Gold As A Percentage Of Global Financial Assets

Commodities / Gold and Silver 2016 Dec 25, 2016 - 05:34 AM GMTBy: I_M_Vronsky

In 2014 Total Global Assets Topped $105 TRILLION (i.e more than $105,000,000,000,000)

In 2014 Total Global Assets Topped $105 TRILLION (i.e more than $105,000,000,000,000)

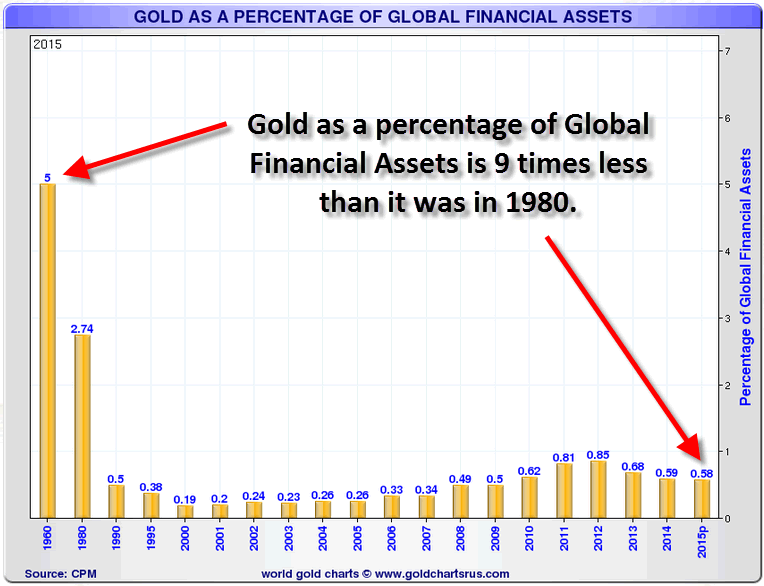

An astronomical amount by any standards. Interestingly, only a small fraction of this monumental amount has been allocated to gold investments. Here below is the record of gold investments since 1980. To be sure a brief history of gold investment demand will indubitably put our analysis into sharp perspective.

In the late 1970s the price of gold soared to the then all-time high of $800/oz…fueled by runaway inflation of that period that propelled gold investments skyward.

(Source: Moore Research Center, Inc)

The price of gold soared from about $160 in 1976 to a little over $800 in early 1980. It is imperative to note that in 1980, gold investments as a percentage of Total Global Financial Assets had reached 5.0%. Hoverer, gold investment demand then began to wane for many of the following years until the new century began in 2000…when the price of gold finally bottomed. In that year gold investments as a percentage of Global Financial Assets had also bottomed at 0.19%.

(Chart Source: SRSrocco Report: https://srsroccoreport.com )

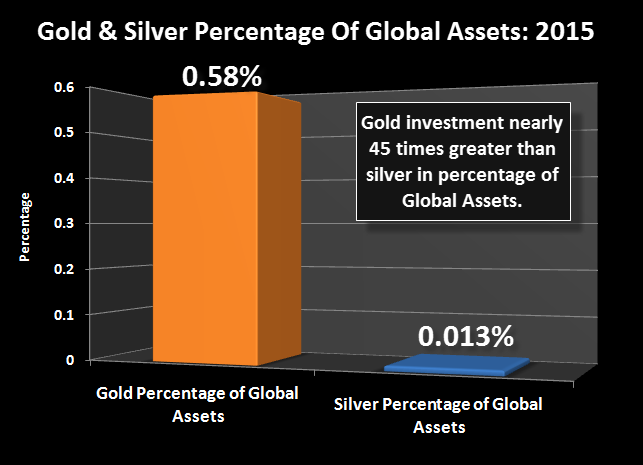

By 2001 gold investments as a percentage of Global Financial Assets began a slow methodical climb until the 2011-2012 period…when gold again make an all-time peak at over $1,900. Understandably, the price of gold then slowly began to decline in concert with the diminishing gold investments as a percentage of Global Financial Assets (which dropped from 0.85% to last year’s 0.58%. Think about it: Gold investment as a percentage of Global Financial Assets were nearly 9 Times greater in 1980 than it is today. To be sure the implications and ramifications of the above are mine-boggling. Here is another chart focus on how minuscule recent gold investment is as a percentage of Global Financial Assets:

(Chart Source: SRSrocco Report: https://srsroccoreport.com )

Gold Forecast: In the event gold investments as a percentage of Global Financial Assets again rises to 5.0%, it means 0.05 X 105,000,000,000,000 = $5.25 Trillion ($5.250,000,000,000) will flood into gold. This begs the question: What might be the impact of a tsunami of increased gold investments hitting world markets?

Here Are The Estimating Rationale

- Total global gold production is estimated at about 3,000 tonnes.

- 3,000 tonnes is equivalent to 96,450,000 troy ounces (as there are 32,150 oz/tonne)

- Value of one year’s global gold production at $1,150/oz is about $110 Billion

Consequently, in the event gold investments as a percentage of Global Financial Assets again increases from 0.58% to 5.0%, the demand might explode exponentially to $5,250,000,000,000 ($5.25 Trillion). For this reason this analyst does not dare try to predict how high the gold price will be turbocharged as a result...when this happens. 2017 looks to be a Golden Year for precious metals investors.

(Source: http://www.gold-eagle.com/article/making-case-12000-gold-and-360-silver)

By I. M. Vronsky

Editor & Partner - Gold-Eagle

www.gold-eagle.com

Founder of GOLD-EAGLE in January 1997. Vronsky has over 40 years’ experience in the international investment world, having cut his financial teeth in Wall Street as a Financial Analyst with White Weld. He believes gold and silver will soon be recognized as legal tender in all 50 US states (Utah and Arizona having already passed laws to that effect). Vronsky speaks three languages with indifference: English, Spanish and Brazilian Portuguese. His education includes university degrees in Engineering, Liberal Arts and an MBA in International Business Administration – qualifying as Phi Beta Kappa for high scholastic achievement in all three.

© 2016 Copyright I. M. Vronsky - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.