Diwali, Gold and India – Spiritual, Religious Gold Buying Over?

Commodities / Gold and Silver 2016 Nov 02, 2016 - 03:41 PM GMTBy: The_Gold_Report

I live in Dubai where Diwali has been the focus for many this weekend. With Diwali comes not just fantastic light displays and celebrations but also huge adverts for Hindus to buy gold for their loved ones in India and throughout the world.

I live in Dubai where Diwali has been the focus for many this weekend. With Diwali comes not just fantastic light displays and celebrations but also huge adverts for Hindus to buy gold for their loved ones in India and throughout the world.

Buying gold at Diwali is a religious or spiritual act and it is considered auspicious and thought to bring good fortune and prosperity.

Win Gold Coins for Shopping

Not only are there offers to buy gold jewellery, bars and coins but there are competitions to win gold. When I went to do my weekly shop at a Carrefour I was delighted to see a gold coin on display that I could win.

‘The more you shop the more coins you can win’ the poster told me, so on I shopped convincing myself I was making a possible investment decision.

Double page spreads, billboards and radio adverts regarding gold are not uncommon here and are very much a part of day-to-day life. The gold price, UAE gold coin and reports of gold take front and centre of the daily newspaper. Back in London an FT mention of gold and at least six people forward it onto me. In Dubai, the Middle East and much of Asia, it’s no big deal.

Whilst the local Emirati population has a desire to hold gold it is the Indian population (who represent 42% of society here), their countrymen and their love for gold, that has me fascinated this week.

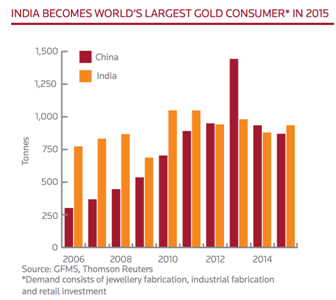

India is often quoted as the world’s largest gold importer, a crown that has been wrestled away by China, but both still rule the charts. This is a relatively new phenomenon for India. Until 1990 gold imports were pretty much banned, just eight years prior to that only 65 tonnes of gold had been brought in, by 2010 imports had reached over 1,000 tonnes.

We have written about India’s understanding of, spiritual affinity and love of gold in the past, usually around this time of year when everyone starts writing about it. It is festival and wedding season, and it is one of the few periods when mainstream precious metals analysts actually look at physical demand and supply – the heart of what makes gold so interesting. They look away from the hot air the West spews out about the dollar, all powerful central bank interest rate changes, presidential elections and EU traumas affecting the gold price and instead tell a real human-based story about gold demand in India, and how it provides strong underlying support for the gold price.

But this year something has changed. I am now living in among this desire to buy gold yet at the same time I am reading on Bloomberg and Reuters that the Indian gold market is on its knees.

Is this love trade really over? Was the bustling gold souk in the old part of Dubai just a mirage?

The truth is, the Indian gold market has had some tough blows in the last few years. And yet, he Indian gold market has shown incredible resilience over the years. Despite this, every single year without fail, there are renewed warnings and misleading headliens regarding a decline in Indian demand.

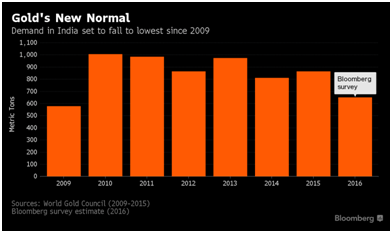

We are in the final quarter of the year when gold demand should be booming. Yet Bloomberg interviewed ‘five jewellers and traders’ (yes, five, an excellent sample size in a country of 1.25 billion). The findings of the survey concluded that ‘[gold] demand has just fallen off a cliff’ and predicted that just 650 tonnes would be imported this year.

Has gold demand fallen off a cliff? Why does Bloomberg think so? And why is this only important at this time of year?

Why do you only care about India during Diwali?

