Mosul, US Elections, and Other Madness

ElectionOracle / US Presidential Election 2016 Nov 05, 2016 - 06:04 AM GMTBy: David_Galland

Dear Parader,

Dear Parader,

I’m pleased to report that the shakedown cruise on my latest folly, Bad Brothers Wine Experience, has come to an end, and we are now officially open regular business hours.

Over the last week, we welcomed our first guests off the street (from London, no less) and discovered just how much goes into running a wine bar/restaurant, thanks to upwards of 250 people passing through the front door.

Happily, our guests seem to have enjoyed the place, helping us quickly zip from the 49th to the 9th highest-ranked restaurant in Cafayate on Trip Advisor, a good start.

With the ship having left port, albeit with the lighthouse still in sight, I’ll have more time to focus on these weekly musings. While I have found the process of opening a wine bar “interesting,” writing brings me the greater joy, and I look forward to once again being a bit more luxurious with the time spent in its pursuit.

While still a bit time-pressed, in today’s edition I want to catch up on a couple of current events, both of which are timely and, in their own ways, important.

Mosul

While the news is dominated by the most manic-depressive presidential election in modern times, there is a massive tragedy unfolding in the Iraqi city of Mosul.

To most Americans, Mosul is just another Middle-Eastern backwater. And, I suppose, that is what it has become.

However, back in the day—the day being in 1127—it was the seat of power for the nascent Zengid dynasty.

Like Damascus, Mosul has a very rich history, and an unfortunately favorable geographic location on the Tigris river, a key intersection for important north-south and east-west trade routes. The current city actually encompasses the ancient city of Nineveh, the capital of the mighty Assyrian empire.

You can read more about Mosul here.

The founder of the dynasty, Zengi (also known as Zangi) was a remarkable man. His father, the Turkish governor of Aleppo, was beheaded for treason when Zengi was nine years old, after which he was raised by the governor of Mosul.

After rising to power as the Turkish atabeg of Mosul in 1127, Zengi used a combination of natural intelligence, cunning, flexible ethics, hunger for power, and a “capacity for untampered violence” to add Aleppo, Hama, and Edessa to his portfolio.

One Muslim chronicler described Zengi as thus:

“He was like a leopard in character, like a lion in fury, not renouncing any severity; not knowing any kindness… he was feared for his sudden attacking, shunned for his roughness; aggressive, insolent, death to his enemies and citizens.”

So, basically Conan the Barbarian.

Among his greatest accomplishments was crushing the army of the Crusader King Fulk of Jerusalem and returning that iconic city to the Muslims.

But Zengi was an equal-opportunity conqueror, swinging back and forth through the Levantine, changing rivalries, attacking allies, taking on not just the Crusader kings, but Muslim rulers as well Byzantines.

On several occasions, Zengi made a run at the jewel of the Middle East, Damascus. Like Mosul, when most in the West think of Damascus today, it is as a dirty, war-torn hellhole.

However, that overlooks its remarkably rich history as one of the oldest continuously inhabited cities in the world. Among over 100 other monuments from antiquity, it is home to the Umayyad Mosque, also known as the Great Mosque of Damascus, one of the oldest and largest mosques in the world. For Muslims, it is considered the fourth-holiest place in the world and the place where Jesus will return in the End of Days.

Like Mosul, the reason Damascus was so rich is also the reason it has suffered so greatly over the millennia. Namely, it sits squarely in the crossroads between Asia, Africa, and Europe.

As a consequence, in addition to Zengi, the city was invaded by pretty much every power in the region, including Alexander the Great, Pompey the Great of Rome, the Israelites, the Egyptians, the Persians, the Turks, etc.

But I meander.

My point here is quite simple, to add just a bit more context to the battle for Mosul now occurring, or the slow-motion disaster in Damascus. Because once the chaotic campaign for US president comes to an end next week, Mosul will once again be much in the news.

The Current Battle for Mosul

As you are probably aware, the Islamic State (ISIS) extremist group shocked the Iraqi government—and pretty much everyone else—by taking Mosul in a surprise attack in June of 2014.

Now, two years on, a diverse coalition—with US backing—is currently closing in on the city with the intention of dealing ISIS a crushing blow.

The problem is that Mosul, a city of more than one million inhabitants, is a dense warren of easily defended streets. Which is to say that the only way the coalition is going to take it is by engaging in house-to-house fighting, the sort of war-making that even the highly skilled and well-armed US military avoids at pretty much all costs.

