Inevitable Global Ruin: Top Hedge Fund Managers Sound the Alarm

Stock-Markets / Financial Crisis 2016 Dec 10, 2016 - 11:47 AM GMTBy: Jeff_Berwick

When monetary control is centralized, as it is today, prosperity withers. The Wall Street Journal just surveyed top hedge fund managers and found a significant belief that full-fledged, global ruin is on its way. Tamper with freedom, monetarily or otherwise, and you end up facing catastrophe.

When monetary control is centralized, as it is today, prosperity withers. The Wall Street Journal just surveyed top hedge fund managers and found a significant belief that full-fledged, global ruin is on its way. Tamper with freedom, monetarily or otherwise, and you end up facing catastrophe.

That’s just where we are today.

The managers pointed directly at the purposeful monetary mismanagement of central banks around the world. These central banks large and small are pumping oceans of money into financial markets as well as lowering rates until they are actually negative, which has never happened before in recorded history.

When the final catastrophic implosion eventually occurs, we will look back on this era with amazement, wondering how people didn’t sense the disaster to come.

Here at TDV, we’ve been quite aware of what’s going to take place right from the start. Even our name – The Dollar Vigilante – speaks to our awareness of the world’s impending monetary ruin.

We were something of a lone voice because people have a hard time visualizing that King Dollar can collapse. But before all of this is over, not a currency – or economy – will be left standing. We’ll probably have to start from scratch.

We’ve said for years that all of this ends in a rock and a hard place scenario. The two options are to stop the money printing and interest rate suppression… leading to a catastrophic crash and depression of biblical proportions. Or, to continue with it until we reach hyperinflation… leading to an even worse catastrophic crash and depression of biblical proportions.

For now, they continue on with the game. And the longer they continue playing this game the crazier everything will get.

The European Central Bank, for instance, just announced it would extend its asset purchase program until the end of 2017. Its balance sheet will soon be larger than the Federal Reserve’s. The Fed has been buying bonds for years as part of its quantitative easing program.

According to these managers, the time is nearing when the world’s overstuffed markets simply won’t be able to absorb more cash. The final collapse may be a sudden unexpected major bankruptcy or perhaps a countrywide default.

Or maybe the monetary strategy itself will cause the final damage as some managers interviewed by the WSJ suggested.

Here:

“There’s no non-messy way out of this,” said Luke Ellis, chief executive of Man Group, one of the world’s biggest hedge-fund firms with $80.7 billion in assets. “There’s two versions” of how this ends, he added.

Either central banks could move to so-called ‘helicopter money,’ where they buy debt from the government, which then spends the proceeds or gives it to the population to spend. This “for a few years looks golden then leads to hyperinflation,” he said.

Or the speed at which money circulates within the economy could grind to a halt. “Then you effectively have a barter economy,” he said.

As is normal with government programs (for central banks despite their so-called independence are basically government monetary entities), the easing programs are actually doing the opposite of what they were supposed to do.

For instance, the ECB has purchased €48.2 billion ($51.2 billion) of corporate debt in about six month’s time, but the buying hasn’t been accompanied by private sector participation.

The selectivity that markets are supposed to encourage is lacking in this case. Securities are purchased with an eye toward stimulating “growth” while large private-sector investors grow even more skeptical. With so much money flowing into markets indiscriminately, it becomes impossible to winnow out deserving companies from those that are not.

Additionally, aggressive easing over the long term encourages social dysfunction. Low-to-negative interest rates eventually bankrupt retirees and savers while those who have significant assets grow richer because a low-interest rate environment yields significant, if short-term, business opportunities while assets generally keep up with inflation to a point.

The most disturbing point that the interviews with top managers reveal involves a “hard stop.” These managers say what we’ve long understood: Once central banks sustain too-low interest rates over a significant period of time, there’s no going back. There’s no way out. Ruin on a vast – worldwide – scale is the only… inevitable… result.

Government debt-to-GDP levels continue to rise while investors pour into markets that are only an inch from collapsing because they have nowhere else to go.

What we keep in mind here at TDV is that these have long ago ceased being “normal” markets where normal investing can yield results.

Even the world’s largest firms are in chaos and if you’re going to take positions on a variety of fronts you have to think in ways that you wouldn’t have before.