It is considered auspicious to buy gold during the festivals of Diwali and Dussehra, and this additional demand for gold is added to due to the final quarter of the year being wedding season, when between 35% and 40% of a wedding’s expenses is thought to be spent on gold. But, and this may come as a shock to those running the Bloomberg survey, the country does still buy gold the rest of the year.

A few years ago Jeff Nichols wrote that he believed gold bears ‘have a fairly provincial view and limited understanding of gold’s increasingly bullish long-term fundamentals.’ He defined ‘provincial’: ‘they are ignoring more than half the world.’ Because, Western mainstream analysts and commentators only consider gold demand in the East during times of celebration, because it is seen as the done thing, and it is disregarded the rest of the year.

What the mainstream forgets is that gold isn’t purchased during these special occasions because of good marketing (as we see in the West during Christmas time and present giving), but because it is a trusted form of currency and investment.

Gold demand, not dead yet.

First up it is important to note that the World Gold Council expect gold demand in India to be around 750 – 850 tonnes this year, not quite as dire as Bloomberg but still slightly off the 926 tonnes seen in the fiscal year of 2015 -2016. In 2015, gold demand climbed about 2.5% on the previous year. MMTC-PAMP (the Indian gold refiner) have reported a dramatic drop in gold imports this year, in value terms numbers dropped 76% to 60 tonnes between April and July.

Meanwhile, the jewellers who clearly weren’t speaking to Bloomberg are even more than the WGC and are reported to be expecting sales to be increasing to by 50-60 percent over last year, according to the Indian Bullion and Jewellers Association. This doesn’t necessarily mean increased imports. It may be on account of some increased stock building by jewellers earlier in the year.

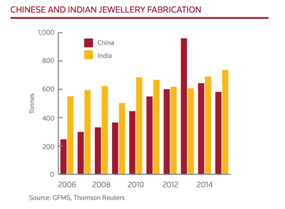

This year has been tough though for gold traders in India. In the first half of the year 100 tons of demand was lost due to a strike by jewellers in protest over a tax on jewellery made and sold in the country. Jewellery has suffered. In 2014 India consumed 668.5 tonnes of jewellery, an increase of 6% from 632.2 tonnes in 2014 and 615.7 tonnes in 2013. However Q1 this year saw jewellery consumption down to 72.9 tonnes from 148.5 tonnes in Q1 2015, according to GFMS estimates, while between April and June it fell further from 56.3 percent to 69.2 tonnes from 158.2 tonnes.

Whilst numbers might be down somewhat, there is no threat to them no longer contributing to global gold demand. Many believe that China still own the gold crown, but according to a GFMS, Thomson Reuters survey, India still reigns. In fact, last year India’s gold bar demand saw an 81% increase in growth in the second-half of the year, contributing to an overall 16% increase worldwide. China, in comparison only saw a 19% increase.

Gold is the fall-guy when it comes to black money and over spending.

The government has, without doubt, been the single most negative force on India gold demand in recent years. Given the measures that have been taken, official gold demand has been impressively resilient.

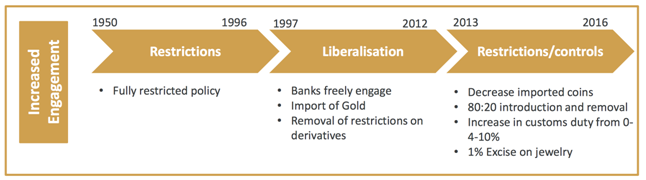

Gold controls in India are nothing new. These have come in both the form of bans, duties and gold mobilisation efforts (to get gold int the financial system). Each time the government has given in due to smuggling rates or low uptake

– In 1947 gold bullion imports and exports were banned under the Foreign Exchange Regulation Act. Lifted in 1966.

– In November 1962, 15 year gold bonds were issued at 6.5% in an attempt to mobilise privately held gold. This only saw an estimated 16 tonnes exchanged for bonds. A small percentage of the total holdings.

– Further efforts at mobilising gold continued between 1962 and 1993. Each was disappointing in regard to how much gold was mobilised.

