millions) |

| Vietnam | 91.8 |

| Thailand | 67.9 |

| Sri Lanka | 21.0 |

| Pakistan | 188.0 |

| Myanmar | 53.9 |

| Mongolia | 2.9 |

| Malaysia | 30.3 |

| Laos | 6.8 |

| South Korea | 50.6 |

| India | 1,311.1 |

| China | 1,371.2 |

| Cambodia | 15.6 |

| Bangladesh | 161.0 |

| Nepal | 28.5 |

Source: The World Bank

Annual GDP Growth in Frontier Markets

The stronger trends of economic growth present in frontier markets serve as a pretext for taking on other risks associated with frontier markets. Apart from India, there are not very many options for emerging markets in Asia that are able to deliver the same level of growth. Some emerging markets in Asia that delivered slower economic growth include the following: Indonesia(5.18%), South Korea(3.3%), Malaysia(4.0%), Taiwan(0.7%), and Thailand(3.5%). India is a unique emerging market outlier to note, which has outpaced many frontier markets in GDP growth.

GDP Growth(%)

| 2011 | 2012 | 2013 | 2014 | 2015 | |

| India | 5.5 | 5.6 | 6.6 | 7.2 | 7.5 |

| Bangladesh | 6.5 | 6.5 | 6.0 | 6.1 | 6.6 |

| Cambodia | 7.1 | 7.3 | 7.4 | 7.1 | 7.0 |

| Laos | 8.0 | 7.9 | 8.0 | 7.4 | 7.0 |

| Nepal | 4.6 | 3.8 | 5.7 | 2.3 | 3.4 |

| Mongolia | 17.3 | 12.3 | 11.6 | 7.9 | 2.3 |

| Myanmar | 5.6 | 7.3 | 8.4 | 8.5 | 7.0 |

| Pakistan | 3.6 | 3.8 | 3.7 | 4.0 | 4.2 |

| Sri Lanka | 8.2 | 6.3 | 3.4 | 4.5 | 4.8 |

| Vietnam | 6.2 | 5.2 | 5.4 | 6.0 | 6.7 |

| Average | 7.3 | 6.6 | 6.6 | 6.1 | 5.7 |

Source: WorldBank/Trading Economics

While the World Bank has lowered its forecast for global economic growth to 2.4%, frontier markets are easily poised to outpace other economies in terms of economic growth.

Consumer Confidence

Frontier markets in Asia generally have the highest level of consumer confidence. Pakistan, Vietnam, and India were ranked as three of the top countries for consumer confidence among other frontier and emerging markets in Asia. Other markets, such as Myanmar, Laos, and Cambodia delivered strong GDP growth of 6.5-7.0%, and although no data for consumer confidence was listed on Trading Economics, these markets are certainly strong markets for consumption.

| Country | Consumer Confidence |

| China | 105.60 |

| India | 128.00 |

| Indonesia | 110.00 |

| Japan | 43.00 |

| Europe | -6.40 |

| Malaysia | 78.50 |

| Pakistan | 170.69 |

| Philippines | 2.50 |

| South Korea | 102.00 |

| Taiwan | 78.66 |

| Thailand | 74.20 |

| Vietnam | 144.80 |

| USA | 91.20 |

Source: Trading Economics

Health Expenditure Per Capita

Markets with low health expenditure per capita are also strategic areas for investment, as the country’s pharmaceutical and healthcare industries continue to develop through increased expenditure from the rising middle classes. India is an interesting outlier to note since its expenditure falls below some of these frontier markets, and its biotechnology industry is prestigious in terms of its quality and relatively low cost.

| Country | Health Expenditure Per Capita(USD) |

| Bangladesh | 31 |

| Cambodia | 61 |

| China | 420 |

| India | 75 |

| Indonesia | 99 |

| Japan | 3,703 |

| South Korea | 2,060 |

| Laos | 33 |

| Malaysia | 456 |

| Mongolia | 195 |

| Myanmar | 20 |

| Nepal | 40 |

| Pakistan | 36 |

| Sri Lanka | 127 |

| Vietnam | 142 |

Source: WorldBank

Inflation: What’s Working?

