How to Get a Firm Handle on Gold's Ups and Downs

Commodities / Gold and Silver 2016 Dec 21, 2016 - 07:28 AM GMTBy: EWI

Watch the yellow metal's price pattern to anticipate key junctures

Watch the yellow metal's price pattern to anticipate key junctures

By Elliott Wave International

[Editor's Note: The text version of the story is below.]

*********

Hardly anyone likes gold today.

In the closing days of November, the Daily Sentiment Index (trade-futures.com) registered a ten-day average of just 9.1% gold bulls. That was only the third time in the sentiment gauge's 30-year history that such a low bullish reading was recorded.

This headlines captures the negativity toward gold (gold-eagle.com, Nov. 16):

Gold Price Forecast: Bearish Pattern Calls for Caution

But, as we've shown on these pages again and again, financial markets often have a way of turning up just when pessimism becomes the most extreme.

Indeed, this happened with gold a year ago. Last December, large speculators such as hedge funds were so unenthusiastic about gold's bullish prospects that they held their smallest net-long position in 12½ years.

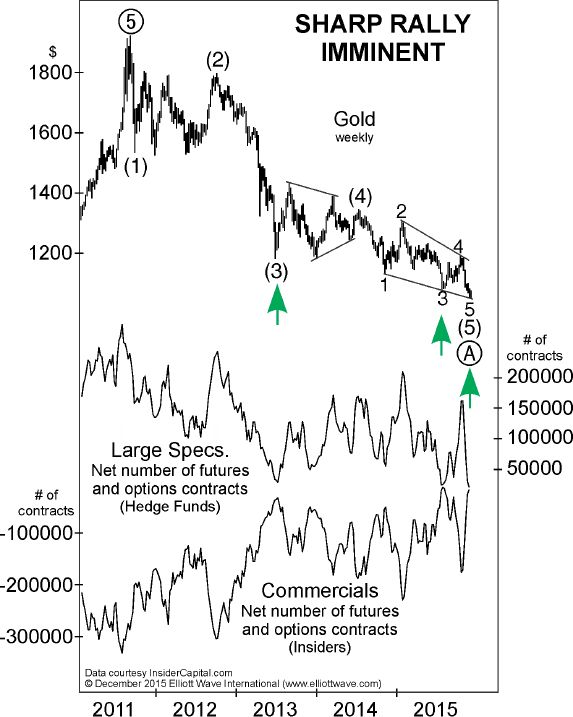

Let's go back to our December 2015 Elliott Wave Financial Forecast, which showed this chart and said:

Gold prices are in the late stages of an ending diagonal, which, when complete, will finish a five-wave decline from the September 2011 peak at $1921.50. ... Over the past week pessimism has grown more intense, which is consistent with an impending rally, the same message conveyed by the completion of a diagonal pattern.

That forecast was published within hours of gold's Dec. 3, 2015 low of $1046.20! In July, the price of the yellow metal rose to $1375.53, a 31% rally.

By then, sentiment had turned decidedly bullish. Here are a couple of headlines:

- [Legendary Investor] Warns "Gold Will Go Higher Than Most People Can Imagine" (Zerohedge, June 27, 2016)

- Why is the gold price rising? Five forces driving the precious metal (July 15, The Telegraph)

Here are the five reasons listed by The Telegraph for gold's rise:

- The Brexit effect

- Interest Rates

- U.S. Dollar

- Eurozone crisis

- China's demand

That's a perfect example of hindsight being 20/20. When gold was approaching a bottom last December, no one saw the upcoming Brexit vote or other fundamentals as bullish factors. After the rally, the reason for it appeared "obvious." This is why basing investment decisions on such "fundamentals" often results in disappointment.

We take a different approach. We watch price patterns, which warn us of trend changes before they occur. This is from our July Financial Forecast, which said this about gold's 6-month long rally:

[The current wave up] has now satisfied its minimum expectations.

From the July high through Dec. 1, gold's price declined 15%.

The Wave Principle is not a crystal ball. Yet, when you watch price patterns and sentiment extremes -- the true leading trend indicators -- you can often spot gold's key junctures well before other investors read about it in the news.

In fact, we believe gold may be at such a juncture right now.

Get an Introduction to the Wave Principle AppliedLearn how to apply the Elliott Wave Principle to your favorite markets. In this free 15-minute video, EWI Senior Analyst Jeffrey Kennedy explains how to take the Wave Principle and turn it into a trading methodology. You'll learn the best waves to trade, where to set your protective stop, how to determine target levels, and more. |

This article was syndicated by Elliott Wave International and was originally published under the headline How to Get a Firm Handle on Gold's Ups and Downs. EWI is the world's largest market forecasting firm. Its staff of full-time analysts led by Chartered Market Technician Robert Prechter provides 24-hour-a-day market analysis to institutional and private investors around the world.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.