Biased 2017 Forecasts - Debt, Housing and Stock Market (1/2)

Stock-Markets / Financial Markets 2017 Jan 01, 2017 - 03:01 PM GMTBy: James_Quinn

A couple weeks ago I was lucky enough to see a live one hour interview with Michael Lewis at the Annenberg Center about his new book The Undoing Project. Everyone attending the lecture received a complimentary copy of the book. Being a huge fan of Lewis after reading Liar’s Poker, Boomerang, The Big Short, Flash Boys, and Moneyball, I was interested to hear about his new project. This was a completely new direction from his financial crisis books. I wasn’t sure whether it would keep my interest, but the story of Daniel Kahneman and Amos Tversky and their research into the psychology of judgement and decision making, creating a cognitive basis for common human errors that arise from heuristics and biases, was an eye opener.

A couple weeks ago I was lucky enough to see a live one hour interview with Michael Lewis at the Annenberg Center about his new book The Undoing Project. Everyone attending the lecture received a complimentary copy of the book. Being a huge fan of Lewis after reading Liar’s Poker, Boomerang, The Big Short, Flash Boys, and Moneyball, I was interested to hear about his new project. This was a completely new direction from his financial crisis books. I wasn’t sure whether it would keep my interest, but the story of Daniel Kahneman and Amos Tversky and their research into the psychology of judgement and decision making, creating a cognitive basis for common human errors that arise from heuristics and biases, was an eye opener.

In psychology, heuristics are simple, efficient rules which people often use to form judgments and make decisions. They are mental shortcuts that usually involve focusing on one aspect of a complex problem and ignoring others. These rules work well under most circumstances, but they can lead to systematic deviations from logic, probability or rational choice theory. The resulting errors are called “cognitive biases” and many different types have been documented.

Heuristics usually govern automatic, intuitive judgments but can also be used as deliberate mental strategies when working from limited information. Kahneman and Tversky created the heuristics and biases research program, which studies how people make real-world judgments and the conditions under which those judgments are unreliable. Their research challenged the idea that human beings are rational actors, but provided a theory of information processing to explain how people make estimates or choices. Kahneman won a Nobel Prize in economics for his work in behavioral economics.

To put their research into terms the common person can understand, human decision making is extremely flawed due to our biases, feelings, irrational thought processes and beliefs in falsehoods. It’s over-confidence in our decision making ability that causes us the most problems. For the average person this can result in financial hardship, frustration or a premature death.

When high level government officials, bankers or corporate executives make flawed decisions due to their biases, it can mean war, financial disasters, depressions, or disastrous legislation like Obamacare. Hubris, egotism and faulty reasoning, as noted by Mark Twain one hundred and fifty years ago, can kill you and in some cases lead to war and unthinkable levels of death and destruction.

“It’s not what you don’t know that kills you, it’s what you know for sure that ain’t true.” – Mark Twain

In the seven weeks since the election of Donald Trump as our next president, I’ve witnessed the largest case of hindsight bias in world history. Hindsight bias, also known as the knew-it-all-along effect or creeping determinism, is the inclination, after an event has occurred, to see the event as having been predictable, despite there having been little or no objective basis for predicting it.

On November 7 the “expert” pollsters like Nate Silver; every corporate mainstream media network, newspaper, and website; along with elitist economists, professors, Hollywood movie stars, Wall Street bankers, and billionaire oligarchs; were 100% sure Hillary Clinton was going to be elected president. Only the deplorables thought otherwise – and they spoke loudly. Putin had nothing to do with the result.

These very same “experts” and “deep thinkers” now act as if Trump’s election was foreseeable, predictable and the likely outcome. They bloviate about how and why he won as if they knew it was going to happen. When 99% of all establishment “experts” were sure Trump was going to be crushed in a Clinton landslide, why should anyone listen to a word they say?

The same people who didn’t see even the faintest possibility of a Trump victory now expect the ignorant masses to believe their analysis of what will happen next. I would like to attribute their obtuseness to cognitive biases, but I believe it is more insidious. The Deep State propaganda machine is hard at work spreading falsehoods.