Unlike the surprise attack that took Mosul, in this case ISIS has had abundant time to prepare for the assault it knew was inevitable.

And like Zengi, this is a group that has shown a pronounced willingness for “not renouncing any severity.” Thus, human shields, booby traps, and the willingness to undertake mass executions are all on the table.

The one thing that is almost certainly not on the table, given that the city is now effectively surrounded, is for the ISIS fighters to flee into the desert where, with the help of US drones, they could be picked off à la the Highway of Death during the Iraqi retreat from Kuwait.

While we are all distracted by the US presidential circus, the battle for Mosul is shaping up to be a humanitarian catastrophe. And once it’s over, the “allies” trying to unseat ISIS—including the heavily armed Kurds, the Sunni-dominated Iraqi army, and the Shi’ite militias—will find themselves face to face, with little inclination to civilly hand the keys to the city to the other members of their coalition of convenience.

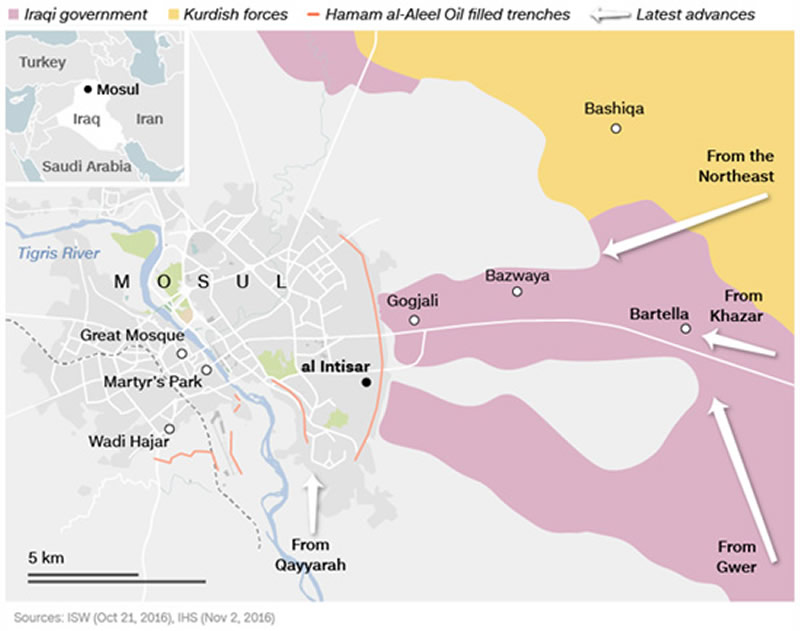

As I write this, coalition forces are starting to fight their way through the outskirts of Mosul proper but, as expected, are meeting heavy resistance. If you look at the map above, you will note the Tigris pretty much splits the city down the middle. It is a near certainty that once ISIS is pushed back over the river, they will blow the bridges, stalling any advance.

As a result, the battle could last a few weeks, but more likely a few months, during which time it will be the civilian population that bears the brunt of the pain.

The fact is, the Middle East is a rough neighborhood, and it has been pretty much from the beginning of recorded history.

The humanitarian crisis in Mosul (and Damascus, for that matter) has happened dozens of times over the millennia—as it will for centuries to come—as one Zengi wannabe after another attempts to seize the strategic crossroads.

The US can decide to keep interjecting in the area or simply accept that the entire region is basically “Chaostan,” as Rick Maybury of Early Warning Report has termed it, and will never change.

It’s a damn shame, but it’s not the damn shame of the US, because there will always be another Zengi.

(If you’re interested in learning more about the region, you might enjoy The Crusades— The Authoritative History of the War for the Holy Land, by Thomas Asbridge, a truly comprehensive account of all the Crusades. For more current events, I think that George Friedman’s new service, Geopolitical Futures is absolutely the best resource.)

The Elections

A month or so ago, I came to the conclusion that the US presidential election was going to be won by Hillary. In the latest edition of our Compelling Investments Quantified, I provided my rationale as follows:

With the US presidential election just under two weeks away, we’re going to hold our noses and call it for Hillary.

Our reasons are not really important, and there is punditry aplenty to provide deeper analysis as to why, despite Clinton’s serious shortcomings, the odds are in her favor. However, pushed to support our prediction, we would mention the following:

- Media Bias. Never has the mainstream media been so unambiguously aligned against a presidential candidate as they have been against Trump. From the onset, there have been daily revelations about Trump, many of them sensationalized trivia dating back a decade or more. These have been accompanied by a persistent willingness to whitewash Hillary’s past misdeeds and recent transgressions.