– In 1968 the Gold Control Act was implemented which forbid the holding of gold bars and restricted families’ jewellery holdings. This was abolished in 1990.

– In 1977 the government considered controlling the market in an attempt to stop smuggling. According to the MCX this idea was seen as an impossibility due to foreign exchange reserves. Instead, the confiscated gold was sold in small quantities through the RBI, ‘however, it did not have any major impact on smuggling.’

From 1997 gold was in free flow and demand began to climb. However from 2012 the current-account deficit was wearing the government down so they turned to gold to solve their problems, although perhaps not in a conventional sense. In 2012 an economic survey found “There is scope to discourage unproductive imports, like gold and consumer goods, to restore balance.”

The government began to place various restrictions on gold imports in the form of duties and import/export ratios. Since 2012 the import duty has gradually climbed from 2% to 12%.

When the Indian government announced gold controls it was because the level of imports had derailed the rupee and pushed the current account deficit to unprecedented levels, or so they said.

In truth zero-rated tariff structures for capital goods imports punished the current account deficit by $339 billion, more than that of gold which accounted for $161 billion. Gold however, is the barbarous relic in some western economists’ theories and books, and so it came to be in certain economic and government circles in India as well.

Government imposed controls and duties on gold are no longer just because of the current account deficit. Instead these are decisions made to clamp down on ‘black money’ (money that has not been declared). Marwan Shakarchi, chairman of MKS (Switzerland) SA, told Bloomberg the drop in gold demand “is a sign the government is serious about cracking down on black money,” he said, referring to a campaign by Prime Minister Narendra Modi “to curb undisclosed income.”

$450 billion is thought to escape the eye of the tax man in India, and as a result is hot money. As ever when a government looks to crack down on money laundering and tax evasion, gold is often blamed as a source (rather than bi-product) of the situation and suffers as a result.

Import duty on gold in India remains a source of discussion, which many believe should be cut from 12% to just 6%. However, despite the fall in the current-account deficit, there is little incentive for the government to reduce the import tax on gold. In 2015 they raised $3.3 billion.

At the beginning of the year, Finance Minister Arun Jaitley decided to keep the duty intact (much to the market’s surprise) and went further by imposing an excise duty on gold jewellery sales from March. This lead to the one-and-a-half month strike by jewellers, who have been punished plenty by recent gold duties.

The decisions by Jaitley curbed gold jewellery demand in the first quarter, sending it to its lowest level in seven years to 88.4 tonnes. Total demand slumped 39 percent from a year ago to 116.5 tonnes, according to the WGC.

Next year a general sales tax on gold jewellery will be imposed. Commentators at this year’s LBMA conference stated that they believe this tax will be around 18%. Unsurprisingly a tax at that level would normally reclassify a good as a luxury, but this is more than a ‘nice-to-have’ item for Indian gold buyers. And so we suspect this will have little impact on unofficial gold figures.

Smuggling is encouraged

For all the various figures and commentaries that point to and suggest a drop in gold demand, there is one area which speaks for itself when it comes to the country’s desire to own gold no matter what. Smuggling.

Smuggling is rife thanks to government controls and imposed duties (see below), the efforts to curb gold demand have been so relentless that it appears to just encourage more smuggling, each year. It is the smugglers who have offered the unfaltering supply to the buyers who will continue to demand gold. Even prior to the 1990s, gold continued to be bought, thanks to smuggling.

The trouble with illegal activity is that you never know whose figures to believe and so reliable numbers are hard to come by. Recently someone told me that 70% of the gold brought into India was smuggled, and this was repeated at this year’s LBMA conference when it was reported that two-thirds of India’s gold inflows come via smuggled channels, including men with “stomachs full of gold,” as we reported in 2014.

Officially, 100 tonnes of gold is thought to have been smuggled into the country between April and September this year, according to business-standard.com. In 2014 the BBC reported that an estimated 700kg was smuggled into India each day, although the World Gold Council believes a far more conservative 175 tonnes of gold were smuggled into India in all of 2014.