“A reliable way to make people believe in falsehoods is frequent repetition, because familiarity is not easily distinguished from truth. Authoritarian institutions and marketers have always known this fact.” – Daniel Kahneman, Thinking, Fast and Slow

The onslaught of 2017 predictions from a myriad of Wall Street “experts” talking their book, highly educated economists demonstrating their lack of prescience, mainstream media pundits peddling propaganda and cheerleaders cheering for their home teams, has already begun. I haven’t written an annual forecast article in a few years because I was tired of being wrong. Since I have no newsletters or books to sell, no investments to peddle, and no agenda to push, an annual forecast will just be my best guess at what will happen in 2017.

The two biases most likely to color my analysis are confirmation bias (The tendency to focus on information in a way that confirms my preconceptions) and pessimism bias (The tendency to overestimate the likelihood of negative things happening). My family and friends think I’m a pessimist. I think I’m a realist. I try to use data to back-up my conclusions, but as George Dvorsky points out, our brains often lead us astray.

“The human brain is capable of 1016 processes per second, which makes it far more powerful than any computer currently in existence. But that doesn’t mean our brains don’t have major limitations. The lowly calculator can do math thousands of times better than we can, and our memories are often less than useless — plus, we’re subject to cognitive biases, those annoying glitches in our thinking that cause us to make questionable decisions and reach erroneous conclusions.” – George Dvorsky

My predictions will be framed by my belief we are midway through a Fourth Turning era of crisis. The three catalysts framing this Fourth Turning are debt, civic decay, and global disorder. No amount of normalcy bias, optimism bias, over-confidence, or desire for the status quo, will take precedence over the uncontrollable mechanisms propelling this Fourth Turning.

We are in the midst of a once in a lifetime crisis and there is only one thing more frightening than not knowing what is coming next, and that is living in a world run by “experts” who think they know exactly what is going to happen next. These are the same “experts” who didn’t see the 2005 housing bubble, the 2008 financial collapse, the EU implosion, Brexit, or the Trump presidency.

“It’s frightening to think that you might not know something, but more frightening to think that, by and large, the world is run by people who have faith that they know exactly what is going on.” – Amos Tversky

I try to understand the world around me every day, but the hyper-complexity, noise, Deep State propaganda, and volume of data points is overwhelming to our easily distracted brains. I have constructed a story in my mind of how things will develop over the next five to ten years based upon the generational theory put forth by Strauss & Howe in their book The Fourth Turning. It is not a story with a happy ending.

I don’t have high confidence that I understand how it will play out and what specific events will propel history in the making. I can admit my deficiencies, while people in power with the ability to blow up the world overestimate their understanding of the world and ignore the role of chance in events.

“We are prone to overestimate how much we understand about the world and to underestimate the role of chance in events.” – Daniel Kahneman, Thinking, Fast and Slow

Knowing what I don’t know about the unknowns, I’ll try and use what I do know to make some prognostications about 2017:

Debt Forecast

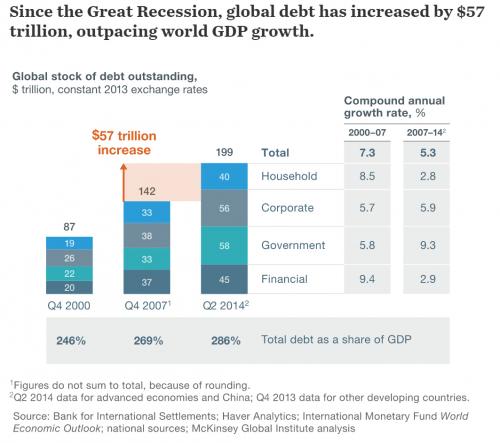

It is fascinating to me no one seems all that worried about the systematically dangerous levels of global debt supporting essentially bankrupt governments, banks and consumers. Global debt stood at $142 trillion at the end of 2007, just prior to a worldwide financial meltdown, caused by too much bad debt in the financial system.

To “fix” this problem, central bankers around the globe ramped up their electronic printing presses to hyper-drive and created another $57 trillion of debt by mid-2014. They haven’t taken their foot off the gas since. Today, global debt most certainly exceeds $225 trillion and has surpassed 300% of global GDP. Rogoff and Reinhart made a pretty strong case that when debt to GDP exceeds 90%, disaster will follow.

