Silver Prices and the Russian Connection

Commodities / Gold and Silver 2017 Jan 03, 2017 - 01:21 AM GMTBy: DeviantInvestor

Silver prices nearly reached $50.00 in April of 2011. They crashed to a low under $14 in December of 2015 and currently (December 2016) sit at about $16.

Silver prices nearly reached $50.00 in April of 2011. They crashed to a low under $14 in December of 2015 and currently (December 2016) sit at about $16.

Silver prices, in our increasingly unreal debt based fiat currency world, streak higher and subsequently crash to unbelievable lows.

Option One: Silver prices are near the end of their correction and will rally substantially higher. Why? Exponential increases in debt and total currency in circulation lift the prices for nearly everything, including college tuition, cigarettes, the S&P, housing, health care, silver and gold. We have heard this before and we see the consequences of using our “fake money” every day.

Option Two: Silver prices reached a generational high in 2011 and will collapse even further in coming years. Why? Supposedly the crushing deflation will rule the world for several years and prices for stocks, bonds, real estate, gold and silver will crash to unbelievable lows. We have heard this before. Some prices will probably crash, but silver and gold should rise because they are real money and independent of (surging) counter-party risk.

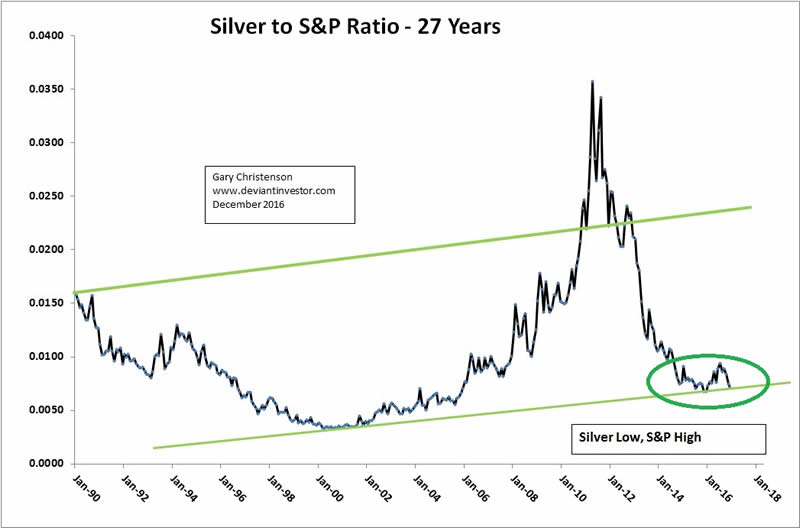

The Silver to S&P 500 Ratio: This ratio shows the relative valuation of silver compared to stocks in the U.S. See the chart below for the ratio since 1990.

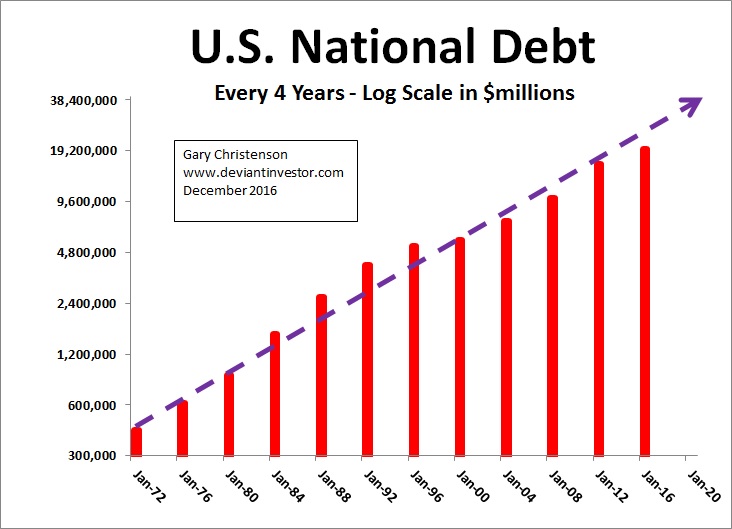

Silver is currently too low compared to the S&P 500 Index. We live in an exponential world – exponentially increasing debt, banker profits, silver prices, monetary nonsense and more. Examine the increase in U.S. national debt and the – more or less – parallel increase in silver prices – both on log scales.

Silver prices increase exponentially along with debt, currency in circulation, and consumer prices. However, if the world had cast aside economic delusions and returned to a world without central banks, fiat money, fractional reserve lending, unpayable debts … but I digress.