Another investors’ confidence sign for frontier markets is when inflation begins to drop from its double-digit highs to a new, stable level. Other global frontier markets, such as Nigeria and Argentina, are struggling drastically with extremely high inflation rates.

| Country | Inflation |

| Cambodia | 3.04% |

| Bangladesh | 5.53% |

| Laos | 1.85% |

| Nepal | 8.60% |

| Mongolia | 0.10% |

| Myanmar | 10.06% |

| Pakistan | 3.88% |

| South Korea | 1.20% |

| Sri Lanka | 3.90% |

| Thailand | 0.38% |

| Vietnam | 3.34% |

| Kuwait | 2.90% |

| Argentina | 40.50% |

| Nigeria | 17.60% |

| Morocco | 1.60% |

Source: Trading Economics(Most Recent)

Some of the most notable improvements for inflation in various frontier markets include the following:

- Vietnam’s inflation has recovered from its record high of 28% in 2008, to its current level of 3.3%

- Laos’ inflation has also dropped to 1.85%, from its high of nearly 10% in 2011

- Mongolia’s inflation has dropped to 0.1%, and was nearly 15% during 2014.

Corporate Taxes

Another added bonus for some frontier markets in Asia is the relatively lower corporate tax rates, which is one of many catalysts that results in companies shifting production to these countries. A classic example I often cover on here is the shift of manufacturing from China to Vietnam, partially because Vietnam’s corporate tax rate is 5% lower.

| Country | Corporate Tax Rate |

| Bangladesh | 25% |

| Cambodia | 20% |

| China | 25% |

| India | 34.6% |

| Korea | 24.2% |

| Laos | 24% |

| Mongolia | 25% |

| Nepal | 29.5% |

| Pakistan | 32% |

| Philippines | 30% |

| Sri Lanka | 15% |

| Taiwan | 17% |

| Thailand | 20% |

| Vietnam | 20% |

| Asia Average | 22% |

| Global Average | 23.6% |

Source:KPMG/Trading Economics/Multpl

Ease of Doing Business

Vietnam is ranked as one of the top frontier markets, apart from Mongolia, for ease of doing business. I feel somewhat skeptical about Mongolia’s higher ranking, although I am very optimistic about how the government has been wisely handling mining disputes this year. Overall, it can easily be stated that the ease of doing business is one clear-cut area where emerging Asia can prevail over other frontier markets.

| Country | Ease of Doing Business Ranking |

| Singapore | 1 |

| Korea | 4 |

| Hong Kong | 5 |

| Taiwan | 11 |

| Japan | 34 |

| Thailand | 49 |

| Mongolia | 56 |

| China | 84 |

| Vietnam | 90 |

| Nepal | 99 |

| Sri Lanka | 107 |

| Cambodia | 127 |

| India | 130 |

| Laos | 134 |

| Pakistan | 138 |

| Myanmar | 167 |

| Bangladesh | 174 |

Source:WorldBank

Buy Frontier/Sell Emerging

Frontier markets are substantially outperforming the majority of emerging markets in terms of economic growth, have much more favorable demographics and growth potential, and these markets’ stock market discount should consequently be taken advantage of. The greater fortune may very well be present for investors that buy into these discounted markets earlier when growth is strong.