The media bias reached full bloom in the presidential debates where moderators made no attempt at appearing impartial, effectively giving the middle finger to democracy. It hasn’t helped that Trump was always at the ready to provide the media with more rope.

- The Race Card. Early on, Trump was unfairly but effectively framed as a racist, eliminating his chances of making serious inroads with the ethnic voting blocs crucial to winning the presidency in this election and every US election going forward. These ethnic groups may not care very much for Hillary—few do—but given the choice, the vote will go to Bill Clinton’s wife every time.

- The Electoral College. As discussed in the September 16 edition of The Passing Parade, when voting for a presidential candidate, you are actually voting for your state representative in the Electoral College. Members of the Electoral College are nominated by their respective parties as a reward for being good functionaries who know how to toe the party line. Trump’s alienation of old-school Republicans and neocons alike makes it all but certain that, even if he managed to eke out a victory in the popular vote, he’ll flunk out in the Electoral College.

Since writing that, despite the traditionally liberal media outlets trying to keep a lid on it—and that’s most of them—the Clinton campaign has suffered a number of body slams related to Hillary’s email accounts.

In an appropriately bizarre twist, the FBI announced the discovery of thousands of emails from the account of the detestable Anthony Weiner, estranged pedophile husband of Huma Abedin, Hillary’s closest aide. Further, that they may reopen the investigation.

To add a sour cherry to the topping, there is credible talk of indictments being handed down in relation to the Clinton Foundation.

Against this traffic accident for the already unloved and untrusted Hillary, Trump has done the best thing he can do at this point by avoiding controversy, stepping just outside of the media’s unflattering spotlight and allowing Clinton to take center stage.

While I still believe the proverbial (and maybe, literal) fix is in for Hillary, the establishment candidate, there are a couple of ways Trump wins.

- The FBI. The feds are now pawing through Weiner’s dirty laundry. I have read a solid analysis that opined the only reason FBI Director Comey notified Congress about the new inquiry was because he knew there was something in the Weiner emails that would cause Hillary to immediately be indicted, should she be elected, and so felt the need to force the issue in the hope she would step aside before next Tuesday.

Regardless, should the FBI find a smoking gun, it would be forced to act quickly in order to force her to withdraw, which, given the late date, could happen even as you read this. It would be shocking, unprecedented, remarkable… but those words only begin to describe this election so far. At this point, nothing would surprise me.

- The Weather. If there is one certainty in this mad, mad election, it is that 99.99% of Trump’s supporters will turn out to vote. For Hillary, the enthusiasm level is somewhere between “meh” and “sigh.” Any sign of bad weather in the key states will keep her voters home in droves.

In our Compelling Investments Quantified, we analyzed the investment consequences of a Clinton victory, but promised to rush a special analysis to our subscribers should Trump pull a rabbit out of the hat.

However, as Trump’s star appears to be on the ascent while Clinton craters, and given that the elections are just around the corner, our own Jake Weber took a quick look at the best way to insure your portfolio against a post-Brexit-like crash should Trump win.

I would like to add to Jake’s recommended hedge a reminder that when you focus on deep-value stocks, such as those we cover in Compelling Investments Quantified, as any sell-off would be a great time to back up the truck and buy even more of the best companies, at better prices.

(Accessing our complete list of portfolio recommendations is as easy as taking us up on our fully-guaranteed 6-month trial subscription. Details here.)

And with that, I invite Jake to step up to the podium.

Is Your Portfolio Hedged Against a Trump Surprise Victory?

By: Jake Weber, Garret/Galland Research

With the recent FBI investigation, the tides in this presidential election have once again shifted. While it still may be a long shot, Donald Trump has a good chance to be sworn into office in January.

Just how much of a shot does The Donald have at winning the election? That varies widely depending on where you look.

