These Commodity Markets Resource Sectors Will Soar in 2017

Commodities / Resources Investing Dec 29, 2016 - 07:11 PM GMTBy: The_Gold_Report

A perfectly timed opportunity and a deep-value contrarian speculation are setting up in the resource sector, says Lior Gantz, editor of Wealth Research Group.

A perfectly timed opportunity and a deep-value contrarian speculation are setting up in the resource sector, says Lior Gantz, editor of Wealth Research Group.

There's no doubt that zinc is currently the most attractive base metal investment out there—it's almost a fairytale story. In fact, it will present the biggest opportunity in 2017.

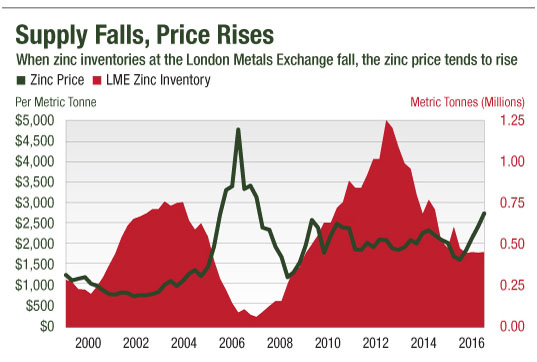

The natural resource sector is based on the most fundamental economic equation, supply and demand, and zinc is following a classic pattern that is truly the quintessential formation of a once-in-a-generation bull market.

As resource legends begin to launch new companies in this industry, the window of opportunity will be opened for a few short months, and Wealth Research Group plans to help members capitalize.

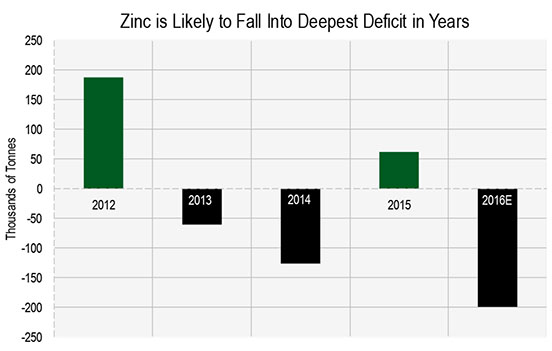

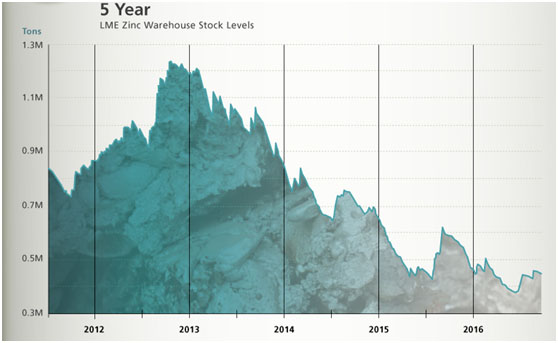

As seen in the chart, 2016 is proving to be a year in which we will see a severe supply deficit, and it will carry on into 2017.

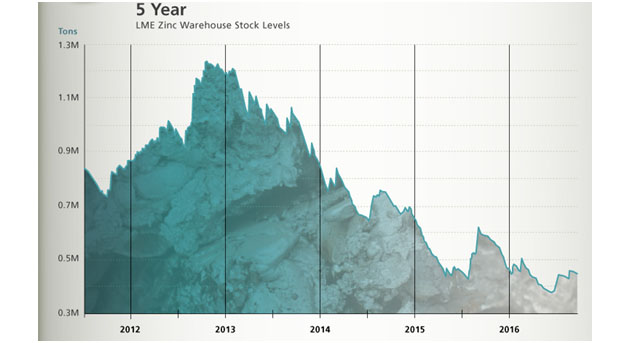

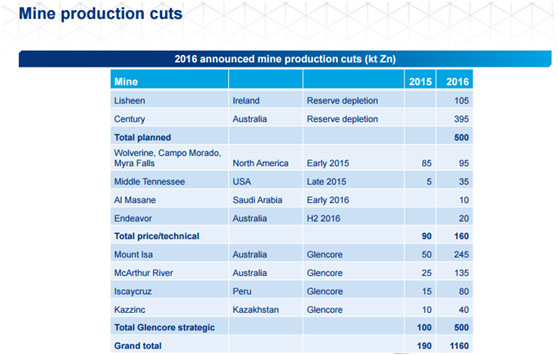

In 2016, zinc is the top-performing metal, and the reason is simple: stockpiles are ultra-low and two major mines have shut down.