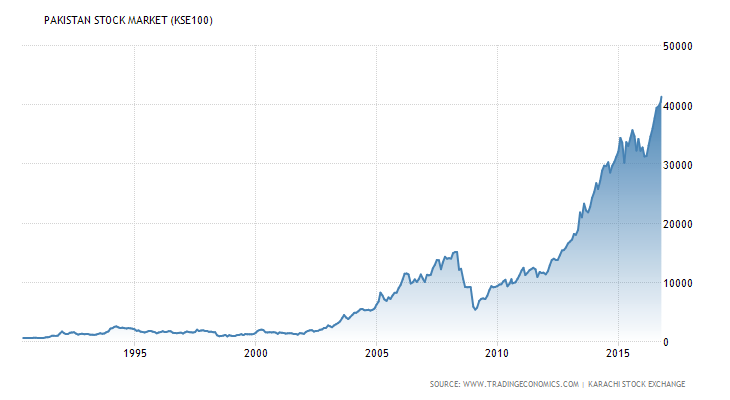

For some of the perks of buying in long before a market receives its emerging market upgrade, check out the stellar growth of Pakistan’s stock market in the past 20 years.

South Korea’s stock market has come a long way since 1980, when its GDP was only $65.2 billion.The next part of this insight will focus on some of the best investment themes to capture domestic consumption from the “bottom of the pyramid” in frontier markets, as well as providing justification for an overweight in India for emerging market investors.

Stock Markets

I have excluded markets such as Cambodia, Laos, and Myanmar which currently only have between 3-5 stocks listed on their exchanges, thus making Bangladesh, Vietnam, Pakistan, and Sri Lanka the best frontier markets for accessing listed equity. I have also excluded Mongolia because its market capitalization is relatively smaller(around $669 million) and I prefer mining companies listed on other exchanges, and have also excluded Nepal.

| Country | Stock Market Capitalization | Stock Market Capitalization/GDP |

| Bangladesh | $75.5 billion | 38.7% |

| Pakistan | $74 billion | 27.4% |

| Sri Lanka | $19.3 billion | 23.4% |

| Vietnam | $75.3 billion | 38.9% |

| South Korea | $1.37 Trillion | 99.5% |

| Thailand | $409.9 billion | 103.7% |

| India | $1.7 Trillion | 82.0% |

Source: Trading Economics/Various Stock Exchanges

The average stock market capitalization for these four frontier markets is only 14.9% of Thailand’s stock market capitalization, a major feat considering Vietnam, Pakistan, and Bangladesh all have substantially larger populations. Another interesting trend to note is that these markets’ stock market capitalization/GDP is significantly lower than other emerging Asian peers.

Comparison with MNC’s

It is even more interesting to note that most of these frontier market’s total stock market capitalization even lags behind some multinational corporations.

| Constituent | Market Capitalization |

| Netflix | $43.5 Billion |

| Procter and Gamble | $236.1 Billion |

| McDonald’s | $97.4 Billion |

| Starbucks | $77.9 Billion |

| IBM | $147.6 Billion |

| Combined MC for Sri Lanka, Vietnam, Pakistan, and Bangladesh | $244.1 billion |

Is Starbucks really worth more than Vietnam’s entire stock market? Is McDonald’s really worth more than Pakistan’s stock market, and is Netflix(trading at over 300 P/E) really worth twice as much as Sri Lanka’s stock market? When we take into account the strong trends of growth present in these frontier markets and the lower market cap/GDP for frontier markets, it is clear to see the potential for these markets is being relegated, and that these markets are a safe bet moving forward. Proctor & Gamble’s stock market capitalization is nearly the same as the combined stock market capitalization of Sri Lanka, Vietnam, Pakistan, and Bangladesh.

A 2014 article from The Economist notes how some emerging stock markets were worth the same as some multinational corporations ( Mexico=IBM).

Moving forward, I have more faith in the simple growth story of the rising middle class in frontier Asia.

Vietnam’s Stock Market

I rank Vietnam as the most favorable frontier market due to its comparatively favorable demographics, lower GDP per capita, comparatively stronger economic growth, high consumer confidence, improved inflation, ease of doing business, and lower corporate tax rate. Vietnam currently trades at over 16X P/E, which is a premium to MSCI Emerging Markets. This, coupled with the country’s relatively high level of debt and need to implement more credible privatization efforts, are my main short term concerns with the market at the moment. The following 20 investment themes in Vietnam have strong potential: Pharmaceutical Manufacturing, Textile Manufacturing, Food and Beverage Producers, Automotive Industry(various segments), Industrial Parks, Real Estate, Logistics, Oil and Gas, Steel Production, Banks, Brokerages, Seafood Companies, Education, Rubber Exporters, Plastic Manufacturing, Retail Companies, Animal Feed/Livestock, Furniture Producers, Tourism, and Non-Life Insurance. At the moment, the premium is somewhat justifiable and it is easily possible to construct a portfolio with lower valuation.