The truth is, that whilst official figures suggest things are flat in the Indian gold market, smuggling remains rife and is playing an increasing role in gold import figures. Whilst big brand jewellers might not want to partake (or admit to partaking) in illegal gold activities, the demand (and therefore supply) is coming from somewhere. Otherwise smugglers wouldn’t be risking jail fines and uncomfortable plane journeys to get the gold from Dubai, Singapore, Bangladesh and Nepal into India.

India is a massive country with a massive land border and it is impossible to prevent smuggling.

Who is buying the gold, smuggled or not?

A GFMS 2016 gold survey found those households dependent on agricultural activities, in India, contribute to 35% of annual gold demand. Within rural households gold comprises 45% of their total savings.

There is no asset as liquid as gold, in India. And this is one of many reasons why it is so popular with those in rural and unbanked areas. Central banker Y. V. Reddy once said, “The real purchaser of gold is typically a peasant.” Whilst Jeffrey A. Franks, of the IMF, was once quoted as saying, “Holding gold has, in fact, often in history served, from France to India, as the only way the peasant can protect himself against inflation and the vicissitudes of politics”.

But to a government so influenced by uber-Keynesian and neo-liberal economics, it continues to treat their own people in a similar vein. “it should be noted that labour-only households adopt a high risk-high return strategy due to their over-investment in one asset, viz. gold.” stated a paper by NSE and the Institute for Financial Management and Research (IFMR) in 2015. But for those spending 45% of their wealth on gold, this is not a ‘high-risk return strategy.’

S.Gurumurthy in the Hindu Business Line writes, “Only gold, no other asset, has so consistently beaten inflation. The average inflation during 2001-02 to 2005-06 was 4.7 per cent but gold yielded 9.2 per cent — almost double. The average inflation for 2006-7 to 2010-11 was 6.7 per cent but the yield on gold was 23.7 per cent — three times plus. Average inflation for 2012 is 9 per cent but gold returned 33.5 per cent — almost four times. Traditional India intuitively seems to understand the value of gold.”

This is something that has been unappreciated, or most likely ignored, by government trying to crack down on gold ownership. Taxes on gold have been created with the wealthier in mind. These are the people who usually operate within the financial system, pay taxes regularly and are used to and more receptive to such government and more western approaches.

However, an asset that represents 45% of a rural household’s savings is unlikely to suddenly disappear thanks to a new law passed by the government.

As an India farmer looks at it, the Indian rupee has lost over 88% of its purchasing power in relation to the US dollar, since 1978. The rising price of gold has helped to maintain purchasing power.

It is also important to question what gold is used for, in some areas. Of the 41.2 million non-farming businesses in India (employing over 100 million people) 91% are funded by families and unofficial private financing companies. Gold is frequently used as loan collateral.

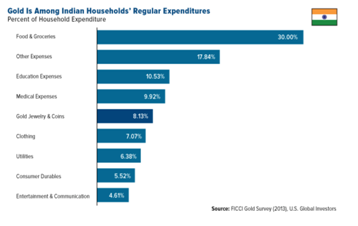

Across the financial spectrum, gold remains a key feature in household expenditures

There is an argument that with the growth of the middle classes and urbanisation, the term ‘rural household’ is perhaps outdated and misconstrued. The middle class in India grew by 67% between 2001 and 2016. With this change in the demographics of India, will no doubt come changing demands and practices.

Some market commentators point to the millennials as a potential problem for the gold market, in both India and China. Whilst they have all had the need to own and hold gold drilled into them, there are now a number of other ways they’d like to spend their money.

One also has to consider how a squeezed middle-class will look at the 0.9% return in rupee terms that gold has delivered since 2013, versus the 5.6% on property and 11.9% on local equities (according to Kotak bank).