Hillary’s Narrowing Lead in the Polls

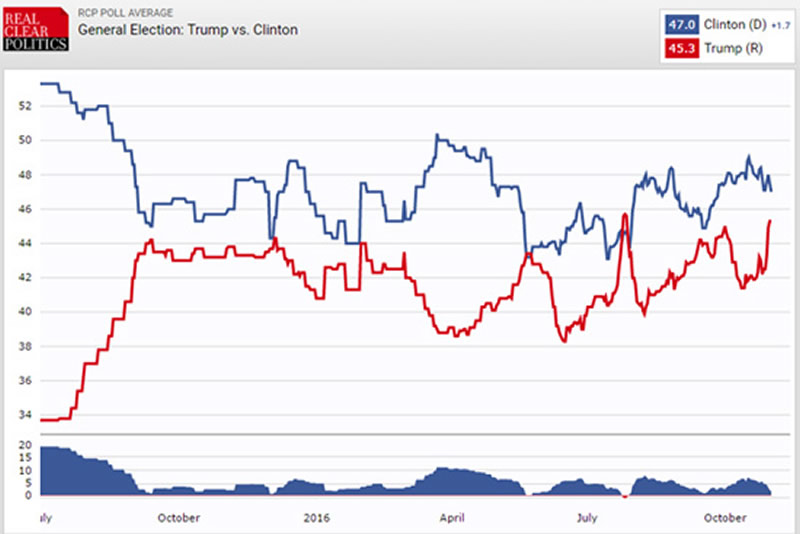

Polling averages from Real Clear Politics show that the odds favor Clinton only slightly over Trump. The margin has narrowed since the FBI reopened its investigation into Hillary’s emails.

Of course, the sentiment of the popular vote that polling captures isn’t the deciding factor in a presidential election.

In three US presidential elections—the latest being Bush/Gore in 2000—the candidate who won the popular vote did not become president.

In two other elections, a tie led to the president being selected in the House of Representatives. In other words, in 5 out of 43 (or roughly 12%) of US presidential elections, the victors arrived in office in some fashion other than winning the popular vote.

The Deciding Votes

It’s the race to a majority of 270 Electoral College votes that decides the election. If you factor in Trump’s chances of taking key swing states like Florida with 29 electoral votes or Pennsylvania with 20 electoral votes, it looks like more of a long shot.

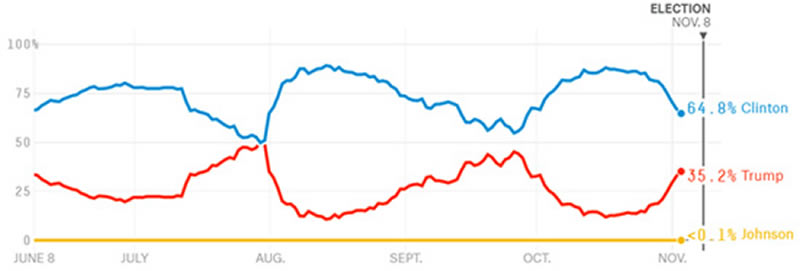

Nate Silver’s latest projections on fivethirtyeight.com give Trump only a 35.2% chance of winning enough Electoral College votes.

Don’t Be Fooled by the “Wisdom of the Crowds”

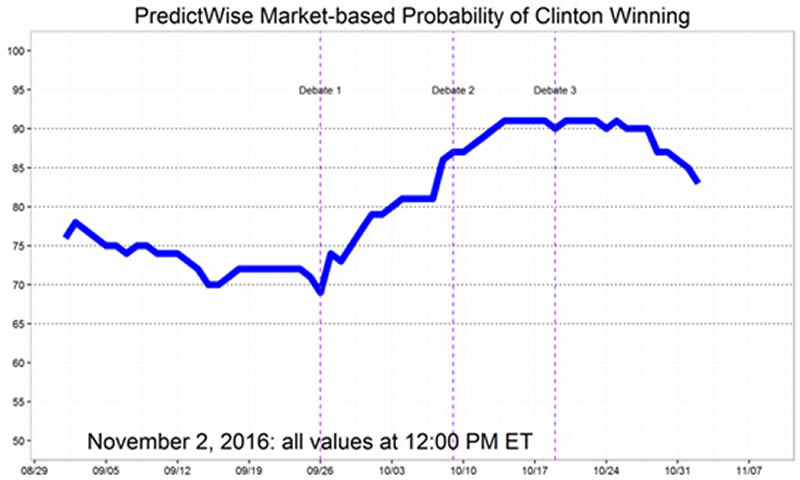

Then there’s the betting market odds that supposedly convey the “wisdom of the crowds,” taking into account more than the whims of a snapshot poll. According to the PredictWise model that factors in betting odds, Clinton still has an 84% chance of winning the election.

The betting markets are confident that Hillary will win, even with the current FBI investigation. But before you side with the “smart money” bets on Hillary, perhaps you should recall how wrong the bookmakers got it with the Brexit vote in June. Some bookies had odds that Britain would vote to leave the European Union at less than 10%. Yet the unthinkable happened.