Global debt issuance reached a record $6.6 trillion in 2016, with corporations accounting for $3.6 trillion – most of which was used to buy back their stock at all-time highs. What could possibly go wrong? The level of normalcy bias amongst financial “experts”, the intelligentsia, and the common man is breathtaking to behold. We are in the midst of the mother of all bubbles, never witnessed in the history of mankind, and we pretend everything is normal, with no consequences for our reckless disregard for honesty, rational thinking, or simple math.

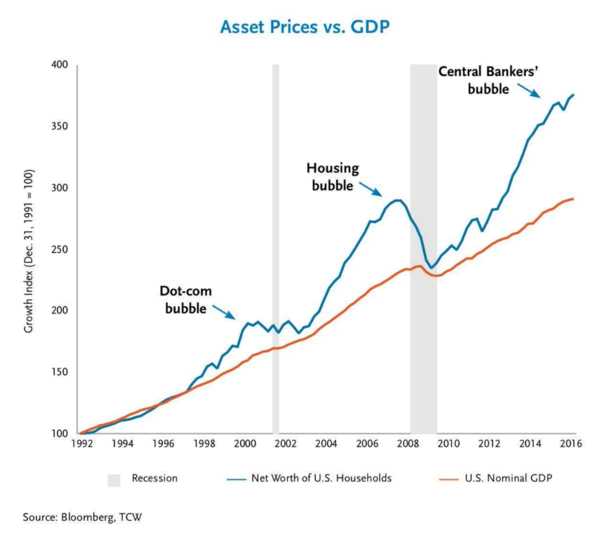

The 2000 dot.com bubble and the 2008 housing bubble were one dimensional. This mother of all bubbles required the global coordination and unprecedented irresponsible intervention of the US Federal Reserve, the European Central Bank (ECB), the Bank of Japan (BOJ), the Bank of England (BOE) and the Swiss National Bank (SNB) to lead the world to the brink of monetary disaster. The highly educated theorists running these central banks have created tens of trillions in unpayable debt while suppressing interest rates to zero or below at the behest of their Deep State masters.

The result is simultaneous bubbles in stocks, bonds and real estate. The pin destined to pop all the bubbles is slightly higher interest rates. The 1% increase in the 10 Year Treasury is already causing havoc in the housing market, the bond market and is hammering pension funds. With the hundreds of trillions in globally interconnected derivatives primed to detonate, 2017 could be an explosive year.

Here are a few things I think could happen in 2017 on the economic front:

- The national debt stands at $19.9 trillion and will reach $20 trillion before Obama departs. With spending on automatic pilot and tax revenue in decline, the national debt will reach $21 trillion in 2017. With most of the debt financed short-term, the increase in rates will ratchet the interest on the debt from $433 billion to over $550 billion.

- With the CPI increasing by over 3% in the first few months of the year, the Fed will continue to raise rates, and the 10 Year Treasury will breach the 3% level.

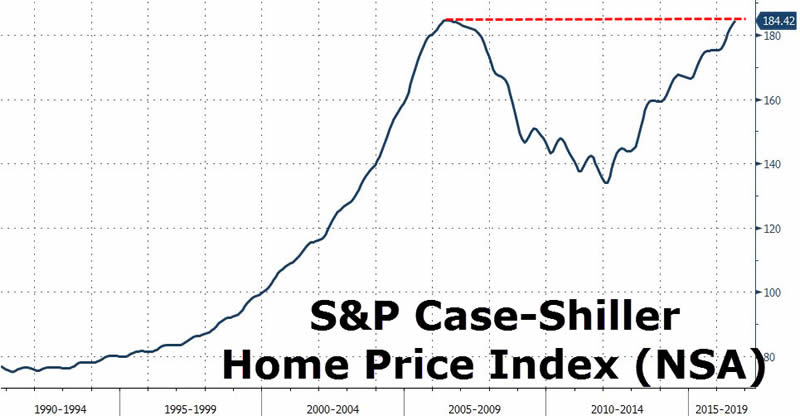

- Home prices have surpassed the 2006 peak, even though existing home sales are still 20% below 2006 levels and housing starts are 50% below 2006 levels. The entire “recovery” has been engineered by the Fed and Wall Street at the high end of the market. With mortgage rates up 1% already, the further increase will result in existing home sales and housing starts falling by 20% in 2017 and home prices falling by 5% to 10%.