Pakistan’s Stock Market: Investment Themes

Pakistan is ranked as my 2nd choice for frontier markets, based on the long-term outlook for the country, as well as the immediate catalysts that are in place for the market. Pakistan’s P/E was 10.77 as of the end of September 2016, and its P/E has the potential to rise to 12-13 due to its recent emerging market upgrade announcement for 2017.

Some positive outliers for this market include the following:

- Favorable Demographics: Over half of the country’s population is currently under 24 years old, which provides long-term opportunity for increased consumption. The country’s median age is currently 23.4.

- GDP: Pakistan’s GDP(269.97 Billion USD) is the highest among other frontier markets that I observed, and the country is a key global contributor for many sectors (sugar, textiles, cement, etc.).

- Population: The country’s population(188.0 million) was the highest among all frontier markets that I observed.

- Consumption: Pakistan had the highest consumer confidence among all markets observed.

Some less favorable factors for this country include the following:

- Slower Growth: Economic growth between 2011 and 2015 was slightly below 4%, significantly lagging behind all of the previously mentioned frontier markets. However, the IMF projects that the country’s GDP growth will reach 4.5% and 4.7% in 2016 and 2017.

- Ease of Doing Business: Pakistan only ranked above Myanmar and Bangladesh for the country’s ease of doing business. Political risks from terrorism lower foreign investors’ confidence for this region.

Some strong investment themes for the country that I have previously covered include the following:

- Banks: There is still very low penetration for this market, and the Global Findex Database ranks the country as the lowest for financial inclusion in South Asia. Only roughly 13% of the population currently has a bank account.

- Textile Companies: Another strong component of the economy, which employs around 30% of its population. Growth for textile exports, along with exports in general, has been sluggish, with textile exports most recently declining by 2% YoY.

- Pharmaceutical Manufacturers: Pakistan’s large economy, coupled with its increasing birth rates, is resulting in an increased demand for pharmaceutical products. This industry achieved growth of 12%in 2015.

- Hospitals: As previously noted, Pakistan’s healthcare expenditure per capita significantly lags behind frontier and emerging Asia, which presents a strong opportunity for investment in listed hospitals. Shifa International Hospitals currently trades at 22.9 P/E, quite a bargain, given the higher valuation in emerging markets such as Thailand.

- Automotive Distributors: Pakistan’s automotive industry has been delivering double-digit growth amid slowdowns in other emerging markets, and the penetration rate for vehicles in Pakistan is still very low.

Bangladesh Themes

Bangladesh is another significant frontier market to note, with strong trends of economic growth, and the largest stock market capitalization out of the previously mentioned frontier markets.

Some positive outliers for this market include the following:

- Demographics: Nearly half of the population is under 24 years old, and the median age is currently 26.3, a strategic area for strong consumption.

- GDP Per Capita: The country’s GDP per capita lags behind other frontier markets such as Vietnam, Sri Lanka, and Pakistan.

- Population: The country’s population of over 160 million was the 2nd highest among all frontier markets, only falling behind Pakistan.

- Growth: Bangladesh’s GDP growth was consistently above 6% between 2011-2015.

The only main concern I noted was that the country ranked 174 for ease of doing business, and its relatively higher inflation of 5.5%. Since gaining its independence in 1971, the country has increased its real per capita income by more than 130% and cut its poverty by more than half. Around 1/3 of the population currently lives below the poverty line.