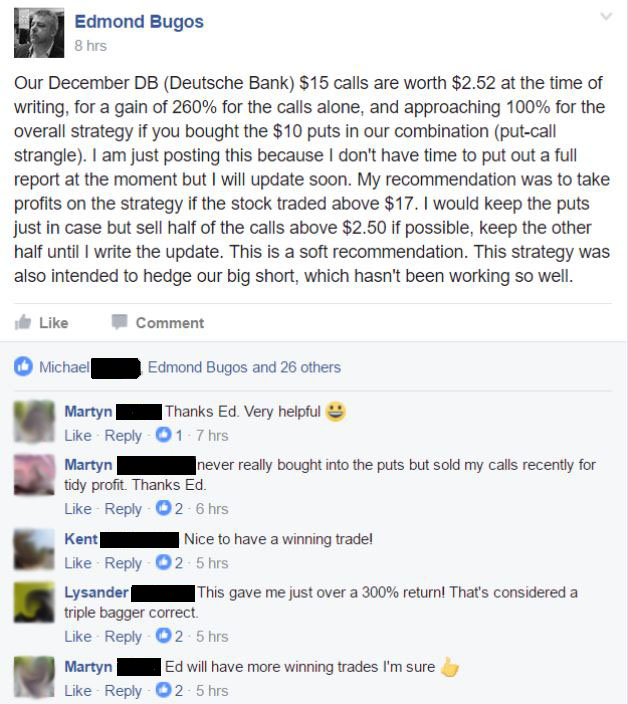

For instance, Deutsche Bank is in terrible shape, likely bankrupt as a matter of fact. But we’re also well aware that in this day and age, large institutions are basically exempt from market blowback, especially ones as large as DB.

Knowing this, we suggested subscribers buy both out of the money puts and calls on Deutsche bank.

The strategy cost $1.35 to put on: 65c + 70c for the puts and calls. So we’re up 200% on the strategy or almost 500% on the calls alone. We knew that DB could go to zero. But we also believed that one way or another, at least in the short-term, various kinds of bailouts were likely to be arranged. So we hedged our bets and won.

This is important to take note of.

Here, in our daily blog, we give our general overview of what we think is going on. But we give much more specific detail and strategy in the newsletter (subscribe here).

For example, while we said that the Shemitah and Jubilee time frames could see a major crash, and there were many, including the August 2015 crash, China and Brexit… we also told subscribers to use far out-of-the-money put options to play the crash because there is also a risk of continued central bank money printing which can push the stock market much higher (albeit lower in real terms).

Through this strategy, we made 4,500% in three days last August which many subscribers made fortunes on.

Throughout 2016, we warned that Jubilee Year could bring an immediate market break and numerous economic and military disasters. But we also pointed out that, as it was with Shemitah, much of what was taking place during Jubilee could be seen as laying the groundwork for further disasters.

In fact, these hedge funds managers are talking along exactly the same lines. What has been done via government monetary policy has not yet matured into a full disaster. But as they concur, the disaster is nearly here and what’s worse, is inevitable.

We’ve shaped our entire approach to markets and news analysis around our understanding that Western monetary policy is untenable. It’s allowed us to position ourselves in such a way as to turn potential losses into significant profits. Our subscriber base, as you can see, has been handsomely rewarded as well.

I anticipate that 2017 will be a good deal worse than 2016 – by an order of magnitude. There’s simply no way global trends can continue as they are now. Cash confiscation, negative interest rates and aggressive central bank monetary manipulation will take their toll and the results will be ruinous for most, but not for us and our subscribers.

We’ve built an entire library of books and reports to help prepare you for the inevitable. And, we regularly make big gains on trades along the way. And, we have an entire network of like-minded subscribers around the world who are happy to help you prepare.

These are not normal times. And CNBC and most financial advisors are not going to even have the slightest clue of how to help protect you or help you profit during these extreme times.

To protect yourself, take advantage of our free book offer, Getting Your Gold Out of Dodge, to help you to secure and internationalize your precious metals HERE.

Anarcho-Capitalist. Libertarian. Freedom fighter against mankind’s two biggest enemies, the State and the Central Banks. Jeff Berwick is the founder of The Dollar Vigilante, CEO of TDV Media & Services and host of the popular video podcast, Anarchast. Jeff is a prominent speaker at many of the world’s freedom, investment and gold conferences as well as regularly in the media.

© 2016 Copyright Jeff Berwick - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jeff Berwick Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.