Tech Breakthrough Could Make This The Biggest Winner Of OPEC’s Cut

Commodities / Oil Companies Dec 12, 2016 - 12:50 AM GMTBy: OilPrice_Com

As far as the markets are concerned, OPEC’s 32.5-million bpd output cut deal agreed to two weeks ago could go either way, and the uncertainty makes it anyone’s guess—but MCW Energy, the pioneer of breakthrough clean oil sands extraction in Utah, is not concerned:

As far as the markets are concerned, OPEC’s 32.5-million bpd output cut deal agreed to two weeks ago could go either way, and the uncertainty makes it anyone’s guess—but MCW Energy, the pioneer of breakthrough clean oil sands extraction in Utah, is not concerned:

If oil prices remain low, its production costs are dramatically reduced, and in any scenario, its breakthrough technology makes everything from Utah’s vast oil sands to the Permian Basin’s massive offerings easier to extract.

When you combine MCW’s immunity from oil price vulnerability with a Utah play that has an estimated 87 million barrels of proven reserves worth about $3.4 billion in today’s market, can produce at a market-defying $27/barrel and is the first technology to offer a clean, safe and efficient way to get oil sands out of the ground and pump more from the giant Permian Basin, you have a company poised for massive gains in the New Year.

For all those oil sands skeptics out there: This isn’t Canada, where production is presently prohibitively expensive, and oil sands are equated with toxic trailing ponds that make environmental issues a major hurdle.

This is Utah, and more precisely, it’s Asphalt Ridge, in the heart of the western Green River Formation, where MCW Energy has been cleaning Utah’s oil sands and selling it off since the beginning of this year, with plant capacity now being augmented to 500bbl/day. And it’s all being done with zero water and zero trailing ponds.

But there is an even bigger play going on behind the scenes here—beyond the revolutionary oil sands developments: MCW’s proprietary technologies can boost production and reserve values and unlock the potential of sizable assets, not only from their estimated 89 million barrels in Utah, but also from an estimated 168 million barrels they’ve recently scooped up in Texas’ prolific Permian Basin—just for starters. This is where top producers such as Anadarko Petroleum Corp. (NYSE:APC), Apache Corp. (NYSE:APA), BHP Billiton (NYSE:BHP) and Chevron Corp. (NYSE:CVX) are gathering in full force to tap America’s oldest and most prolific basin whose best days are still ahead of it.

Nor does it stop there: This proprietary technology can also be licensed out for potentially millions in sales because it not only improves the filtration of a pay zone, but it’s also poised to be the hottest new thing in global remediation—from Alberta’s trailing ponds and far beyond.

The ‘back of the envelope’ upside here is fantastic, and the future looks lucratively clean.

As MCW Energy (traded in the U.S. under MCWEF and in Canada under MCW.V) forges ahead, carving out a unique position and pioneering an entirely new oil sands future, paying only passive attention to illusory OPEC ups and downs, here are 6 reasons to keep a very close eye on this company right now:

1. Utah is Ground Zero for Clean Oil Sands

Canada might be a global oil sands behemoth, but extracting is a dirty process that’s given bitumen a dirty reputation. Utah is the venue that will rebrand oil sands, and MCW is the company that is making it happen with propriety technology.

And Utah has over 32 billion barrels of oil sands to be extracted in 8 major deposits. It also has fantastic infrastructure and a royalties set-up that makes great sense for operators. Now that it is possible to extract oil sands without harming the environment—or using up the state’s water supply—32 billion barrels of potential here is expected to generate some massive royalties.

2. A Billion-Barrel Play with Plenty of Upside

MCW Energy has two leases in the oil sands heartland of Utah—one at Asphalt Ridge and one at Temple Mountain.

The 1,128-acre Asphalt Ridge lease is estimated to hold 20 million barrels of bitumen, according to assessments by Chapman Petroleum. MCW Energy acquired this acreage in 2012, and built a 250-barrel/day plant onsite, which is now in the process of being augmented to handle twice that.

Then, just this year, MCW acquired the lease from nearby Temple Mountain Energy, adding another estimated 88 million barrels of bitumen to its portfolio, which Chapman values at $81 million. This is where it gets really big: This is the site of a future 2,500-barrel per day plant, for which the design is already nearing completion.

To recap, that’s 100+ million in bitumen in total. And it doesn’t stop there. MCW Energy is seeking more prime acreage in Asphalt Ridge—which is believed to hold some 1 billion barrels of recoverable oil.

3. Production Costs that Don’t Depend on OPEC

While traditional oil and gas companies are having a tough time coming up for air in the ongoing depressed oil price environment, MCW Energy is moving forward quickly precisely because low oil prices have given them a production boost.

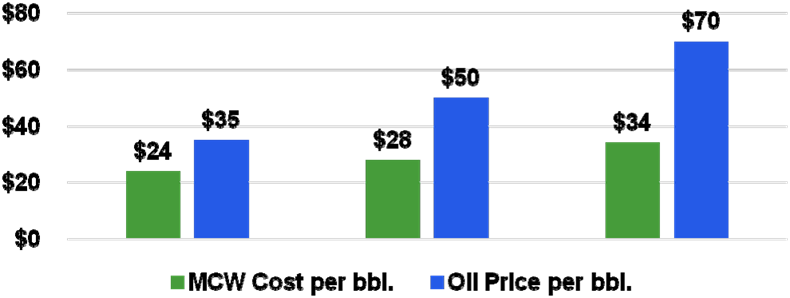

In 2015, MCW produced 10,000 barrels and sold some 6,000 barrels to the Utah market, with an average cost per barrel hovering between $31 and $33.