“People are less inclined to buy the traditional gold jewellery these days. They prefer to buy gold bars and coins available at banks instead. Jewellery shops in different parts of the city have also pulled a large chunk of customers away from us,” Gaurav Verma, a gold merchant at Sarafa Market, told the Times of India.

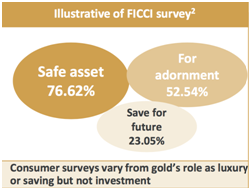

However In 2014-15, a survey carried out by the Federation of Indian Chambers of Commerce & Industry (FICCI)NSE and the Institute for Financial Management and Research (IFMR) found that more than three quarters of Indians view the precious metal as a “safe asset.”

Interestingly only 23.05% saw this as a way of saving for the future – even though this is in many ways what a safe asset is.

A presentation by MMTC PAMP at the LBMA conference this month suggested that in India where “there may be an investment benefit, the driver for Gold is not ‘conventional’ investment.”

Can the government change how Indians buy gold?

In 2013, the Reserve Bank of India Working Group to Study the Issues Related to Gold Imports and Gold Loans stated that “demand for gold appears to be autonomous and a function of several influences and factors that may not be strictly amenable to policy changes” (i.e.it ignores Western theory).

It goes on “…gold demand is price inelastic… buyers take recourse to unauthorised channels to buy gold”.

The government, whilst actively working against gold imports has decided it would still like to benefit from the cultural desire to own gold and overcome the growing smuggling rings.

One thing that we are now seeing in India is the marketing to encourage the mental shift of gold ownership for investment rather than for savings.

Financial bods and government look down on and worry about the ‘investment strategy’ of these rural households. The discomfort with Indian’s buying and holding gold outside of the financial system has led to the Reserve Bank of India setting up a committee to consider why so much money is put into the safe haven.

They will look at “whether, how, and why the financial allocations of Indian households deviate from desirable financial allocation and behaviour.”

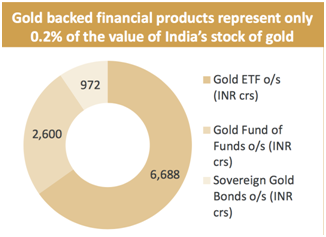

In a 2015 paper by NSE and the Institute for Financial Management and Research (IFMR) explains why, really they would be better getting their gold into the financial system, stating that given ‘gold ETFs outperformed physical gold by providing returns of 23.97% at a standard deviation of 10.04% compared to returns of 20.97% at a standard deviation of 13.56% for physical gold. Inclusion of a wider suite of financial assets including gold ETFs, MMMFs, and corporate bonds could lead to a Pareto improvement in the risk-return profile of households.”

However this analysis was carried out without considering those slightly important considerations such as commission, taxes, management fees etc. With ETFs there is always ‘fee drag’, something which is non existent for an Indian household who just keeps it at home, out of harm’s way.

For those families spending £20,000 -£25,000 on gold, standard deviations, corporate bonds and ‘suites of financial assets’ are unlikely to undo hundreds and thousands of years of buying physical gold.

Last November, Modhi launched the India Gold Coin, along with the World Gold Council. GFMS reports that the launch, “saw an underwhelming response, attributed to less awareness and minimal distribution network.” It is the country’s first ever sovereign gold coin and the only coin to be hallmarked by the Bureau of Indian Standards.

Jewellery sales might be down, but the government (like China) has tried to formalise gold demand by launching gold-backed sovereign bonds – effectively monetising gold. However, they have so far had little uptake, they represent less than 0.2% of the country’s total gold products.

Here, it is also important to question what gold is used for, in some areas. Of the 41.2 million non-farming businesses in India (employing over 100 million people) 91% are funded by families and unofficial private financing companies.

The government aren’t shy about persuading citizens to buy bonds instead of physical gold, this season. Money Today reports the launch of the ‘sixth tranche of SGB [sovereign gold bonds] the government has launched it at discount of Rs50 at Rs, 2957, which is it the lowest subscription price for 2016-2017. But at the same time the government has reduced the interest rate from 2.75% to 2.5% on these bonds.”