Bookmakers aren’t in the business of predicting outcomes. The goal of the bookie is to make money no matter the outcome. A bookie shifts odds based on how people are betting in order to balance their risk. Therefore a few big bets can easily skew the odds as they did with the Brexit vote. And it appears that a few high-rolling Hillary backers may be skewing the betting odds in her favor as well.

Markets Fear Uncertainty

There has been a lot of violence surrounding Trump rallies over the course of the campaign, which could have created a pool of supporters willing to pull the Trump handle in the voting booth but not admit it to the pollsters.

Trump is an outsider who brings change and uncertainty. It doesn’t matter what model you look at, his chances according to polling, forecasting, and betting odds have all improved since the FBI reopened its investigation. So I wouldn’t totally discount Trump living in the White House next year.

The markets have made their distaste for Trump abundantly clear. The CBOE Volatility Index (VIX), the so-called “fear index,” has jumped over 30% since the news broke. The S&P 500 is down 1.4%, and gold is back above $1,300 per ounce for a 2.4% gain in a matter of a few days.

How to Hedge

Regardless of your political beliefs, it would seem prudent to at least hedge your portfolio against a surprise Trump victory—and gold is the obvious choice.

Gold has long been a hedge against political uncertainty, and if there’s one thing we’ve learned from the campaign trail, it’s that Donald Trump is unpredictable.

In the first debate, Trump attacked the Federal Reserve for intervening in politics and keeping interest rates too low. But he also said, “When they raise interest rates, you’re going to see some very bad things happen, because they’re not doing their job.”

Trump wouldn’t be able to replace Yellen as the Fed Chair until 2018, but he could still shake things up if he continued to be outspoken about Fed policy while in office. It’s unclear what Trump thinks the Fed should do. Regardless, a president meddling in the affairs of Federal Reserve monetary policy should be supportive of gold.

There is also a lot of uncertainty about Trump’s policies. Both candidates have expressed protectionist trade policies that could damage economic growth. Trump has maintained a harsher tone against trade agreements and has even pledged to build a wall on the Mexican border. If he somehow is able to follow through on the plan, something tells me he won’t get Mexico to pay for it.

He has also pledged to spend $1 trillion on infrastructure, more than double Hillary’s plan and without raising taxes. The plan calls for private funding to cover $167 billion of the spending, with the government offering a tax credit on the equity investment. The remaining balance would be fronted by the government and almost certainly cause the budget deficit to soar. Another positive for gold.

Fear not, if the “smart money” turns out to be right with their bets on Hillary, then there’s $50 trillion in cash on the sidelines that could also support gold prices.

No matter who wins the election, gold is a smart place to invest.

Here Come the Clowns

Enviro-Madness. As some of you know, I grew up in the small town of Kamuela on the Big Island of Hawaii. Our front window looked out on the majesty of Mauna Kea, which is technically the highest mountain in the world. I can attest to its height because on one occasion, we actually drove all the way to the top to go snow skiing. To do so required taking oxygen bottles, and even then it was a miserable experience.

In this moonlike environment, there is nothing but nothing, except 13 large telescopes that take advantage of the mountain’s height and clear air to ponder the stars. Yet, when a consortium wanted to add another telescope, the world’s largest and most advanced, the environmentalists teamed up with the native Hawaiians to launch a pitched battle to block it. You know, because it was treading on sacred ground and despoiling the beautiful nature—which is to say, dirt and the few scrub brushes that can grow at such altitudes. And so the consortium is now looking at spending its $1.4 billion in the Canary Islands. Mission accomplished, the local economy be damned.

White Just Isn’t Right. As I don’t need to tell you, in our current epoch the new “original sin” is that of being born white. To underscore the point, students at the University of Berkeley blocked a bridge leading into the campus, but only to white people. At what point does being anti-racist devolve into being racist? Not sure, but I think the US has already crossed that bridge. Here’s the story.

While there are many wonderful things I could point to about life in the Argentine outback, the almost complete lack of political correctness certainly ranks near the top of the list.

And with that, I will sign off for the week by thanking you once again for subscribing to these meandering weekly musings.

David Galland

Managing Editor, The Passing Parade

Garret/Galland Research provides private investors and financial service professionals with original research on compelling investments uncovered by our team. Sign up for one or both of our free weekly e-letters. The Passing Parade offers fast-paced, entertaining, and always interesting observations on the global economy, markets, and more. Sign up now… it’s free!

© 2016 David Galland - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.