As MCW prepares to ramp up production to 500 barrels per day, it’s also seeking to further reduce production costs by moving its extraction plant to the newly acquired Temple Mountain site, which comes along with lower environmental and regulatory costs. Even more significantly, once it makes this move it will cut an estimated $7.60 per barrel off the transportation cost.

While it may sound like an expensive move—relocating an entire plant in a short time. In reality it’s not. The MCW plant is modular. It can be disassembled and re-assembled at the new location in a matter of 90 days. After that, it will be augmented to handle twice its original capacity and should be operational next Spring.

A 2,500-bpd plant could come in at per-barrel cost of around $27, according to a Nexant preliminary report. And costs could be reduced further. MCW estimates that a 2,500 bbl/day extraction unit will optimize production efficiencies with costs ranging from $20 to $24/barrel.

A recent study confirmed MCW’s processing costs are dramatically reduced in a low oil price atmosphere because the petroleum products they use in the extraction process are up to 55 percent cheaper.

The bottom line? The fluctuating production costs for MCW’s operations spell ongoing profit, and it doesn’t matter what rumors OPEC spreads. This is a ship not tied to OPEC’s shores.

4 Breakthrough Technology of Revolutionary Parameters

Over the past six years, the developers of MCW’s technology and plant facilities have spent over 210 man-years getting this just right. What they came up with is an environmentally responsible, ‘closed loop’, solvent-based, extraction technology that doesn’t use any water at all, and it doesn’t leave anything behind that isn’t clean. In this process, the only thing the leaves the MCW plant is oil for sale and clean sand to be returned to the ground.

No trailing ponds. No surface water or groundwater contamination. No greenhouse gas emissions.

How does it work? This is the short version:

- Oil sands ore is passed through MCW’s benign, patented extraction solvents

- The mixture of solvents and extracted oil and transferred to a separation column

- Oil is separated from the solvents, with 99 percent of the hydrocarbons extracted

- Cleaned sand is dried and reused or sold to the construction industry

That’s it—the rest is sales.

It’s great for the environment, not to mention the permitting process. It’s all a green light. MCW has been working in close cooperation with the environmental regulators and has already obtained all necessary permits at both of its lease sites.

5. Management are First-Class Pioneers

The dream team behind this company, which expects its annual revenue to grow to $100 million, represents an evolution in the energy patch.

The former Exxon Mobil president of Arabian Gulf operations—Dr. Gerard Bailey is MCW’s CEO. He thinks this is the hottest thing since fracking technology—and we are inclined to agree.

Bailey recognized a technology that nobody else had; he also was sure it’d make a huge splash on the global oil scene, and once the floodgates are opened, he’ll probably be right.

The 50-year international oil veteran is joined by MCW founder and chairman Aleksandr Blyumkin, who has more than 20 years of international oil and gas experience, particularly in Europe, and Dr. Vladimir Podlipskiy, MCW’s Chief Technology Officer, and a chemical scientist at the UCLA Department of Chemistry. The track records here explain both the breakthrough scientific technology and the aggressive moves on this niche market.

6. Smart, Fast Forward Movement

There’s been an impressive amount of forward movement with this company this year, and again—low oil prices have actually helped. While everyone else in this patch was struggling, MCW was acquiring, developing and building momentum.

In September, the company acquired control of Texas-based Accord GR Energy, which has two enhanced oil recovery (EOR) technologies that MCW is eyeing to increase recoverable resources at Temple Mountain. But the acquisition also gave them 88 drilled and completed wells on 7,000 acres in Texas. There is a documented 168 million barrels of oil in place at shallow depths of 250-300 feet here.

In the Permian Basin, MCW is changing the definition of ‘depleted’. The Permian Basin, the sleeping giant of the U.S. oil and gas patch, has hundreds of wells in the MCW play alone that old technology determined as nearly depleted, but MCW technology tells a different story: There’s a lot more oil in there, and this is where it gets really exciting. The company has already spent $1.5 million on its Phase 1 completion to demonstrate the commercial viability of even the most depleted of 200 drilled wells. Phase II will see MCW apply its proprietary technology to adjust the filtration properties of the pay zone and then recover the oil using a thermal baric process.

Now we’ve entered into the technology licensing phase, where MCW hits the global market. The company has tested oil sands and shale samples in China, Jordan, Indonesia and elsewhere in North America.

But there’s a secondary story unfolding here simultaneously, and the momentum has been building fast. The MCW technology has additional upside: It can be used for remediation, and the attraction is likewise global.

Not only does the MCW technology allow for the clean extraction of oil sands, but it can be used to clean up everyone else’s messes, such as Alberta’s trailing ponds, which cover 176 square kilometers (and counting). Licensing out its technology is the secondary income stream that adds to the already fundamentally attractive set-up here.

To this end, MCW has achieved another first: It has issued the rights to its technology to its first licensee, Canadian-based TS Energy Ltd., which can use the remediation technology in Canada and Trinidad & Tobago. MCW will also joint venture with Vivakor on several remediation projects.

There are a lot of ‘firsts’ here, and they are all historical, but the baseline is this: The company has—for the first time in global history—made the extraction of oil sands clean and not only economical, but profitable. Now they are breathing new life into the giant Permian Basin. They are hungry for acquisitions and have technology licensing and remediation to flesh out their offerings and add to their profits.

This is the break-out. Once the rest of the world catches on, it will already be too big.By James Burgess of Oilprice.com

Legal Disclaimer/Disclosure: This piece is an advertorial and has been paid for. This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. No information in this Report should be construed as individualized investment advice. A licensed financial advisor should be consulted prior to making any investment decision. We make no guarantee, representation or warranty and accept no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Oilprice.com only and are subject to change without notice. Oilprice.com assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.