Another US Election Year, Another Bunch Of Fake Economic Growth Numbers

Economics / Economic Statistics Nov 24, 2016 - 04:00 AM GMTBy: John_Rubino

Some pretty good economic reports have energized various parts of the financial markets lately. Consumer spending is up, GDP is exceeding expectations and even factory orders, that perennial downer, popped this morning.

In response the dollar is soaring and interest rates are at breaking out of their multi-decade down-channel. The economy is clearly recovering, implying a return to normality. Right?

Nah, it’s just the usual election year illusion. When the presidency is at stake the party in power always pumps up spending in an attempt to put people back to work and create the impression of a well-run country whose leaders deserve more time in the spotlight. After the election, spending returns to trend and the resulting bad news gets buried in “political honeymoon” media coverage.

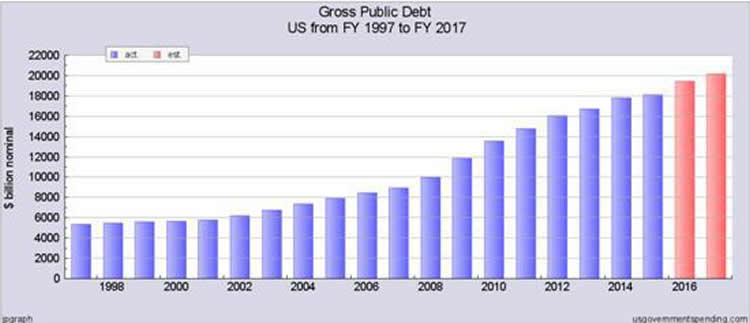

How do we know this year is following the script? By looking at the federal debt. If the government is borrowing more than usual and (presumably) spending the proceeds, then it’s likely that the economy is getting a bit more than its typical diet of stimulus. So here you go:

Note that after seven years of massive increases, the federal debt plateaued in 2015, which is what you’d expect in the late stages of a recovery. With full employment approaching and asset prices high, there should be plenty of tax revenues flowing in and relatively few people on public assistance, so the budget should be trending towards balance.

Well, more people are working this year than last, and stock, bond and home prices all rose in the first half of the year. So why the approximately $1.8 trillion surge in government borrowing? Because a robustly-healthy economy was necessary to help the party in power stay in power.

This is a huge jump in government debt, even by recent standards. And its impact is commensurately large, accounting for a big part of the “growth” seen in recent months. But it’s also unsustainable. You don’t double a government’s debt in a single decade (from an already historically high level) and then keep on borrowing. At some point an extreme event or policy choice will put an end to the orgy.

Either the markets impose discipline through a crisis of some sort, or the government adopts a policy of currency devaluation or debt forgiveness. And – in a nice ironic twist – the people who did the insanely-excessive borrowing are leaving town, to be replaced by folks who will inherit something unprecedented, with (apparently) no clear idea of what’s coming or what will be necessary in response.

By John Rubino

Copyright 2016 © John Rubino - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.