The news site goes onto explain that these SGB’s in paperless format are very handy and ‘save you the hassle’ of looking after it. Unlike with physical gold the owner is locked in for eight years with an exit option after five years. “By investing in these bonds you can cash in on the upside movement in gold prices as well as earn 2.5% interest at the time of exit.” Also, you don’t pay CGT on the gold if you wait the subscribed eight years, unlike with physical gold and ETFs.

Note, this is no longer about current account deficits and black-money, the kind of rhetoric now being used by government bodies is that they are mobilising gold for the good of the people. Given the levels of smuggling, it seems likely that government declarations of a war on gold for the good of the economy has fallen on deaf ears.

Conclusion: Will the Indians keep their gold?

It is clear from smuggling levels, as well as official import levels that gold demand is not going to be ‘falling off a cliff’ any time soon. But more importantly the lesson in India is that their love for gold cannot be ‘dealt with’ in a Western paradigm.

In the West gold is still peddled by the media as the asset of the wealthy and rarely owned by the common man, in India it is very much the latter. It is a cultural and indeed a spiritual phenomenon, not a financial asset.

As the Hindu Business Line, writes (quoting Aseem Chawla, Partner, MPC Legal):

‘Indians are creatures of habits; they save a third of their earning — a phenomenon probably explained by “our cultural values rooted in conservatism” and household savings which constitute large chunk of national savings are normally invested in “safe yet non-productive investments like gold.”’

Ultimately though, we do all buy and hold gold for the same reason – to protect ourselves from incompetence of governments and the central banking system. It is also a hedge against war and the occasional tyranny of our “great leaders.”

No matter which country you live in a practical paradigm must exist that ensures gold imports do not encourage crime and also benefit the citizens as well the economy.

Gold in India, as across the West, is increasingly touted as something that weakens and reduces economic power of individuals. The truth is, it is the ultimate expression of economic power and freedom. It is an asset which cannot be fiddled or debased by governments or banks. Physical gold owned in the safest ways (allocated and segregated), in the safest vaults in the world, cannot suddenly disappear when you go to check your ‘gold balance’ one day.

In many ways, the justification for Indian’s buying gold is stronger than ever, just as we see in the West, as explained by the IBJA:

“The market sentiment looks good as gold seems to be secure investment in the current Indo-Pak political scenario and the ongoing US presidential elections. The good monsoon this year will play a key role in bringing back rural demand in an agro-based economy like India.”

Gold Prices (LBMA AM)

02 Nov: USD 1,295.85, GBP 1,056.51 & EUR 1,169.76 per ounce

01 Nov: USD 1,284.40, GBP 1,048.58 & EUR 1,167.52 per ounce

31 Oct: USD 1,274.20, GBP 1,046.25 & EUR 1,163.22 per ounce

28 Oct: USD 1,265.90, GBP 1,042.47 & EUR 1,160.96 per ounce

27 Oct: USD 1,269.30, GBP 1,038.29 & EUR 1,162.93 per ounce

26 Oct: USD 1,273.90, GBP 1,043.45 & EUR 1,166.13 per ounce

25 Oct: USD 1,269.30, GBP 1,037.53 & EUR 1,165.85 per ounce

Silver Prices (LBMA)

02 Nov: USD 18.54, GBP 15.05 & EUR 16.70 per ounce

01 Nov: USD 18.24, GBP 14.91 & EUR 16.54 per ounce

31 Oct: USD 17.76, GBP 14.59 & EUR 16.22 per ounce

28 Oct: USD 17.61, GBP 14.51 & EUR 16.13 per ounce

27 Oct: USD 17.66, GBP 14.41 & EUR 16.16 per ounce

26 Oct: USD 17.66, GBP 14.46 & EUR 16.17 per ounce

25 Oct: USD 17.73, GBP 14.49 & EUR 16.30 per ounce

This update can be found on the GoldCore blog here.

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.