China is the biggest driver of demand for zinc. It consumes close to 50% of the world's supply. The astounding mega-projects coming include bridges that will connect hundreds of millions of people, the cities that will house 20M–50 million citizens, and the train system that aims to connect to Turkey—these require an unbelievable amount of zinc.

About 50% of all zinc is processed and applied as a coating to iron and steel to prevent rust.

The problem is that between 2008 and 2015, the bleak outlook for the global economy made zinc prices very cheap, and supply disappeared.

Zinc recently bottomed out at $0.66 per pound in December 2015, and it has rallied since then.

Here's the key to understanding resource bull markets: current exploration funding and near-term new producers. That's how an investor can gaze into the supply and demand dynamics going forward. Right now, I can tell you that they’re virtually nonexistent!

Only a handful of projects will come on-line in the next few years, and none of them will make a material difference.

In my personal portfolio, I will certainly own a core position of zinc.

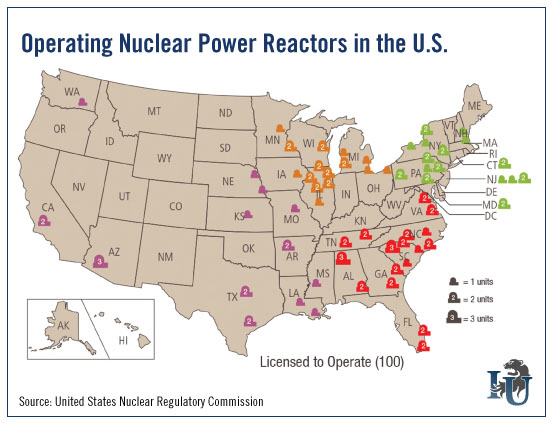

We aren't just focusing on zinc—our team is conducting comprehensive research into uranium at the moment.

Mark my words: the uranium price has become so low that the downside risk is close to zero. Now, the best plan of action is to create a watch list of the best companies and wait for the ideal moment.

Again, the focus is China, which understands that its energy independence is entirely a question of uranium. The superpower can't afford to be dependent on foreign oil, and so it is building new power plants fueled by uranium. And in the U.S., it seems very likely that Donald Trump as president means good news for uranium investors.

Take the time to learn about the world of uranium and its main players and characteristics today with the exclusive report our team has put together, because no one is covering this, and that's why I am genuinely confident that the bottom is close.

Some of the best opportunities will occur in takeovers, where small-caps will be bought at a large premium by the majors.

Ultra-low interest rates have made retirement virtually impossible, and so the strategies needed for a comfortable retirement must include high-yield stocks (like 8.6%) and an allocation into high-potential niches that can make a real difference to your portfolio.

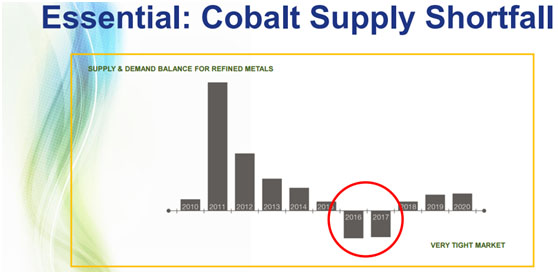

The two that we have spotted are futuristic industries and the cobalt emerging mining world.

This is one metal I am extremely bullish about, since there are so few companies actively looking for it.

Cobalt is one of the metals of the future, and it will be a strategic resource for those who own it.

This is an industry that Wealth Research Group is spending a lot of time investigating and examining.

With companies like Elon Musk's Tesla planning to gobble up most of the world's supply of lithium, for example, and with Asia's super-large appetite for modern living, cobalt and lithium will offer a phenomenal opportunity with Steroid Stocks.

2017 is shaping up to be a year full of opportunities, and investors should make sure to always keep in mind that we are living in a time of corrupt banking systems and a proper allocation into precious metals is a must.

Lior Gantz, an editor of Wealth Research Group, has built and runs numerous successful businesses and has traveled to over 30 countries in the past decade in pursuit of thrills and opportunities, gaining valuable knowledge and experience. He is an advocate of meticulous risk management, balanced asset allocation and proper position sizing. As a deep-value investor, Gantz loves researching businesses that are off the radar and completely unknown to most financial publications.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosures:

1) Statements and opinions expressed are the opinions of Lior Gantz and not of Streetwise Reports or its officers. Lior Gantz is wholly responsible for the validity of the statements. Streetwise Reports was not involved in the content preparation. Lior Gantz was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

Charts courtesy of Wealth Research Group

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.