- The short-term OPEC agreement will allow oil prices to move back to $60 per barrel, further eating into consumer discretionary spending. Desperate fracking companies needing cash flow to service their debt will ramp up. Bankrupt or near bankrupt countries like Venezuela, Mexico, and Iran will also increase production. With a slowing global economy and surging supply, prices will collapse again into the $40s in the second half of the year.

- Holiday sales for the bricks and mortar retailers will be reported in January as lukewarm at best. By February, the store closing announcements will reach into the hundreds. Sears will finally declare bankruptcy and shutter at least 50% of their stores. Mall developers will begin to declare bankruptcy as vacancies and rising interest rates create a perfect storm.

- Consumer debt will reach the previous high of $1 trillion, as subprime student loan and auto debt continues to accumulate at an astounding pace. The spigot for student loans is likely to be tightened under Trump, with over 25% of the loans effectively in default. Auto sales (if you can call six year financing and 40% leases, sales) peaked in 2016. Millions of auto buyers are underwater on their loans, subprime auto loans are going into default quicker than you can say Cadillac Escalade, and higher interest rates will price out more potential suckers.

- The faux jobs recovery is running out of steam. With non-existent wage growth, surging costs for rent, health care, energy, and credit cards tapped out, American families will hunker down and reduce spending further. With consumer spending accounting for 68% of GDP, this will lead to an official recession by the middle of 2017.

- All the recent surveys showing consumer confidence soaring and optimism for 2017 are based on nothing but hope. The promises of a Trump administration will not come to fruition until 2018 at the earliest. He will meet resistance from Democrats across the board and resistance amongst his own party. His grand plans for massive tax cuts and spending increases will run into the reality of $1 trillion annual deficits. As reality sets in, and recession arrives, the unwarranted optimism will fade rapidly. Tax cuts will be tempered by reduced spending plans.

- The USD hitting fourteen year highs against the basket of worldwide currencies does not bode well for bringing manufacturing jobs back to make America great again. The reason for the strong dollar is because we are the best looking horse in the glue factory. With Europe and Japan promoting negative interest rates and the Fed slowly raising rates, the dollar will continue to rise. This will hurt our manufacturing businesses, increase our $500 billion annual trade deficit further, and depress the profits of our global corporations.

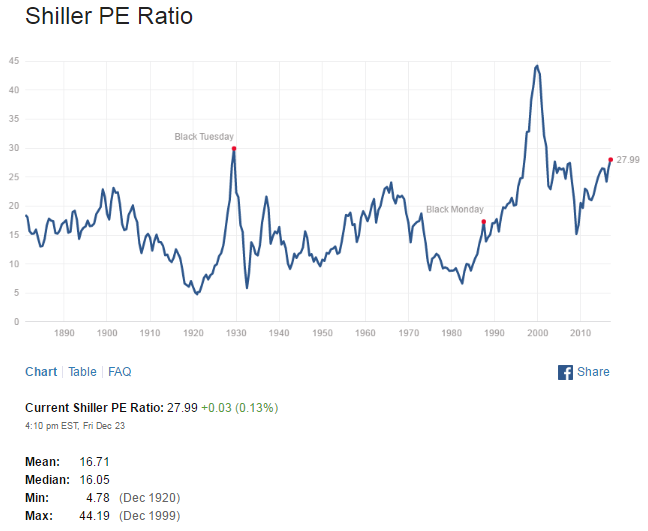

- With rising inflation, rising interest rates, stagnant wages, falling corporate profits, stock valuations at all-time highs, and corporations no longer able to finance stock buy backs at no cost, the stock market will finally hit the wall after a seven year bull market. This last surge of euphoria, based on nothing but Trumpmania sweeping Wall Street, will constitute the final blow-off. The market is currently valued to provide nominal returns of less than 1% over the next twelve years and is likely to experience an abrupt sell-off of 50% in the near future. I believe the near future will be 2017. I think the powers that be will be testing Trump’s mettle in his first year to see if he’ll play ball and do their bidding.

“The illusion that we understand the past fosters overconfidence in our ability to predict the future.” – Daniel Kahneman, Thinking, Fast and Slow

In Part Two of this article I will ponder how much further our civic decay and global disorder will advance in 2017. Over-confidence, hubris and arrogance of our leaders will be the driving factors.

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2016 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.