Is Japan About to Implode the $10T $USD Carry Trade?

Interest-Rates / Global Financial System Dec 02, 2016 - 10:31 AM GMTBy: Graham_Summers

It is said that history has a sense of irony. The latest US election is not an exception.

It is said that history has a sense of irony. The latest US election is not an exception.

Consider the following…

- Donald Trump campaigned aggressively on trade… particularly his opposing of the fact that the US gets taken advantage of by foreign nations via bad trade deals.

- Trump wins the Presidency on November 8, 2016.

- US trade gets royally screwed in the currency markets.

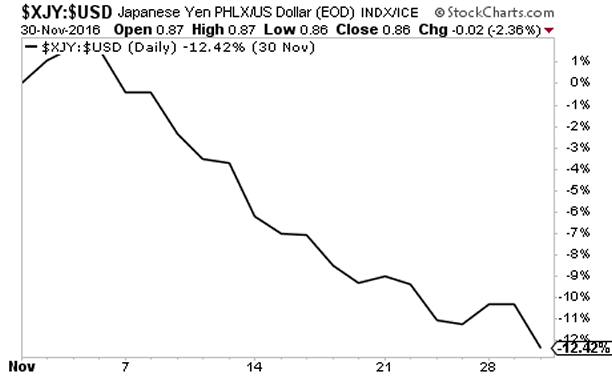

This is not conspiracy theory. Since Trump won the Presidency, Japan has absolutely SHREDDED the Yen relative to the $USD. In a mere three weeks, the Yen/ $USD pair has collapsed an astounding 12%.

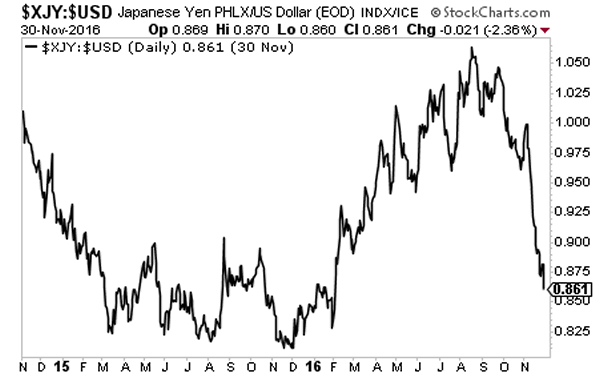

That doesn’t sound like a huge deal, so look at the longer-term chart.

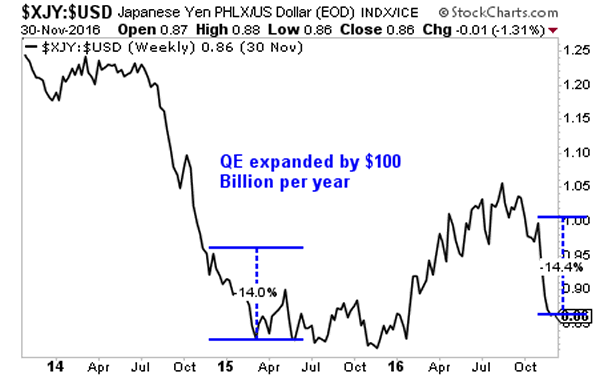

That is a massive currency crash. The Bank of Japan has accomplished in three weeks what previously took six months and a $100 BILLION+ expansion of a massive QE program.

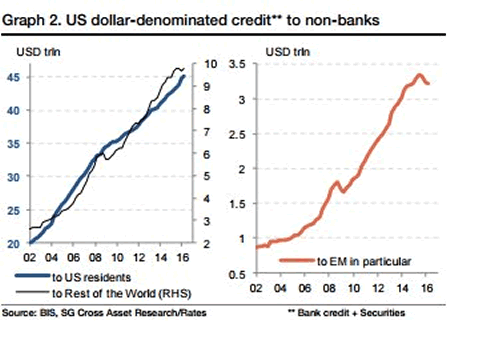

The real problem with this is that it is forcing the $USD sharply higher, triggering a potential crisis the debt markets as the $10 TRILLION US Dollar carry trade ignites.

If you’re unfamiliar with the concept of a carry trade, it occurs when you borrow in one currency, usually at a very low interest rate, and then invest the money in another security, whether it be a bond, stock or what have you, that is denominated in another currency.

Globally over $10 TRILLION of $USD is doing this right now. $10 Trillion: an amount greater than the economies of Japan and German combined.

Every tick higher in the $USD… means more of this trade blowing up. Already, it’s leading credit stress in Asia.

Another Crisis is brewing… the time to prepare is now.

If you’ve yet to take action to prepare for this, we offer a FREE investment report called the Prepare and Profit From the Next Financial Crisis that outlines simple, easy to follow strategies you can use to not only protect your portfolio from it, but actually produce profits.

We made 1,000 copies available for FREE the general public.

As we write this, there are less than 80 left.

To pick up yours, swing by….

http://phoenixcapitalmarketing.com/Prepare1.html

Best Regards

Graham Summers

Phoenix Capital Research

http://www.phoenixcapitalmarketing.com

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2016 Copyright Graham Summers - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.