Assume that debt will continue to increase (it will as long as politicians and the Fed are “on the job”) and that the last 17 years of silver prices tell the story…

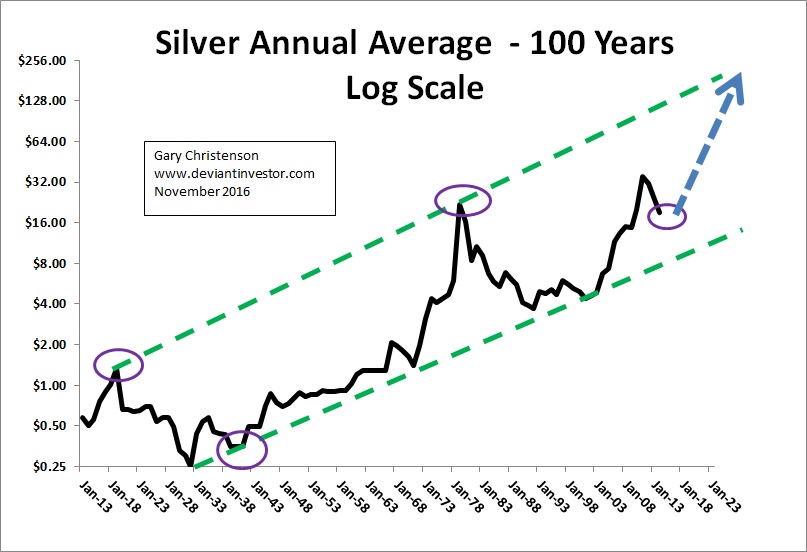

This chart uses a log scale and shows exponentially increasing prices. A green line connects highs since 2001 and another green line connects lows since 2001. The purple line is the geometric mean between the high and low boundary lines.

Prices are propelled higher above the purple line and then crash lower. Assume the purple line is an equilibrium line which suggests we will see the next multi-year move surge above the purple line.

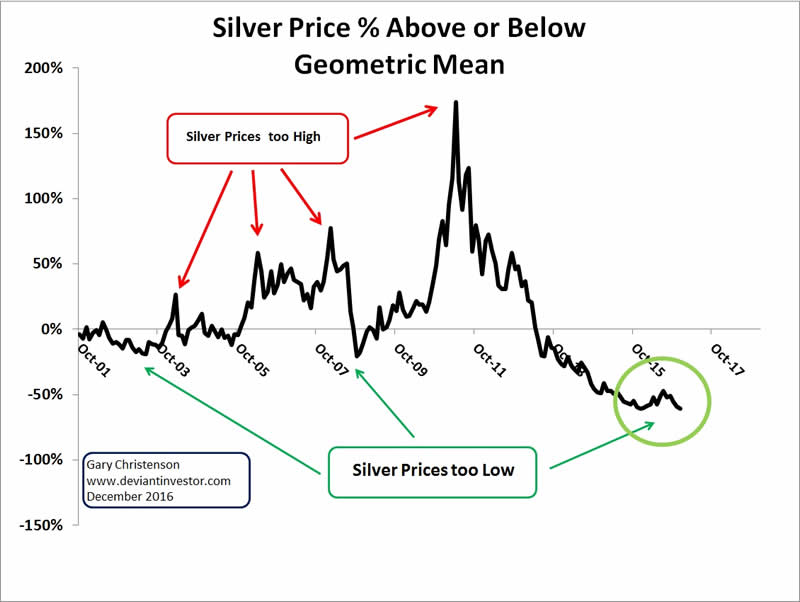

Examine the deviation of the monthly price of silver as a percentage above or below the purple equilibrium line. Silver prices oscillate around the equilibrium line of zero on the following chart.

Silver is far below the equilibrium line and too low compared to its own exponential price history as well as compared to the S&P. The next major move should be UP!

WHY?

Ted Butler: (Subscription service and here.)

“The big theme, as I see it, is JPMorgan becoming more aggressive in acquiring physical silver and gold while at the same time reducing its COMEX short position in each almost as aggressively. It’s hard to imagine a more bullish backdrop for futures prices.”

Bill Holter: (Subscription service)

“I believe deflation will destroy financial assets and not stop until fiat currencies (including and specifically the dollar) themselves are destroyed. The coming credit event will wipe out currencies … and what is the result of grossly lower or worthless currencies? Hyperinflation.”

Currencies are created by increasing debt and are backed by nothing but hope, faith and confidence. Exponentially increasing debt is not sustainable. How long before the dollar, pound, yen and euro begin to resemble the Venezuelan and Argentinian currencies?

It is more sensible to own physical silver, knowing it is grossly undervalued compared to the S&P, national debt, total sovereign debt, and more.

THE RUSSIAN CONNECTION:

In accordance with the current blame-game promoted by the “fake news” diversions: We can blame Russia for HRC losing the election, releasing scandalous emails that the Democratic National Committee desperately wishes had remained private, the election of Trump, NSA spying on everyone, global terrorism, excess debt in the western world, the failure of hope and change, Federal Reserve monetary policy, unemployment, weak silver prices, strong stock markets, global bond market correction, the coming recession, derivatives disasters, slowing retail sales, Italian banking, cold weather, one brutally assassinated reindeer no longer able to pull Santa’s sleigh and a tardy delivery of goodies from the Easter Bunny next year…

Well … maybe Russia should not be blamed for all the above …

Gary Christenson

GE Christenson aka Deviant Investor If you would like to be updated on new blog posts, please subscribe to my RSS Feed or e-mail

© 2016 Copyright Deviant Investor - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Deviant Investor Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.