2017 Will Be A Pivotal Year For Europe

Politics / European Union Dec 12, 2016 - 05:00 PM GMTBy: John_Mauldin

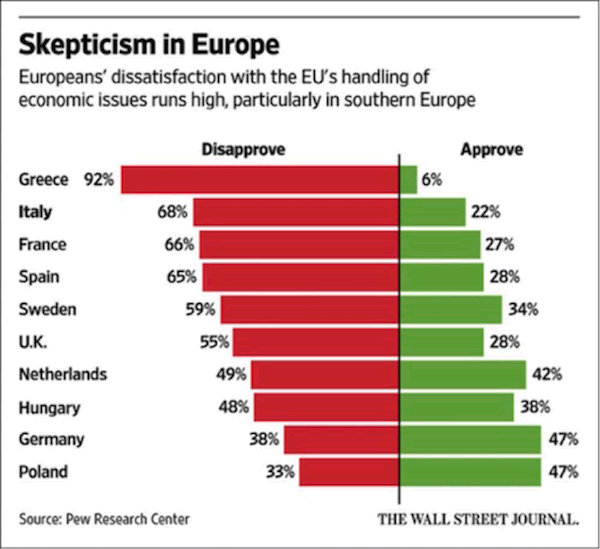

Many people in the EU disapprove of EU economic policies. Greece is by far the unhappiest with Brussels. Italy is next, with France and Spain not far behind. The UK, where people are angry enough to have voted themselves out of the EU, looks even-tempered in comparison.

That suggests to me that if you offered these other countries a chance to ditch the EU and reassured them that they wouldn’t cause the sky to fall, there are some who might take the leap.

Europe is likely to change drastically in 2017

It will be safe to say that 2017 will be a pivotal year for Europe. The UK will keep moving along the Brexit path; Marine Le Pen will have a real shot at taking power in France; and Italy's government could fall into Five Star's control.

Angela Merkel will be up for re-election in Germany and will likely win, but she could be forced into concessions we haven’t seen her make in the past.

As all this is going on, Europe will be glancing nervously both east and west. To the east, Vladimir Putin will be looking for ways to stay in power as energy prices remain soft. To the west, President Trump will be pushing NATO members to boost defense spending—unless they want the US to fold up its umbrella.

Most of those countries have zero room in their budgets for defense if they want to maintain spending levels on social welfare programs. Italy spends less than 1% on defense, and many other countries spend much less. Germany spends only a bit over 1%. (Just for the record, Canada is a member of NATO, and it spends exactly 1%.)

NATO membership only partially overlaps with the EU. One big difference: Turkey is a key NATO ally but only a wannabe EU member. That’s going to mean some delicate negotiations between Ankara, Brussels, and other European capitals.

The investment consequences of all this are very much up in the air. The worst-case scenario is a Eurozone breakup and the collapse of the EU free-trade area. Or both could shrink as Italy and perhaps others leave.

Borders are back in style

The conclusion I keep coming back to is this: Borders are back in style. I think we may look back and see 2016 as the year in which those trends reversed. Nations are again raising border defenses against both immigrants and trade.

Tearing down the borders took decades, of course. They won’t all go back up right away. Some borders will be more open than others. Nonetheless, I think we are in the early stages of the formation of a different world power structure. How it differs will make a difference to your investments.

Get a Bird’s-Eye View of the Economy with John Mauldin’s Thoughts from the Frontline

This wildly popular newsletter by celebrated economic commentator, John Mauldin, is a must-read for informed investors who want to go beyond the mainstream media hype and find out about the trends and traps to watch out for. Join hundreds of thousands of fans worldwide, as John uncovers macroeconomic truths in Thoughts from the Frontline. Get it free in your inbox every Monday.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.