Some of the top investment themes to capture the country’s rapid economic growth include pharmaceutical companies and FMCG companies. On top of this, the country has a strategic standing in the global textile industry due to its comparatively lower wages, and this is also a crucial industry for investment. Some of the most noteworthy and largest companies in these sectors include the following:

- Singer Bangladesh Ltd.: Manufacturer and marketer of consumer electronics, home appliances, and furniture.

- Olympic Industries Ltd: The largest manufacturer, marketer, and distributor of biscuits in Bangladesh.

- Argon Denims: A denim producer, which exports its products to Europe, USA, Canada, Australia, and Japan.

- Beximco Pharmaceuticals: This company received FDA approval for a blood pressure drug last year.

Sri Lanka

Sri Lanka is another intriguing frontier, which has been struggling with a slowdown in exports and its high debt. The government’s Debt/GDP was 76% as of 2015, and the country has required a $1.5 billion loan from the IMF.

Overall the market has some positive traits, but is not a stellar destination for investment like other markets:

- Demographics: Demographics are somewhat favorable for this market, with nearly 40% of its population under 24 years old, and the median age being 32.5. The strong rise of the country’s aged population in the future is another positive trend to note for the rise of healthcare spending in the future.

- Population/GDP: The country’s population is only slightly over 20 million and its GDP is only around 82 Billion USD, around 42% of Vietnam’s GDP.

- Growth: The country’s economic growth has declined from its peak of over 8% in 2011, to its current level of 2.6%.

Sri Lanka’s economy is currently troubled by high debt, and its trends of economic growth are modest at the moment. Nevertheless, there are a large number of interesting growth stocks in the country, which have been able to outpace the country’s economic growth. Some of the following stocks have significant market shares in areas that are able to access the country’s rising domestic consumption, thus offsetting some of the risk associated with investing in Sri Lanka:

- Lanka Hospitals: A private hospital operator in Sri Lanka.

- Ceylon Tobacco: This company is the only legal producer of tobacco in Sri Lanka, dominating the majority of the market.

- Dialog Axiata: Sri Lanka’s largest telecommunications provider.

- Hemas Holdings PLC: A conglomerate, which primarily operates in FMCG and healthcare.

- Lion Brewery Ceylon: A brewery whose products include lagers, stouts, and Carlsberg products.

A Closer Look at Excluded Frontier Markets: Future Outlook

Some frontier stock markets that I initially excluded may be worth looking into in the future, and some of these economies are also significant positive outliers despite having negligent stock markets.

Mongolia: I am optimistic about this market, but prefer mining companies that are listed on exchanges in Hong Kong, Australia, and Canada. The country’s Oyu Tolgoi mining project is projected to contribute to 1/3 of the country’s GDP when in full production in 2021, which has rightfully termed the country as “Minegolia”. Recent improvements included a newly elected government that is much more pro-foreign investment, the resolution of a mining dispute with Khan Resources, and the confirmation of Oyu Tolgoi. I could see another mining boom happening in the 2020s when Oyu Tolgoi goes into full production.

Nepal: Nepal’s stock market is another to watch in the future, with a total market capitalization of approximately $19.6 billion. Nepal was the slowest growing frontier market out of all the markets I observed, with annual GDP growth only reaching 3.4% during 2015.

Laos: Laos has very strong demographics, with over 55% of the population being under 24 years old, and a median age of 22 years old. The market’s GDP growth consistently exceeded 7% between 2011 and 2015, and inflation has dropped to 1.97%. The only issue I have with the market is the small size of its economy($12.33 Billion GDP), and especially the lack of offerings on its stock market. There are currently only five companies listed on its stock exchange, which including the following: a bank, an electricity company, a property service company, a petroleum company, and a construction/home improvements company.

Myanmar: Myanmar is another intriguing frontier market, which has just launched its stock market, and currently only has 3 companies listed. Myanmar also has strong youth demographics, with a median age of 28.6, and its GDP growth averaged at around 7% between 2011 and 2015. The Asian Development Bank is predicting that growth will remain over 8% during the next two years. A large number of companies have been flocking in for private equity deals in the FMCG Sector (breweries, toothpaste, etc.).

Cambodia: Cambodia has also been leading frontier markets in terms of economic growth, with its average annual GDP growth exceeding 7% between 2011-2015. Demographics are also stellar; over 50% of the country’s population is under 24 years old, and the country’s median age is 24.9. However, the company’s stock market currently only offers three options for foreign investors.

Top Frontiers

Laos, Myanmar, and Cambodia are still very intriguing for their economic growth and demographics, which are all poised to create an environment for greater consumption in the future when the country’s median age rise to the upper 20s. Accessing the FMCG through private equity seems like the most appropriate play, although I prefer the simplicity of large frontier markets which produce a flurry of blindingly obvious trades. Mongolia should still represent a small/long term/high-risk section of a portfolio, for investors willing to hold through the 2020s when the country is poised to potentially have another mining boom.

The collective GDP for all five of these markets is approximately $128 billion, with nearly half of this coming from Myanmar; this total amount still lags significantly behind Vietnam’s GDP of $193.6 billion. Moreover, the combined population is only approximately 107.7 million, compared to 188.9 million and 160.9 million for Pakistan and Bangladesh, respectively. This fact, coupled with the country’s smaller stock markets, creates an investment case for frontier Asia which primarily focuses on Vietnam, Pakistan, Bangladesh, and Sri Lanka.

India: An Emerging Outlier

India is also another strong emerging market outlier to examine, which has many similarities to other frontier markets. The market trades at a discount to emerging markets like Thailand and Malaysia, which are both delivering comparatively slower economic growth. Moreover, even a market like the Philippines, which grew by 7% during Q2 2016, currently trades at 27.7X P/E. I think that the price is right for India, especially considering it is outpacing its emerging Asian peers in economic growth.

The icing on the cake for India though is that despite being such a large and developed market, there is still “the bottom of the pyramid” element present and the potential for increased consumption from this group. Some of the previously mentioned statistics for the company were on par with other high growth/underdeveloped markets:

- The country’s demographics are still favorable, with over 45% of the population being under 24 years old. The country’s median age is 27.6.

- India is the world’s 3rd largest economy(PPP), yet its GDP per capita is only $1,581.6, on par with other frontier markets. The GDP per capita for Vietnam and Pakistan is $2,111.1 and $1,429.0 respectively.

- India’s GDP growth was over 7% during 2014 and 2015, on par with other high growth frontier markets.

- The country’s healthcare expenditure per capita was lower than Sri Lanka and Vietnam.

India still has much room for economic growth, similar to other frontier markets, and the obvious opportunity presented by its population and demographics further adds to its investment case. Emerging market funds should be “overweight” in India. I also think frontier funds should be overweight in (or at least increase holdings in) Pakistan and Vietnam while examining opportunities in Mongolia, Sri Lanka, and Bangladesh. This will allow investors to most effectively capture the growth of the bottom of the pyramid, and to mitigate investment risk amid global economic uncertainty.

My Thoughts on Social Implications

Although I did not focus on this aspect in this insight, the bottom of the pyramid concept has very significant social themes, namely eradicating poverty through profit. This can be joined by other factors such as microfinance (Grameen Bank Model) and social business, which were spearheaded by Dr. Muhamad Yunus from Bangladesh. Frontier market investing can therefore not only be considered a profitable endeavor for investors, but also as a social, macroeconomic boost for these frontier markets. On top of this, some frontier funds, such as Tundra Fonder and Vietnam Holding, utilize an ESG focus (environment, social, and governance) in their investments. I also view finance and economics as having very promising potential to be an altruistic force for frontier markets and certainly believe investing can produce social value in frontier markets. The combined impact is very intriguing and extremely leveraged.

Dylan Waller: Futurist/Anarcho-Capitalist/Frontier Market Analyst

Contact: dylan@nomadicequity.com

Website: www.nomadicequity.com

Copyright © 2016 Dylan Waller - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.